- Japan

- /

- Entertainment

- /

- TSE:3659

How NEXON's Completed ¥25 Billion Buyback at TSE:3659 Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Between October 1 and October 23, 2025, NEXON repurchased 3,502,600 shares for ¥11,304.48 million, completing its buyback program with a total of 7,580,300 shares acquired for ¥25.00 billion.

- The completion of this share repurchase reduced NEXON’s total shares outstanding, signaling active capital management and potentially enhancing shareholder value.

- We’ll explore how NEXON’s recently finished ¥25 billion buyback may strengthen the company’s investment narrative through disciplined capital allocation.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

NEXON Investment Narrative Recap

For investors in NEXON, the core belief centers on the company’s ability to drive sustained growth by revitalizing long-standing franchises and expanding globally through new titles and regional launches. The recently completed ¥25 billion share buyback demonstrates commitment to capital returns and efficient balance sheet management, but does not appear to materially shift the current short-term catalysts, such as strong engagement in key titles, or the primary risk: overreliance on mature IPs to meet growth expectations.

The most relevant recent announcement alongside the buyback is NEXON’s dividend increase in August, which saw the interim payout double year on year to ¥15.00 per share. This underscores a consistent approach to rewarding shareholders through both dividends and share repurchases, reinforcing the same disciplined capital allocation narrative that supports optimism around earnings releases and ongoing product launches. Yet, amid these shareholder-friendly moves, investors should remain mindful that NEXON’s heavy dependence on legacy games leaves it vulnerable if new IPs or regions underperform...

Read the full narrative on NEXON (it's free!)

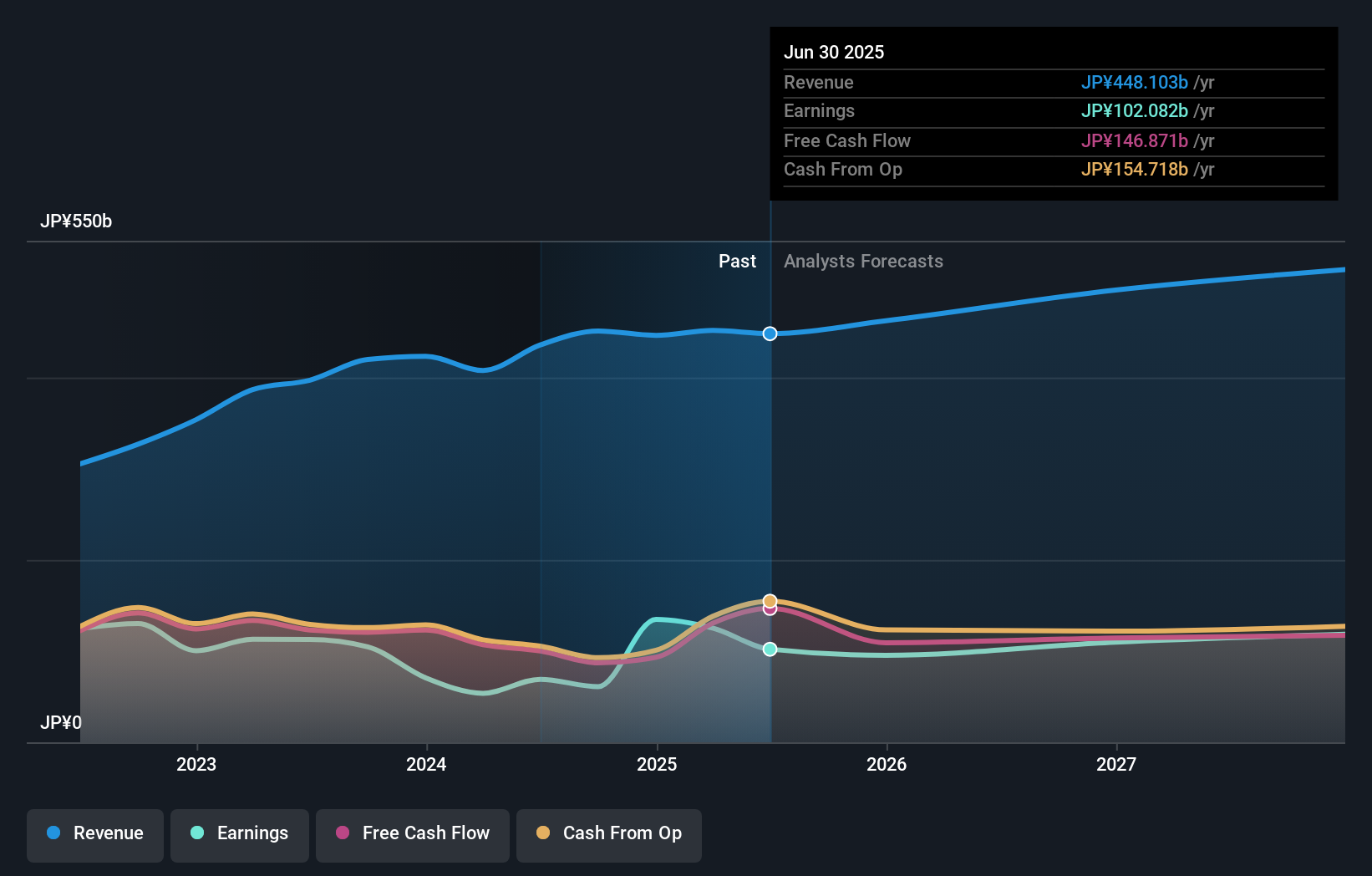

NEXON's outlook anticipates ¥515.1 billion in revenue and ¥111.7 billion in earnings by 2028. This projection is based on revenue growing at 4.8% per year and a ¥9.6 billion earnings increase from the current ¥102.1 billion.

Uncover how NEXON's forecasts yield a ¥3247 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community puts NEXON at ¥1,987, well below current levels. With consistent capital allocation highlighted and the company still reliant on legacy titles, readers can explore a broad set of views to understand how market participants weigh these risks.

Explore another fair value estimate on NEXON - why the stock might be worth as much as ¥1987!

Build Your Own NEXON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NEXON research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free NEXON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NEXON's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3659

NEXON

Produces, develops, distributes, and services PC online and mobile games in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives