High Growth Tech Stocks Including Koal Software And Two Others

Reviewed by Simply Wall St

In a week marked by significant macroeconomic activity and cautious earnings reports, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before experiencing sharp declines. Despite these fluctuations, small-cap stocks demonstrated resilience compared to their larger counterparts, highlighting the potential for high-growth tech companies such as Koal Software to capture investor interest. In this environment, a good stock often exhibits strong fundamentals and adaptability to shifting market conditions, essential traits for navigating the complexities of today's economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Koal Software (SHSE:603232)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Koal Software Co., Ltd. specializes in developing public key infrastructure platforms in China and has a market capitalization of CN¥3.19 billion.

Operations: The company focuses on creating public key infrastructure platforms, generating revenue primarily through software development and related services. It operates within the Chinese market, leveraging its expertise in digital security solutions.

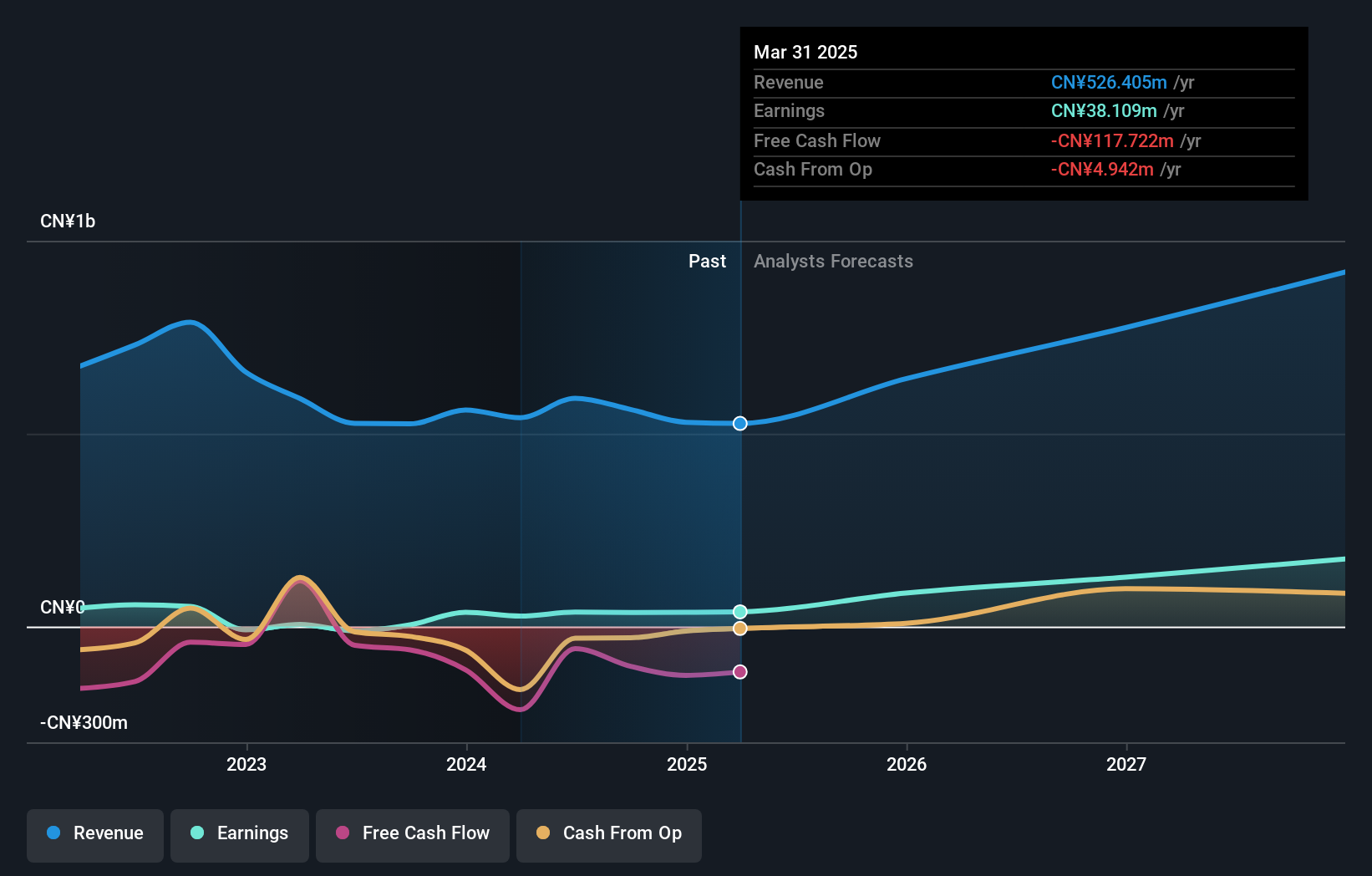

Koal Software, despite a challenging fiscal period with a reported net loss of CNY 38.04 million for the nine months ending September 2024, is poised for substantial growth with an anticipated earnings increase of 45.6% per year. This growth trajectory outpaces the broader CN market's forecast of 26.1%. Significantly, Koal's commitment to innovation is evident in its R&D spending which has consistently aligned with or exceeded industry norms, supporting its strategic focus on developing cutting-edge software solutions. With revenue also expected to grow by 19.5% annually—surpassing the market average—Koal is strategically positioned to leverage sector trends like the shift towards SaaS models, enhancing its long-term revenue prospects through recurring subscriptions.

- Take a closer look at Koal Software's potential here in our health report.

Review our historical performance report to gain insights into Koal Software's's past performance.

Primeton Information Technologies (SHSE:688118)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primeton Information Technologies, Inc. offers professional software foundation platforms and technical services in China, with a market capitalization of CN¥2.28 billion.

Operations: The company generates revenue through its software foundation platforms and technical services.

Primeton Information Technologies, despite recent setbacks with a significant net loss of CNY 68.68 million for the nine months ending September 2024, is positioned for robust future growth. The company's revenue is expected to surge by 24.5% annually, outpacing the CN market's growth rate of 13.9%. This optimism is bolstered by forecasts of earnings growth at an impressive rate of 112.17% per year over the next three years, signaling potential recovery and profitability ahead. Moreover, Primeton's dedication to innovation is reflected in its strategic R&D investments which are crucial for maintaining competitive edge and fostering product development in a rapidly evolving tech landscape.

IG Port (TSE:3791)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IG Port, Inc., with a market cap of ¥38.45 billion, operates as an animation production company both in Japan and internationally through its subsidiaries.

Operations: The company generates revenue primarily through animation production, leveraging its subsidiaries to operate both domestically and internationally.

IG Port, recently added to the S&P Global BMI Index, demonstrates a strong growth trajectory with revenue forecasted to increase by 9% annually, outpacing the Japanese market's average of 4.2%. This growth is complemented by an impressive earnings surge over the past year at 23.7%, significantly exceeding its industry’s decline of 17.1%. Furthermore, IG Port's commitment to innovation is evident from its R&D investments which stand at a substantial portion of its revenue, underlining its strategic focus on sustaining competitive advantage and expanding market reach in entertainment technology.

- Dive into the specifics of IG Port here with our thorough health report.

Understand IG Port's track record by examining our Past report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1289 companies within our High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koal Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603232

Flawless balance sheet with reasonable growth potential.