- China

- /

- Electrical

- /

- SZSE:300820

Asian Stocks Trading Below Estimated Value

Reviewed by Simply Wall St

Amid global market fluctuations driven by trade policy uncertainties and inflation concerns, Asian markets have shown resilience with some indices posting gains despite broader economic challenges. In this environment, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on potential growth opportunities in the region.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13910.00 | ₩27542.04 | 49.5% |

| Avant Group (TSE:3836) | ¥1800.00 | ¥3553.88 | 49.4% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.21 | CN¥30.41 | 50% |

| WEILONG Delicious Global Holdings (SEHK:9985) | HK$11.00 | HK$21.72 | 49.3% |

| Hugel (KOSDAQ:A145020) | ₩329000.00 | ₩642409.32 | 48.8% |

| Takara Bio (TSE:4974) | ¥854.00 | ¥1702.96 | 49.9% |

| GMO internet group (TSE:9449) | ¥3133.00 | ¥6181.69 | 49.3% |

| JSHLtd (TSE:150A) | ¥565.00 | ¥1103.90 | 48.8% |

| LITALICO (TSE:7366) | ¥1092.00 | ¥2128.51 | 48.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.61 | CN¥16.93 | 49.1% |

We'll examine a selection from our screener results.

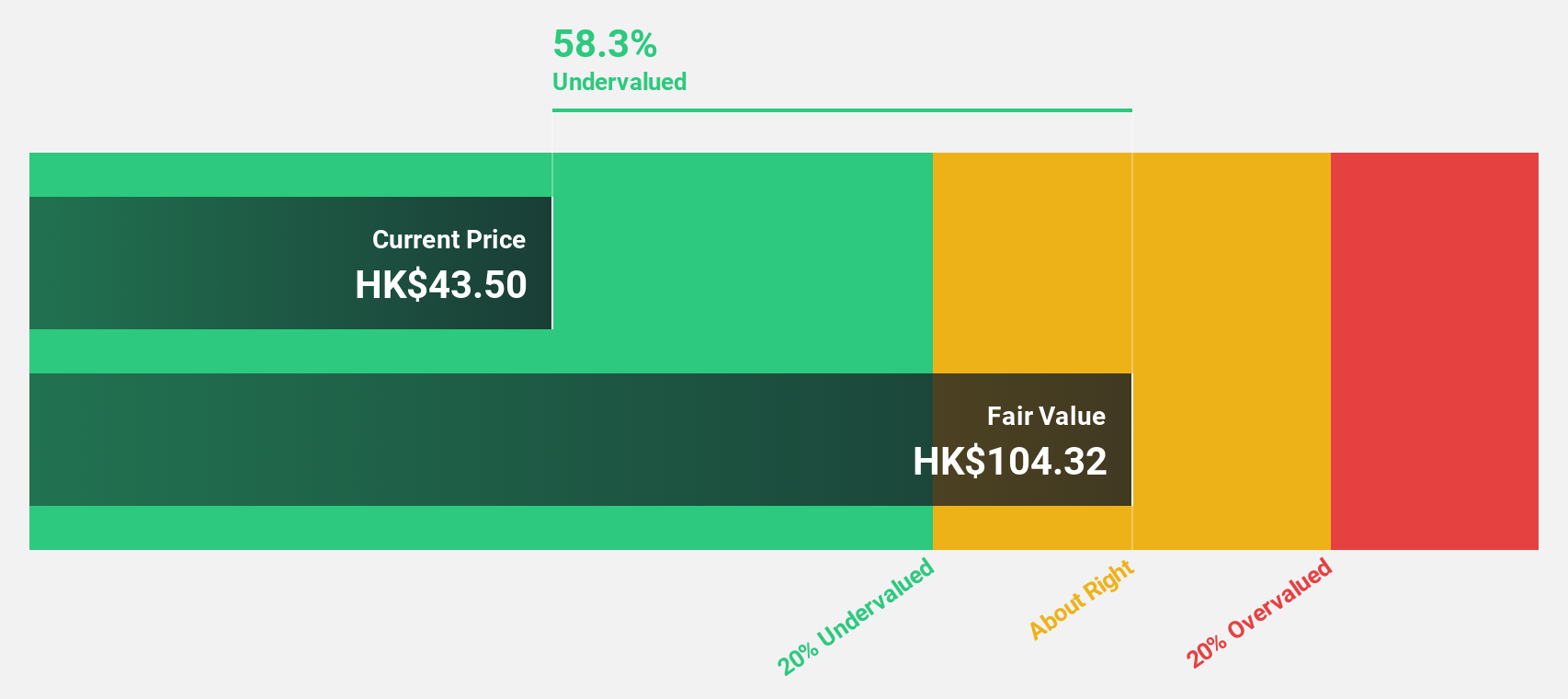

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that functions as a contract research, development, and manufacturing organization across China, North America, Europe, and internationally with a market cap of HK$42.48 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to CN¥2.80 billion.

Estimated Discount To Fair Value: 32.4%

WuXi XDC Cayman is trading at HK$35.45, significantly below its estimated fair value of HK$52.42, indicating it may be undervalued based on cash flows. The company has shown robust earnings growth, with a 153.3% increase last year and forecasts predicting a 27.9% annual rise, outpacing the Hong Kong market's average growth rate. Recent strategic alliances with AbTis and LigaChem Biosciences aim to enhance innovation in ADC therapies, potentially boosting revenue and profitability further.

- Upon reviewing our latest growth report, WuXi XDC Cayman's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in WuXi XDC Cayman's balance sheet health report.

