- Japan

- /

- Metals and Mining

- /

- TSE:5706

Assessing Mitsui Kinzoku (TSE:5706) Valuation After Its Strong Multi‑Year Share Price Surge

Reviewed by Simply Wall St

Mitsui Kinzoku Company (TSE:5706) has quietly turned into a serious long term winner, with the share price jumping almost 3% over the past year and nearly 6 times over 3 years.

See our latest analysis for Mitsui Kinzoku Company.

Short term volatility has picked up, with a sharp 1 month share price return of minus 19.1% following a strong 90 day share price return of almost 59%. However, the 1 year total shareholder return of roughly 289% still points to powerful underlying momentum.

If Mitsui Kinzoku’s surge has you rethinking where the next big move might come from, this could be a good moment to discover fast growing stocks with high insider ownership.

The rally has been supported by improving earnings and a modest increase in revenue. However, shares still trade below analyst targets, leaving investors to consider whether there is more upside ahead or whether future growth is already priced in.

Price-to-Earnings of 21.1x: Is it justified?

Mitsui Kinzoku Company last closed at ¥17,185, and on a price-to-earnings ratio of 21.1x it screens as expensive versus several valuation yardsticks.

The price-to-earnings multiple compares the current share price to the company’s earnings per share, offering a snapshot of how much investors are willing to pay for current profits. For a diversified metals and materials business with cyclical exposure, it is a key gauge of how much future earnings strength the market is baking in.

Here, the market is assigning Mitsui Kinzoku Company a 21.1x price-to-earnings ratio, well above the SWS fair price-to-earnings estimate of 16.5x. This implies investors may be paying a premium that could compress if expectations cool. At the same time, that 21.1x is markedly cheaper than the 34.5x peer average. This suggests that while the stock looks stretched versus its own fair ratio, it still trades at a discount to some faster growing or more richly valued names in the space.

Against the broader Japanese metals and mining industry, however, the contrast is stark. Mitsui Kinzoku Company’s 21.1x price-to-earnings ratio towers over the sector average of 12.1x, highlighting how much more investors are currently willing to pay for its earnings stream.

Explore the SWS fair ratio for Mitsui Kinzoku Company

Result: Price-to-Earnings of 21.1x (OVERVALUED)

However, sustained multiple expansion is not guaranteed, as softer revenue growth and any setback in metals demand or auto-related orders could quickly pressure sentiment.

Find out about the key risks to this Mitsui Kinzoku Company narrative.

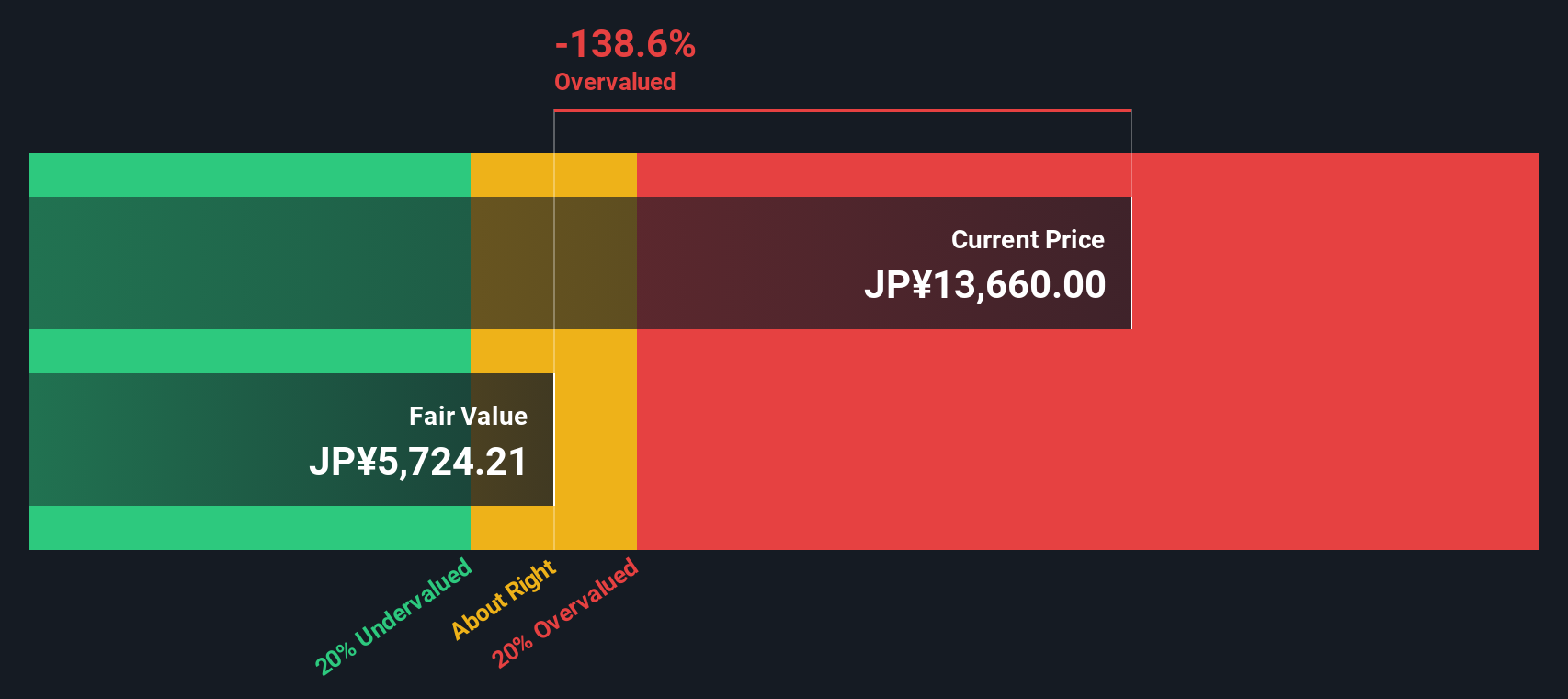

Another View: Our DCF Signals Caution

Our SWS DCF model paints a far harsher picture, putting fair value for Mitsui Kinzoku Company at roughly ¥7,637.5 versus the current ¥17,185 share price. That suggests the stock is trading at a hefty premium and raises the question of whether recent optimism has run too far ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui Kinzoku Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui Kinzoku Company Narrative

If our view does not fully align with yours, or you would rather dig into the numbers yourself, you can build a bespoke story in just a few minutes: Do it your way.

A great starting point for your Mitsui Kinzoku Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you lock in a view on Mitsui Kinzoku Company, give yourself an edge by scanning fresh opportunities that match your style and return goals.

- Target potential bargains by reviewing these 915 undervalued stocks based on cash flows that appear mispriced relative to their future cash flows and growth prospects.

- Tap into innovation-led growth through these 25 AI penny stocks positioned at the heart of artificial intelligence adoption across multiple industries.

- Strengthen your income strategy with these 13 dividend stocks with yields > 3% that can help you build a more reliable and attractive yield profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)