As global markets navigate a mixed economic landscape marked by fluctuating consumer confidence and shifting indices, investors are increasingly seeking stability in their portfolios. In such an environment, dividend stocks can offer a reliable source of income, providing potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.45% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Mitsui Mining & Smelting (TSE:5706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui Mining & Smelting Co., Ltd. is involved in the manufacture and sale of nonferrous metal products both in Japan and internationally, with a market capitalization of ¥266.93 billion.

Operations: Mitsui Mining & Smelting Co., Ltd.'s revenue is primarily derived from its Metals segment at ¥272.77 billion, followed by Mobility at ¥207.19 billion and Functional materials at ¥142.40 billion.

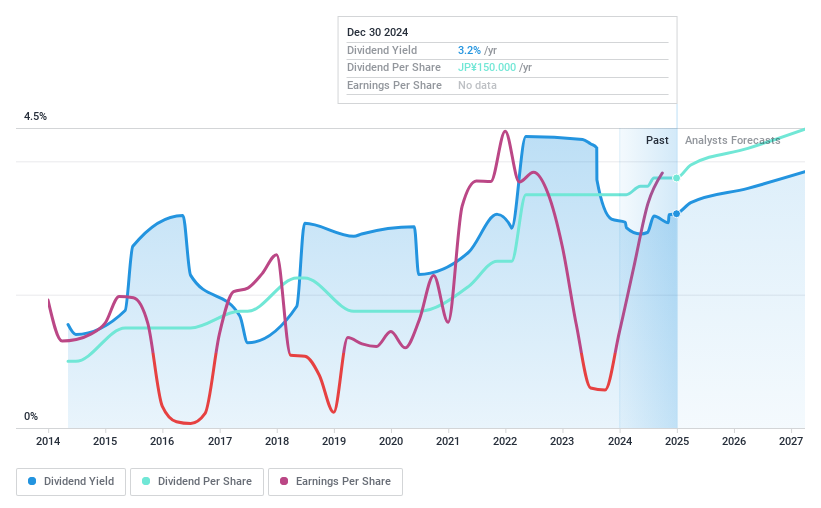

Dividend Yield: 3.2%

Mitsui Mining & Smelting offers a low dividend yield of 3.21%, below the top tier in Japan, but its dividends are well-covered by earnings and cash flows with payout ratios of 15.1% and 20.2%, respectively. Despite an unstable dividend history, recent increases suggest potential growth. The company trades at a good value relative to peers but carries high debt levels. A recent ¥10 billion fixed-income offering could impact financial flexibility and future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitsui Mining & Smelting.

- Insights from our recent valuation report point to the potential undervaluation of Mitsui Mining & Smelting shares in the market.

Hokkan Holdings (TSE:5902)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hokkan Holdings Limited operates in Taiwan through its subsidiaries, focusing on container, filling, and machinery production businesses, with a market capitalization of ¥20.45 billion.

Operations: Hokkan Holdings Limited generates revenue primarily from its Soft Drink Filling segment at ¥39.28 billion, followed by the Container Business at ¥33.66 billion, and the Overseas Segment contributing ¥17.67 billion.

