Investors Shouldn't Overlook KeePer Technical Laboratory's (TSE:6036) Impressive Returns On Capital

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. And in light of that, the trends we're seeing at KeePer Technical Laboratory's (TSE:6036) look very promising so lets take a look.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for KeePer Technical Laboratory, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

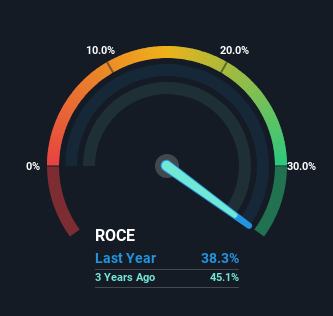

0.38 = JP¥6.1b ÷ (JP¥19b - JP¥3.4b) (Based on the trailing twelve months to June 2024).

Thus, KeePer Technical Laboratory has an ROCE of 38%. That's a fantastic return and not only that, it outpaces the average of 6.7% earned by companies in a similar industry.

View our latest analysis for KeePer Technical Laboratory

Above you can see how the current ROCE for KeePer Technical Laboratory compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering KeePer Technical Laboratory for free.

The Trend Of ROCE

KeePer Technical Laboratory is displaying some positive trends. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 38%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 139%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Bottom Line On KeePer Technical Laboratory's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what KeePer Technical Laboratory has. And a remarkable 521% total return over the last five years tells us that investors are expecting more good things to come in the future. Therefore, we think it would be worth your time to check if these trends are going to continue.

On a separate note, we've found 1 warning sign for KeePer Technical Laboratory you'll probably want to know about.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're here to simplify it.

Discover if KeePer Technical Laboratory might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6036

KeePer Technical Laboratory

Develops, manufactures, and sells car coatings, car washing chemicals and equipment, and other products in Japan.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026