- Japan

- /

- Metals and Mining

- /

- TSE:5706

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by fluctuating market sentiment and policy uncertainties, global indices experienced mixed results, with U.S. stocks retracing some of their previous gains amidst evolving economic signals. As investors navigate these turbulent waters, the appeal of dividend stocks becomes increasingly relevant; these investments are often valued for their potential to provide steady income streams regardless of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Xxentria Technology Materials (TPEX:8942)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xxentria Technology Materials Co., Ltd. manufactures and sells steel composite materials in the United States, Asia, and internationally, with a market cap of NT$11.49 billion.

Operations: Xxentria Technology Materials Co., Ltd. generates its revenue from the manufacture and sale of steel composite materials across various international markets, including the United States and Asia.

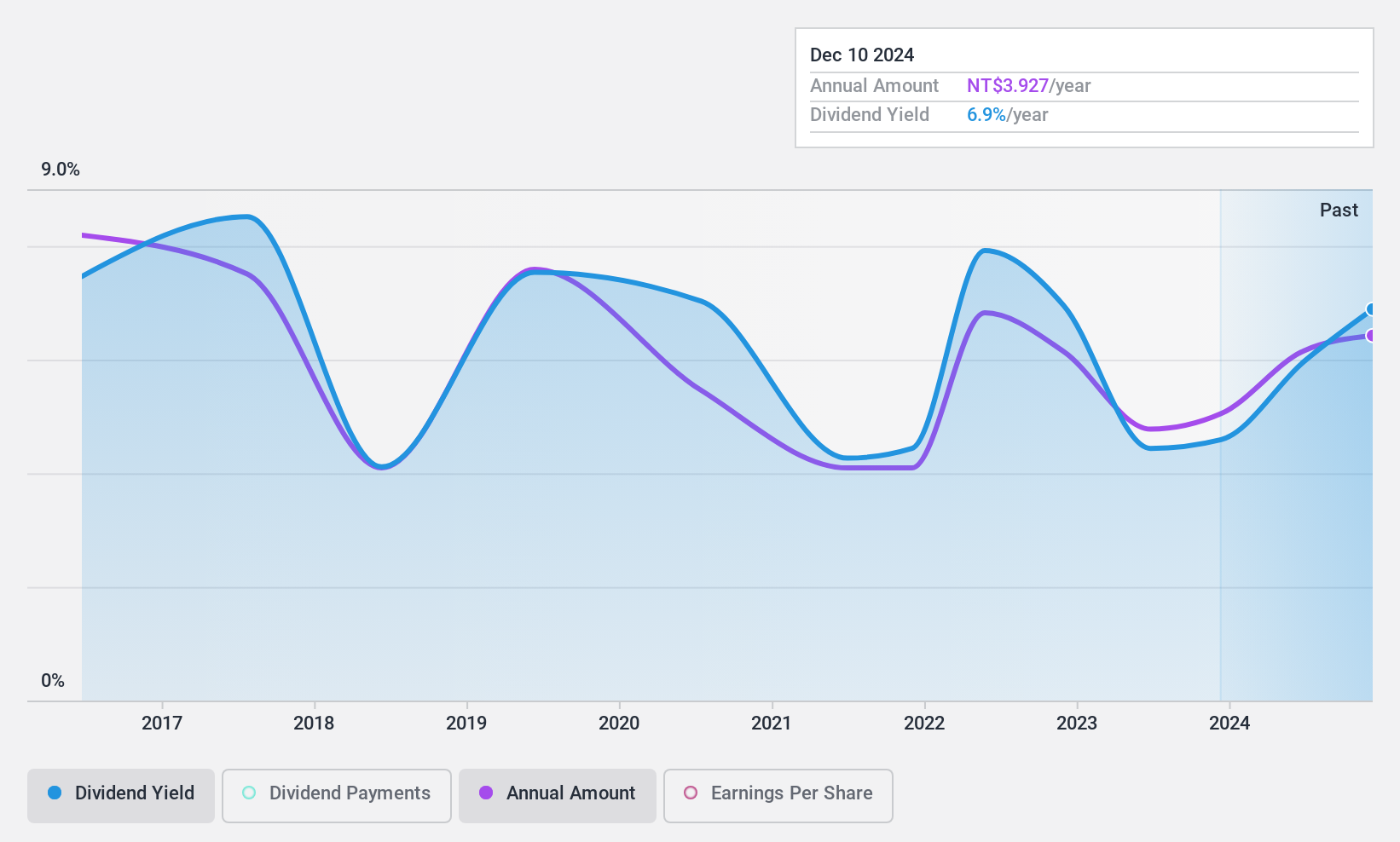

Dividend Yield: 6.8%

Xxentria Technology Materials' dividend yield is among the top 25% in the Taiwanese market, but its dividends have been volatile over the past decade. Despite a recent decline in earnings and sales, with third-quarter sales at TWD 928.72 million and net income at TWD 128.66 million, dividends remain covered by both earnings (payout ratio of 88.4%) and cash flows (cash payout ratio of 78.8%). The price-to-earnings ratio suggests good value compared to the market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Xxentria Technology Materials.

- Our comprehensive valuation report raises the possibility that Xxentria Technology Materials is priced higher than what may be justified by its financials.