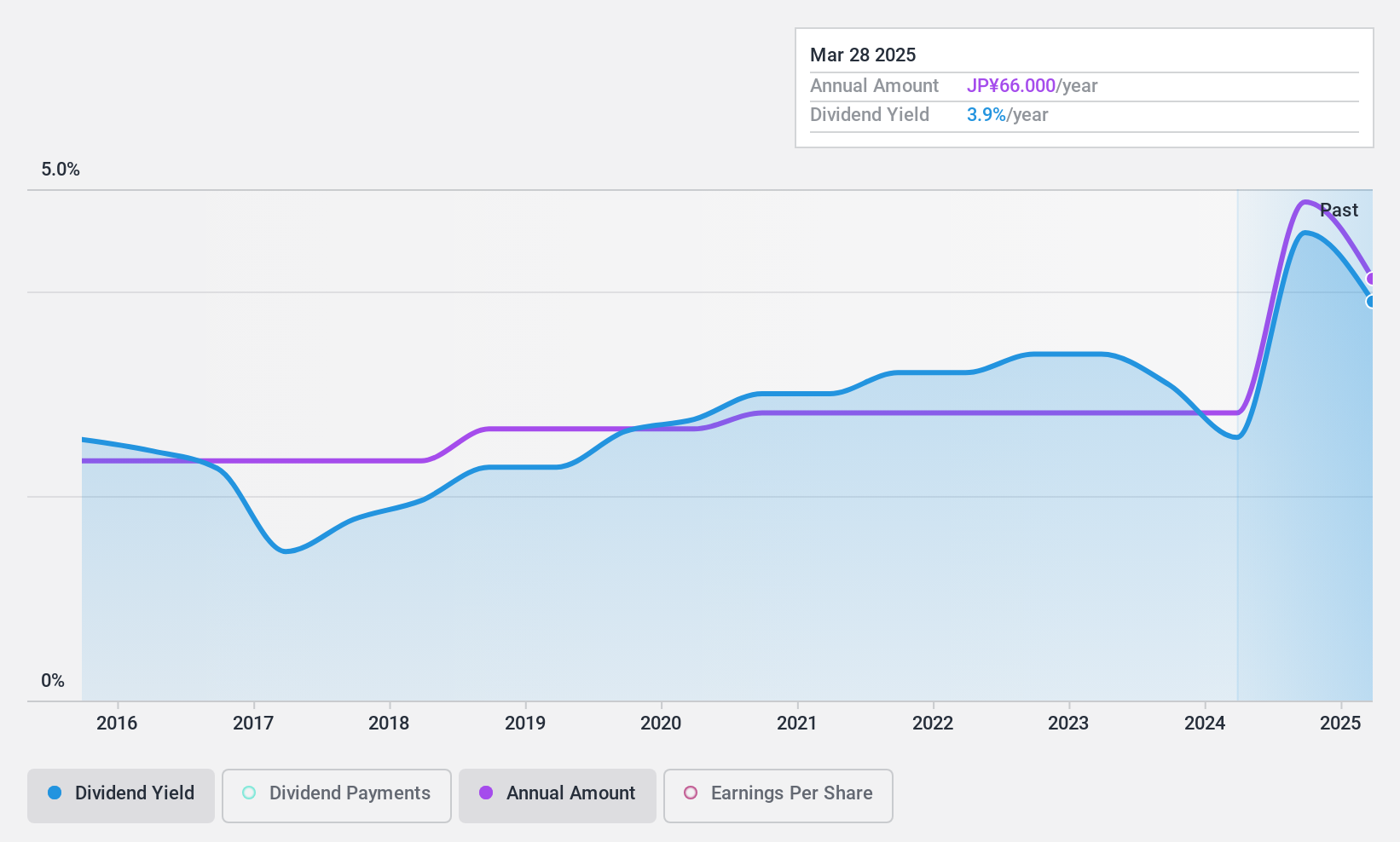

Dividend Yield: 4.7%

Hokkan Holdings' dividend yield of 4.69% ranks in the top 25% of Japanese dividend payers. The dividends are well-covered by earnings and cash flows, with payout ratios of 35.9% and 14.5%, respectively, indicating sustainability despite a volatile track record over the past decade. While the company has become profitable this year, large one-off items have impacted financial results. Trading significantly below estimated fair value suggests potential investment appeal but high debt levels warrant caution.

- Navigate through the intricacies of Hokkan Holdings with our comprehensive dividend report here.

- Our valuation report here indicates Hokkan Holdings may be undervalued.

Sumitomo Mitsui Financial Group (TSE:8316)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Mitsui Financial Group, Inc., along with its subsidiaries, offers banking, leasing, securities, consumer finance, and other services across Japan and various international regions including the Americas and Europe; it has a market cap of ¥14.70 trillion.

Operations: Sumitomo Mitsui Financial Group's revenue is primarily derived from its Global Business Unit at ¥1.35 billion, Retail Business Unit at ¥1.34 billion, Wholesale Business Sector at ¥879.50 million, and Market Business Unit at ¥602.20 million.

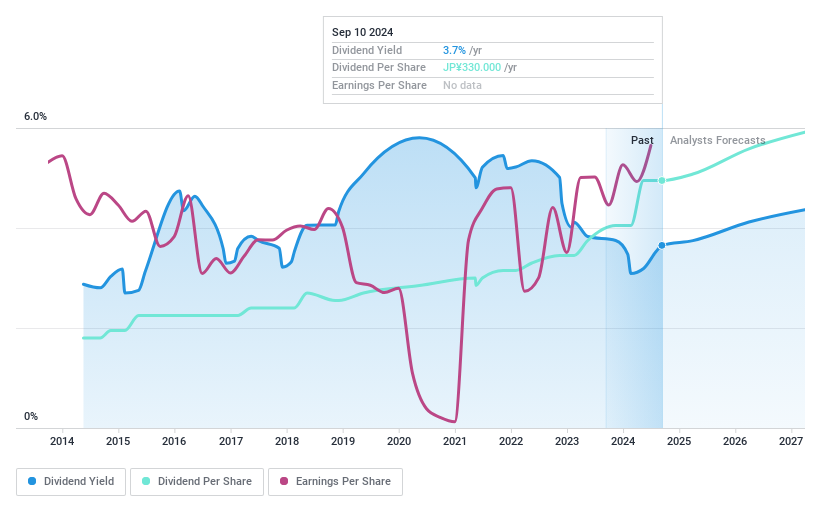

Dividend Yield: 3.2%

Sumitomo Mitsui Financial Group recently announced a share repurchase program to enhance shareholder returns, reflecting a commitment to capital efficiency. The company reported strong earnings growth with net income rising to ¥725.17 billion for the half-year ended September 30, 2024. Its dividend per share increased from ¥135.00 to ¥180.00 year-over-year, indicating growing and stable dividends over the past decade. With a payout ratio of 38.7%, dividends are well-covered by earnings despite being below Japan's top-tier yields.

- Click to explore a detailed breakdown of our findings in Sumitomo Mitsui Financial Group's dividend report.

- In light of our recent valuation report, it seems possible that Sumitomo Mitsui Financial Group is trading behind its estimated value.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1925 more companies for you to explore.Click here to unveil our expertly curated list of 1928 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokkan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5902

Hokkan Holdings

Through its subsidiaries, engages in the container, filling, and machinery production businesses in Taiwan.

Excellent balance sheet established dividend payer.