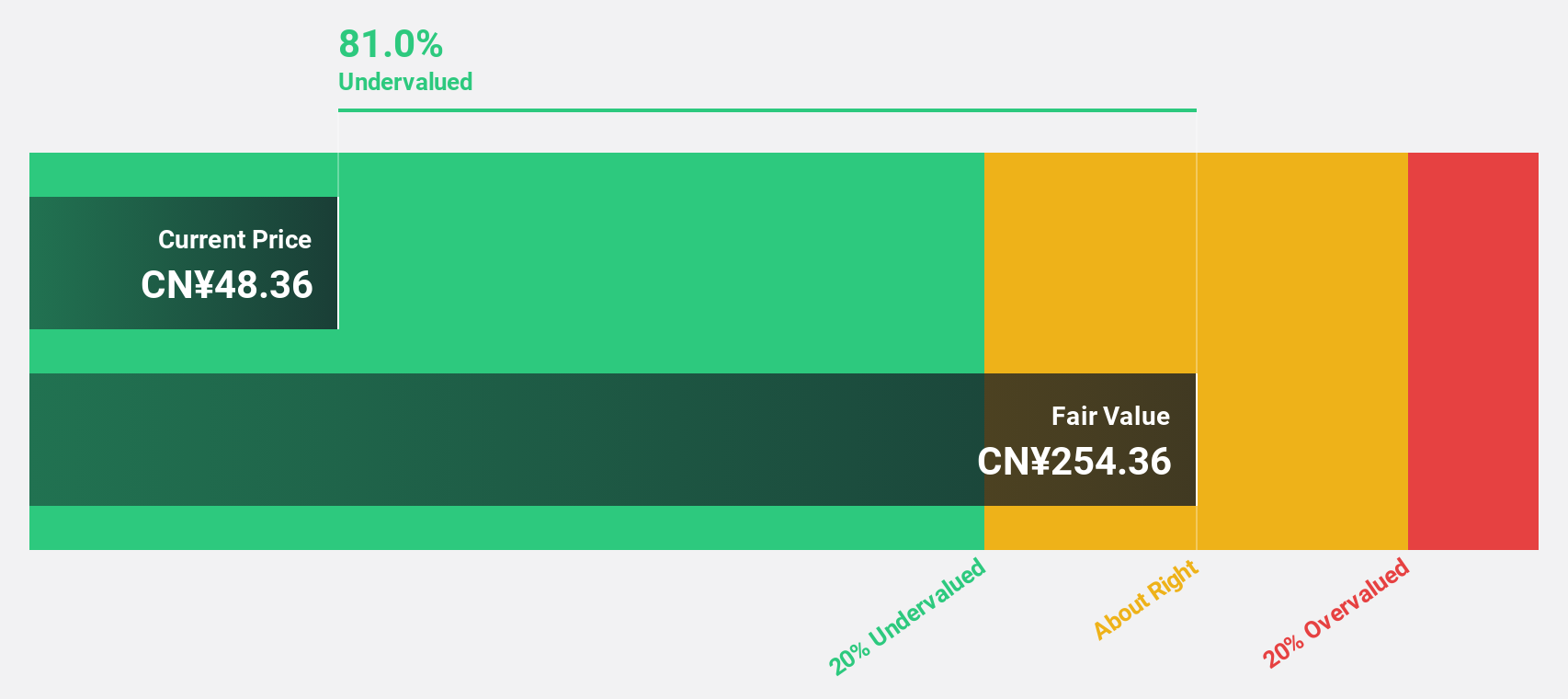

Sichuan Injet Electric (SZSE:300820)

Overview: Sichuan Injet Electric Co., Ltd. specializes in the research, design, and manufacturing of industrial power equipment in China and has a market capitalization of CN¥11.30 billion.

Operations: Sichuan Injet Electric Co., Ltd. focuses on the research and development, design, and production of industrial power equipment in China.

Estimated Discount To Fair Value: 45.1%

Sichuan Injet Electric is trading at CN¥51.31, well below its estimated fair value of CN¥93.53, highlighting potential undervaluation based on cash flows. The company’s earnings are projected to grow annually by 26.3%, surpassing the Chinese market average of 25.5%. Recent developments include a completed share buyback worth CN¥50 million and an upcoming shareholders meeting to discuss governance enhancements, potentially influencing future financial performance positively.

- In light of our recent growth report, it seems possible that Sichuan Injet Electric's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Sichuan Injet Electric stock in this financial health report.

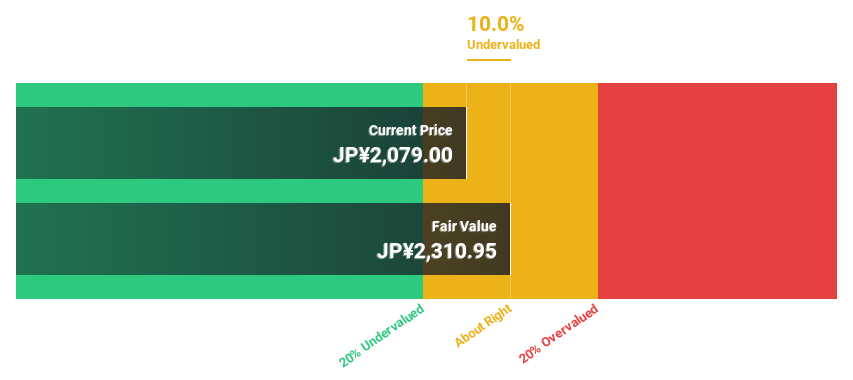

OSAKA Titanium technologiesLtd (TSE:5726)

Overview: OSAKA Titanium Technologies Co., Ltd. manufactures and sells titanium products, with a market cap of ¥74.81 billion.

Operations: The company generates revenue through the manufacture and sale of titanium products.

Estimated Discount To Fair Value: 46.9%

OSAKA Titanium technologies is trading at ¥2,033, significantly below its estimated fair value of ¥3,828.49, suggesting potential undervaluation based on cash flows. Despite a volatile share price and reduced dividend guidance to ¥20 per share from ¥50 last year, the company forecasts net sales of ¥53.5 billion and earnings growth of 15.65% annually—outpacing the Japanese market average—and maintains good relative value compared to peers and industry standards.

- Our growth report here indicates OSAKA Titanium technologiesLtd may be poised for an improving outlook.

- Click here to discover the nuances of OSAKA Titanium technologiesLtd with our detailed financial health report.

Where To Now?

- Embark on your investment journey to our 280 Undervalued Asian Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300820

Sichuan Injet Electric

Engages in the research and development, design, and manufacturing of industrial power equipment in China.

Undervalued with high growth potential.

Market Insights

Community Narratives