Undiscovered Gems with Promising Potential for December 2024

Reviewed by Simply Wall St

As we approach the end of 2024, global markets have shown mixed signals with U.S. consumer confidence falling and major stock indices experiencing moderate gains amid a holiday-shortened week. Despite these fluctuations, small-cap stocks, as represented by indices like the Russell 2000, continue to present intriguing opportunities for investors seeking growth potential in an uncertain economic landscape. Identifying promising stocks often involves looking for companies with strong fundamentals and innovative strategies that can thrive even when broader market sentiment is cautious.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Axtra Future City Freehold And Leasehold Real Estate Investment Trust (SET:AXTRART)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Axtra Future City Freehold And Leasehold Real Estate Investment Trust focuses on investing in freehold and leasehold properties, specifically 17 shopping malls anchored by a Tesco Lotus hypermarket, with a market capitalization of THB27.81 billion.

Operations: Axtra Future City REIT generates revenue primarily from its investments in 17 shopping malls, totaling THB2.95 billion. The trust's financial performance is significantly influenced by its investment properties, with a focus on maximizing returns from these assets.

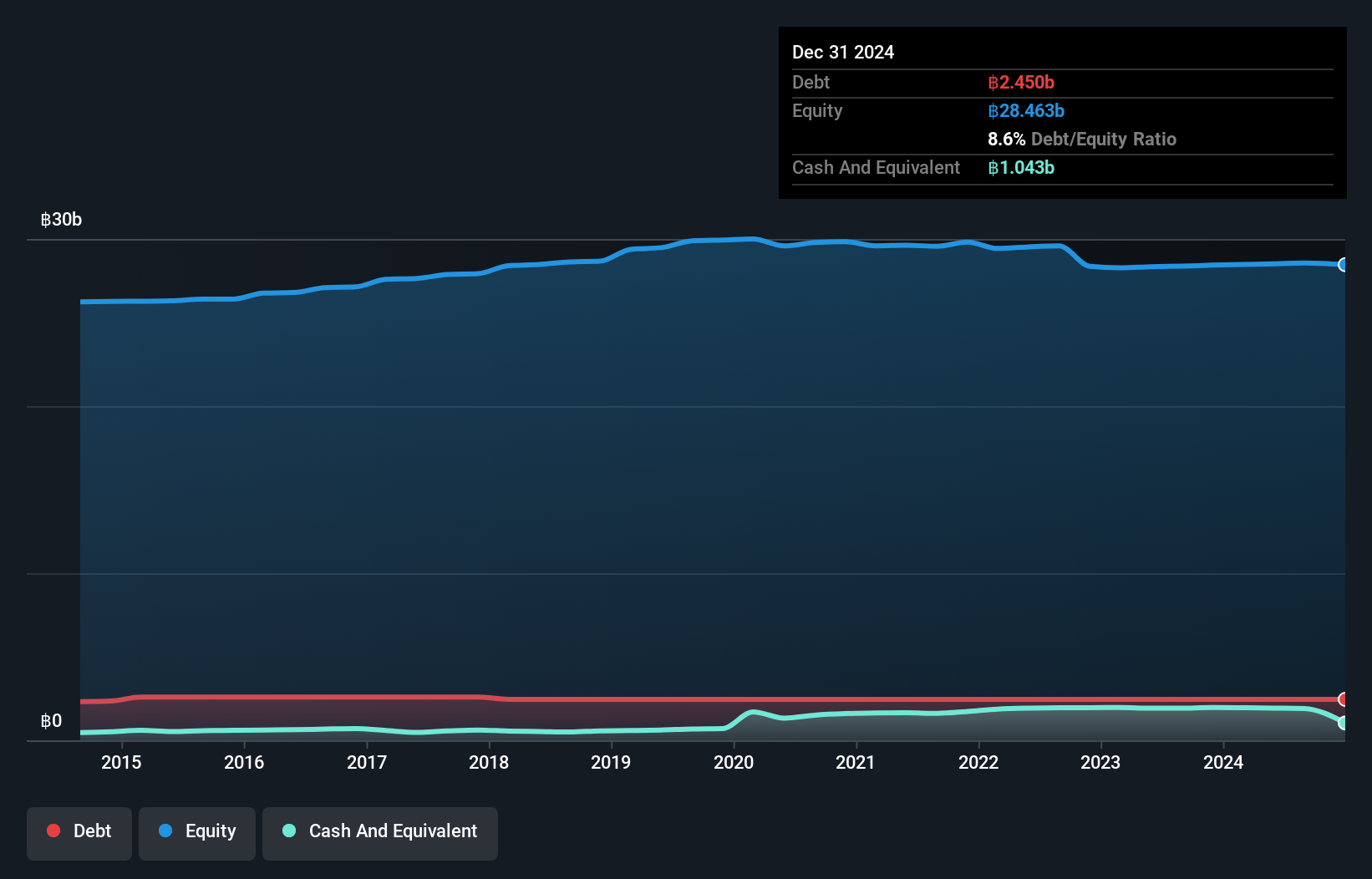

Axtra Future City REIT, a smaller player in the real estate investment trust sector, seems to offer intriguing prospects. The company trades at 27.4% below its estimated fair value, indicating potential undervaluation. With a net debt to equity ratio of 1.9%, it maintains satisfactory leverage levels while its interest payments are well covered by EBIT at 21.5 times over—a reassuring sign of financial stability. Earnings growth has been impressive, surging by 190.9% over the past year, outpacing the Retail REITs industry average of 22.4%. Despite an increase in debt-to-equity from 8.2% to 8.6% over five years, Axtra remains profitable with high-quality earnings and positive free cash flow projections enhancing its appeal as an investment consideration within this niche market segment.

Anhui Anfu Battery TechnologyLtd (SHSE:603031)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Anfu Battery Technology Co., Ltd specializes in the research, development, production, and sale of zinc-manganese batteries in China with a market capitalization of CN¥6.01 billion.

Operations: Anhui Anfu Battery Technology Co., Ltd generates its revenue through the sale of zinc-manganese batteries. The company has demonstrated a net profit margin trend worth noting, reflecting its financial performance in managing costs relative to revenue.

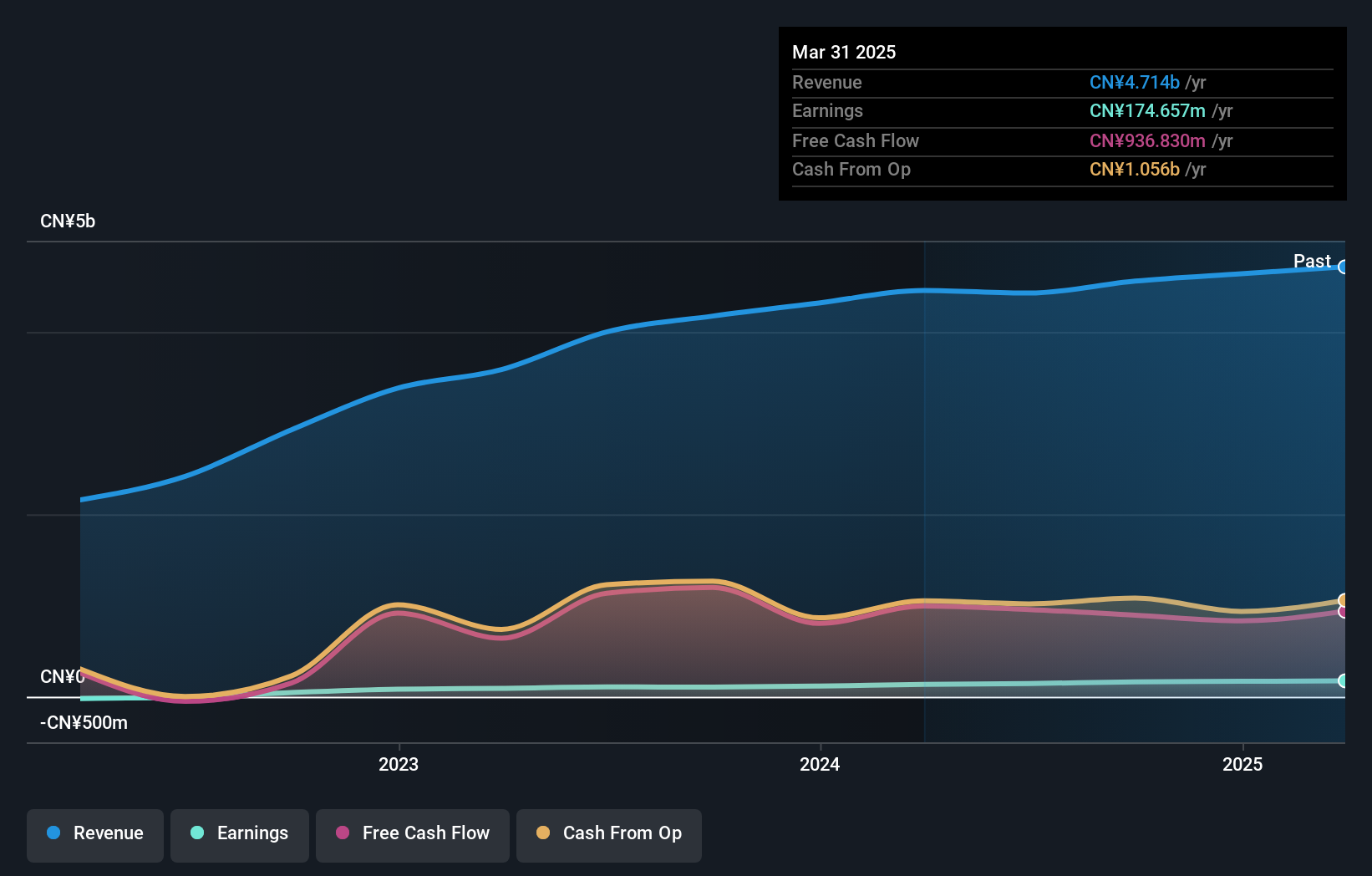

Anhui Anfu Battery Technology is making waves with notable financial strides, boasting a net income of CNY 149.95 million for the first nine months of 2024, up from CNY 103.01 million the previous year. The company trades at nearly 40% below its estimated fair value, suggesting potential undervaluation in the market. With earnings growth outpacing the industry at an impressive rate of 54%, this entity shows robust performance metrics. Furthermore, its debt to equity ratio has improved significantly over five years from 77.8% to a more manageable 53.1%.

Awa Bank (TSE:8388)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Awa Bank, Ltd. offers a range of banking products and services to both individual and corporate clients in Japan, with a market cap of ¥108.79 billion.

Operations: Awa Bank generates revenue primarily through interest income from loans and advances, along with fees and commissions from its banking services. The bank's net profit margin reflects its ability to manage costs relative to income, providing insights into profitability.