Mitsui Mining & Smelting (TSE:5706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui Mining & Smelting Co., Ltd. manufactures and sells nonferrous metal products both in Japan and internationally, with a market cap of ¥272.88 billion.

Operations: Mitsui Mining & Smelting Co., Ltd. generates revenue from several key segments: Metals (¥272.77 billion), Mobility (¥207.19 billion), and Functional Materials (¥142.40 billion).

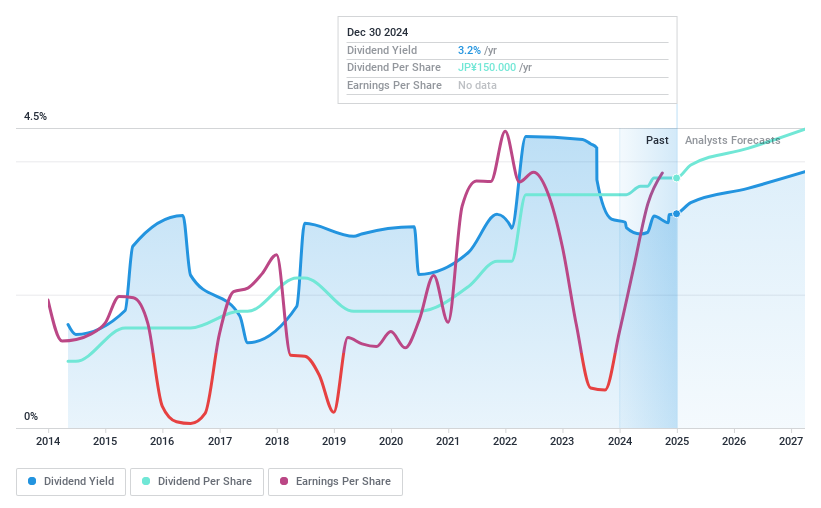

Dividend Yield: 3.1%

Mitsui Mining & Smelting's dividend yield of 3.14% is below the top 25% in Japan, and its dividend history has been volatile. However, dividends are well covered by earnings (payout ratio: 15.1%) and cash flows (cash payout ratio: 20.2%). Despite high debt levels and forecasts of declining earnings, the stock trades at a good value relative to peers and slightly below fair value estimates, with analysts expecting a potential price increase of 22.1%.

- Get an in-depth perspective on Mitsui Mining & Smelting's performance by reading our dividend report here.

- Our expertly prepared valuation report Mitsui Mining & Smelting implies its share price may be lower than expected.

Hashimoto Sogyo HoldingsLtd (TSE:7570)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hashimoto Sogyo Holdings Co., Ltd. operates in Japan, focusing on the processing, manufacture, and sale of plumbing and housing equipment with a market capitalization of ¥23.61 billion.

Operations: Hashimoto Sogyo Holdings Co., Ltd.'s revenue is primarily derived from Piping Materials (¥46.11 billion), Sanitary Ceramic and Fittings (¥46.70 billion), Air Conditioners & Pumps (¥37.92 billion), and Housing Facilities and Equipment (¥28.69 billion).

