- Japan

- /

- Entertainment

- /

- TSE:3659

NEXON (TSE:3659): Evaluating Shareholder Value After Recent Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for NEXON.

After a run-up earlier this year, NEXON's momentum has cooled a bit with a recent pullback. Yet the stock’s year-to-date share price return still sits at a robust 32.8%. The longer-term picture also looks healthy, with a one-year total shareholder return of 16.8%. This suggests that while short-term swings have been pronounced, investors who stayed the course have seen meaningful gains overall.

If these market moves have you eyeing fresh opportunities, this could be the right moment to broaden your outlook and discover fast growing stocks with high insider ownership

But with NEXON’s recent pullback and ongoing strong fundamentals, is the company now trading at an attractive valuation? Or has the market already factored in expectations for future growth, leaving little room for upside?

Most Popular Narrative: 6.2% Undervalued

NEXON's current share price is trading below the most widely-followed estimate of fair value, indicating potential upside if the narrative's assumptions become reality. Enthusiasm among investors seems rooted in several ambitious growth bets that are yet to fully play out in the market.

The strong reliance on legacy titles like MapleStory and Dungeon & Fighter, despite recent surges from updates and content expansions, leaves Nexon exposed to player fatigue and revenue concentration risk. This concentration may compress future top-line growth if new IPs or markets underperform. Intense investment in live-service games, frequent content updates, and global marketing are currently boosting user engagement and revenues, but also driving up recurring expenses (royalties, platform fees, creator payments, and marketing). These increased costs could pressure net margins as incremental returns diminish.

What bold assumptions about user growth, margins, and market expansion are behind this valuation edge? The narrative hinges on a combination of core franchise momentum, aggressive global launches, and a projected profitability profile that might surprise you. Only by digging into the full story will you discover the actual forecasts and the make-or-break variables analysts are betting on.

Result: Fair Value of ¥3,247.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Nexon's expansion falters or player fatigue sets in, future earnings growth could fall short of current optimistic projections.

Find out about the key risks to this NEXON narrative.

Another View: SWS DCF Model Sees Less Upside

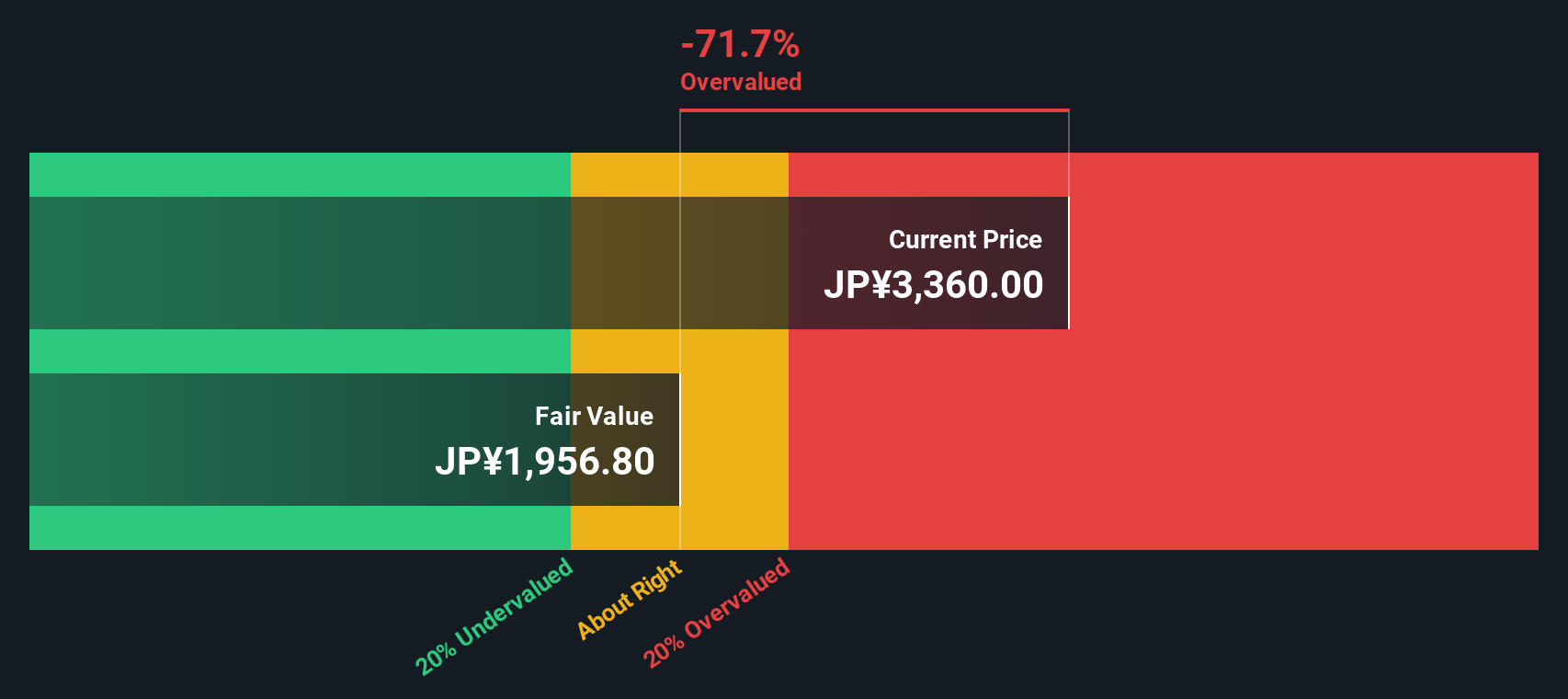

Looking through the lens of the Simply Wall St DCF model, NEXON appears to be trading above its calculated fair value of ¥1,974. This method suggests the market may have already priced in much of the anticipated growth. As a result, shares may appear less undervalued than the multiple-based narrative implies. Which perspective best fits the facts as you see them?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NEXON for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NEXON Narrative

If you see the numbers differently or want to put your own analysis to the test, it takes just a few minutes to create your own perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NEXON.

Looking for More Investment Ideas?

Don’t limit your strategy to just one company when so many fresh opportunities are within reach. Now is the time to take charge and find your next winning investment using these targeted approaches:

- Unlock the potential of tomorrow’s breakthroughs by checking out these 24 AI penny stocks, which are poised to reshape entire industries with artificial intelligence innovation.

- Secure your portfolio with steady income by tapping into these 18 dividend stocks with yields > 3%, offering yields above 3% and a track record of robust financial health.

- Get ahead of the next financial revolution by looking at these 79 cryptocurrency and blockchain stocks, which are transforming markets with blockchain technology and digital currencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3659

NEXON

Produces, develops, distributes, and services PC online and mobile games in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives