- Canada

- /

- Consumer Finance

- /

- TSX:PRL

Kakaku.com And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets experience fluctuations driven by easing inflation and robust bank earnings, investors are increasingly focused on value stocks, which have recently outperformed growth shares. In such an environment, identifying undervalued stocks can be a prudent strategy for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.96 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥1809.00 | ¥3611.35 | 49.9% |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.40 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.575 | £13.12 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1112.30 | ₹2216.41 | 49.8% |

| Vestas Wind Systems (CPSE:VWS) | DKK92.60 | DKK184.75 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5875.00 | ¥11690.54 | 49.7% |

| St. James's Place (LSE:STJ) | £9.315 | £18.60 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.82 | CA$3.63 | 49.8% |

| Coeur Mining (NYSE:CDE) | US$6.36 | US$12.67 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

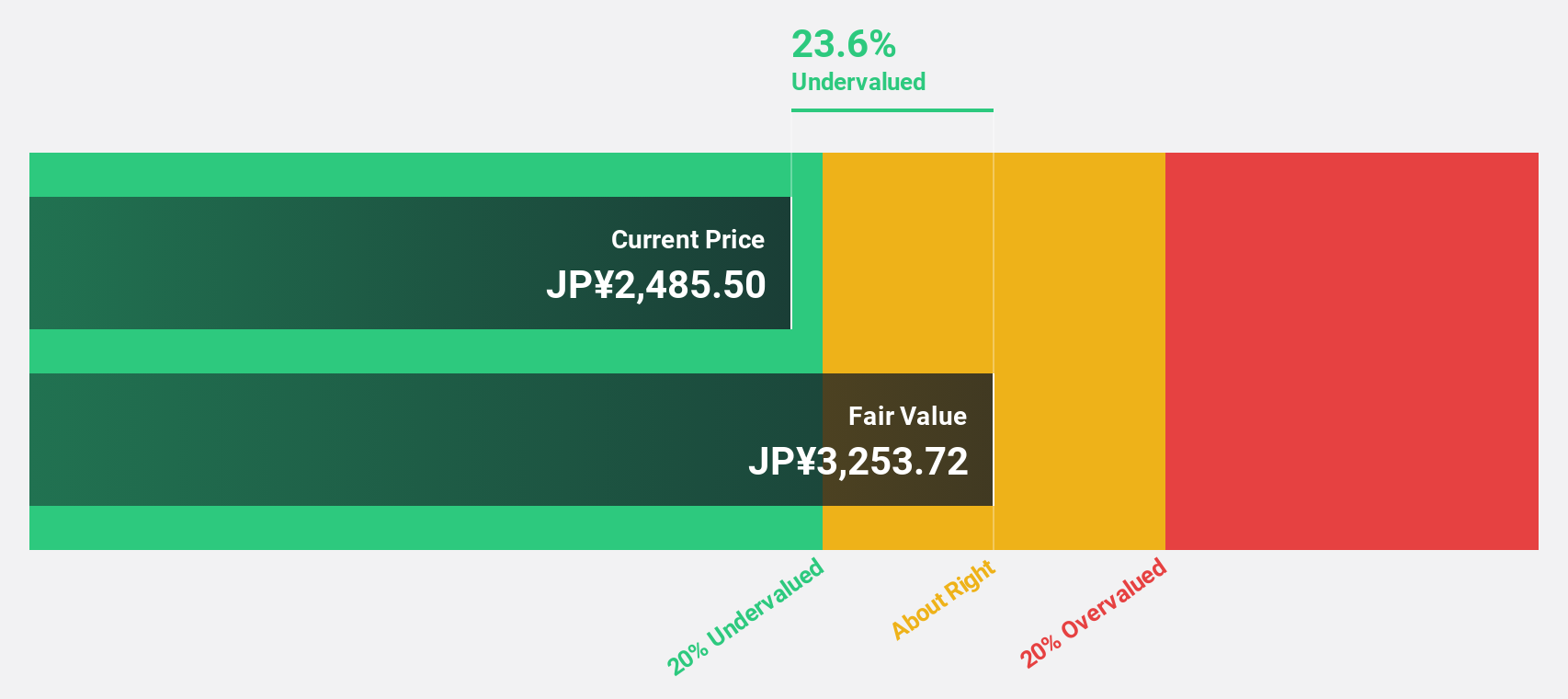

Kakaku.com (TSE:2371)

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan, with a market cap of ¥460.12 billion.

Operations: The company generates revenue from purchase support services and restaurant reviews in Japan, with reported amounts of ¥71.90 billion and ¥42 million, respectively.

Estimated Discount To Fair Value: 21.5%

Kakaku.com is trading at ¥2327, significantly below its estimated fair value of ¥2965.25, indicating it may be undervalued based on cash flows. The company's earnings are projected to grow 10% annually, surpassing the JP market's 8.1%. Recent profit growth of 23.5% and a reliable dividend yield further support its appeal despite slower revenue growth projections compared to high-growth benchmarks. Additionally, the company plans strategic divestment from Pathee Inc., potentially optimizing operations.

- Our expertly prepared growth report on Kakaku.com implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Kakaku.com with our comprehensive financial health report here.

OceanaGold (TSX:OGC)

Overview: OceanaGold Corporation is a gold and copper producer involved in the exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand with a market cap of CA$2.84 billion.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to $1.13 billion.

Estimated Discount To Fair Value: 46.3%

OceanaGold is trading at CA$4.18, significantly below its estimated fair value of CA$7.79, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow 63.9% annually, outpacing the Canadian market's growth rate of 15.5%. Recent exploration results and pre-feasibility studies highlight substantial resource potential in New Zealand, while ongoing production improvements and strategic buybacks further strengthen its financial position despite lower profit margins compared to last year.

- Our growth report here indicates OceanaGold may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in OceanaGold's balance sheet health report.

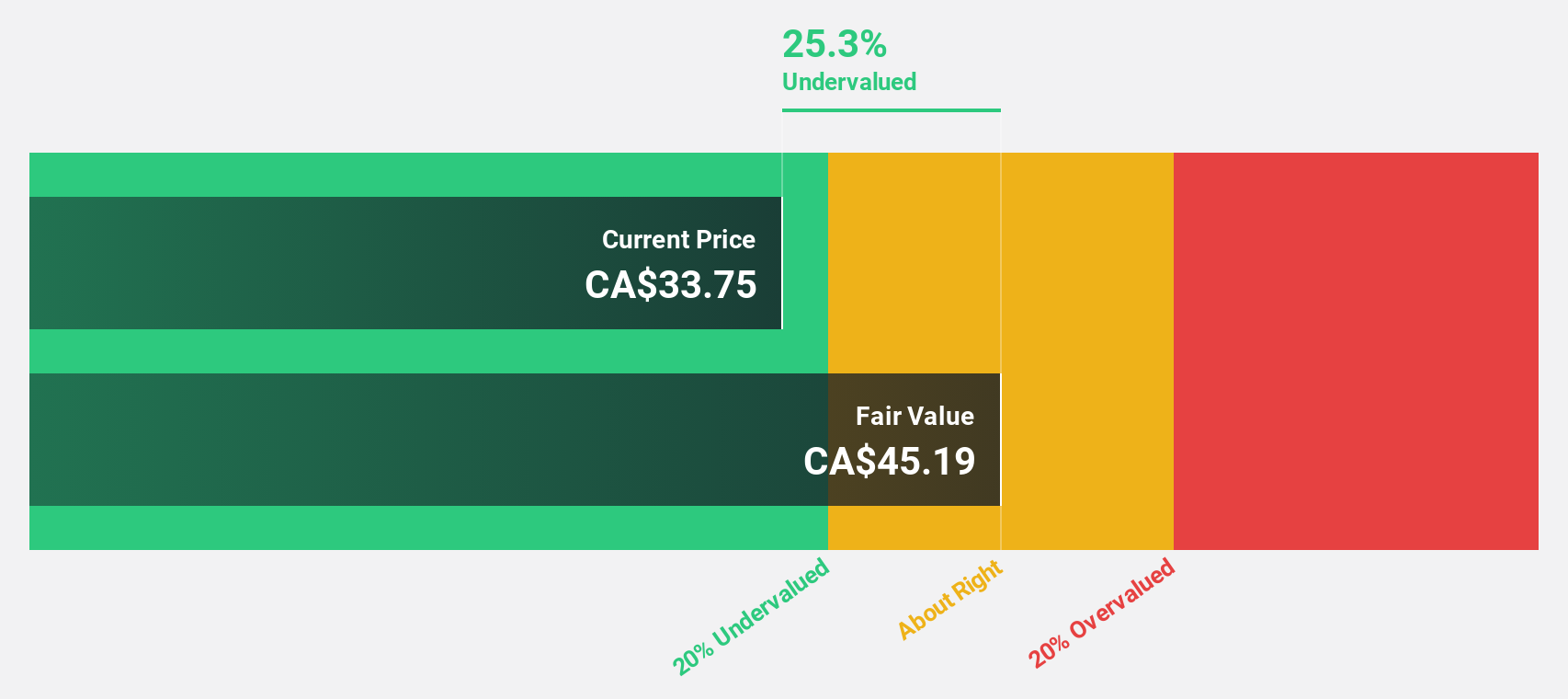

Propel Holdings (TSX:PRL)

Overview: Propel Holdings Inc. is a financial technology company with a market cap of CA$1.40 billion.

Operations: The company generates revenue of $416.43 million from providing lending-related services to borrowers, banks, and other institutions.

Estimated Discount To Fair Value: 11.9%

Propel Holdings, trading at CA$36.94, is slightly undervalued compared to its fair value of CA$41.94. The company's revenue and earnings are projected to grow significantly faster than the Canadian market, with expected annual increases of 25.4% and 38.9%, respectively. However, insider selling has been significant recently, and interest payments are not well covered by earnings. Propel's share buyback program may enhance shareholder value amid ongoing dividend increases and robust financial performance in recent quarters.

- Insights from our recent growth report point to a promising forecast for Propel Holdings' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Propel Holdings.

Seize The Opportunity

- Reveal the 863 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Exceptional growth potential and undervalued.

Market Insights

Community Narratives