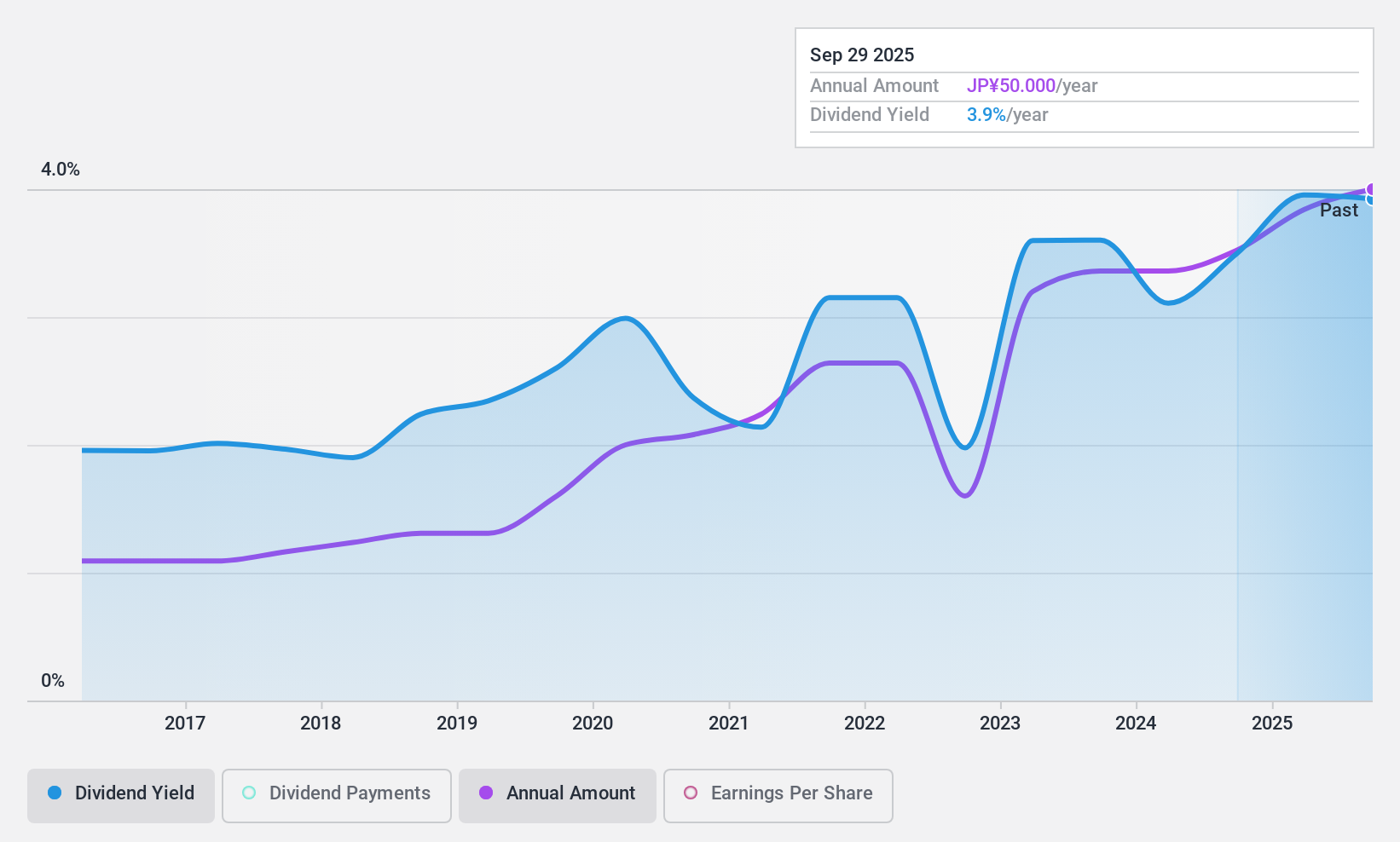

Dividend Yield: 4.1%

Hashimoto Sogyo Holdings offers a dividend yield of 4.05%, ranking in the top 25% of Japanese dividend payers. Dividends have been stable and growing over the past decade, supported by a low payout ratio of 15.9%. However, dividends are not covered by free cash flows, indicating potential sustainability concerns. The stock is attractively priced with a price-to-earnings ratio of 8.9x compared to the market's 13.5x, despite high non-cash earnings and debt issues.

- Unlock comprehensive insights into our analysis of Hashimoto Sogyo HoldingsLtd stock in this dividend report.

- Our valuation report here indicates Hashimoto Sogyo HoldingsLtd may be overvalued.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1950 companies within our Top Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Mining & Smelting

Engages in the manufacture and sale of nonferrous metal products in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.