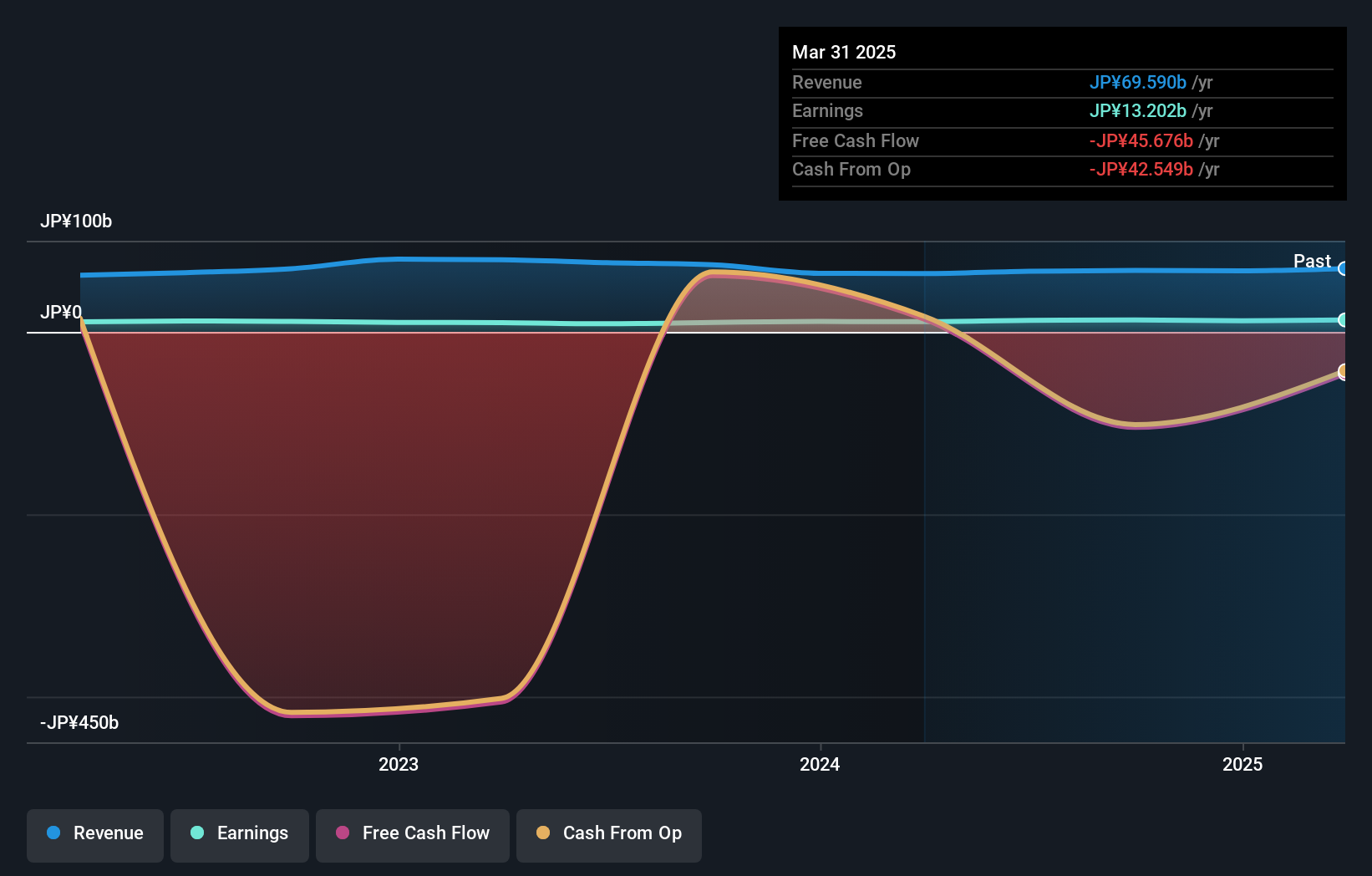

Awa Bank, a compact player in the banking sector, shows promising signs with its recent 26% earnings growth, outpacing the industry average of 22.6%. However, it grapples with a high level of bad loans at 2.1%, paired with a low allowance for these at just 39%. Despite this challenge, Awa Bank trades at nearly 39% below its estimated fair value and maintains robust funding through customer deposits making up 94% of liabilities. The company recently repurchased shares worth ¥499.81 million to enhance shareholder value and flexibility in capital policy.

- Click here and access our complete health analysis report to understand the dynamics of Awa Bank.

Review our historical performance report to gain insights into Awa Bank's's past performance.

Seize The Opportunity

- Explore the 4627 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8388

Good value with proven track record.

Market Insights

Community Narratives