- China

- /

- Metals and Mining

- /

- SZSE:001337

Undiscovered Gems in Asia with Strong Potential September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape, with small-cap stocks in the U.S. showing resilience and outperforming larger indices like the S&P 500, Asia presents its own set of opportunities amid fluctuating economic indicators and market sentiment. In this environment, identifying promising stocks involves looking for companies that demonstrate robust fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lelon Electronics | 17.92% | 5.19% | 9.27% | ★★★★★★ |

| Champion Building MaterialsLtd | 27.07% | -2.25% | 8.20% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -13.99% | -30.38% | ★★★★★★ |

| Ningbo Kangqiang Electronics | 43.88% | 2.48% | -7.32% | ★★★★★★ |

| Kondotec | 12.90% | 6.97% | 11.26% | ★★★★★☆ |

| KC | 2.84% | 8.17% | -0.54% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| ASL Marine Holdings | 155.37% | 13.24% | 51.91% | ★★★★☆☆ |

| Hui Lyu Ecological Technology GroupsLtd | 43.35% | -5.67% | -12.37% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

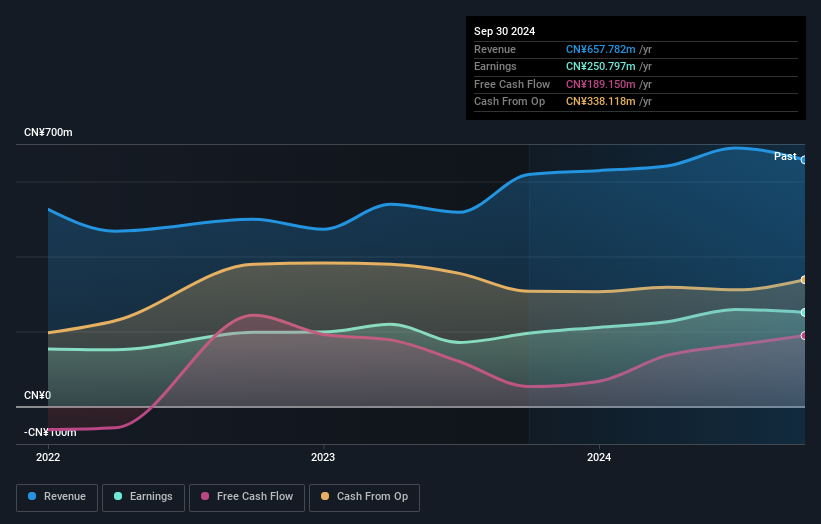

Wenzhou Yuanfei pet toy products (SZSE:001222)

Simply Wall St Value Rating: ★★★★★★

Overview: Wenzhou Yuanfei Pet Toy Products Co., Ltd. operates in the pet toy industry with a market cap of CN¥4.98 billion.

Operations: The company generates revenue primarily through its pet toy products. It has a market cap of CN¥4.98 billion, reflecting its scale in the industry.

Wenzhou Yuanfei, a notable player in the pet toy industry, reported half-year sales of CNY 791.92 million, up from CNY 544.21 million last year, showcasing solid revenue growth. The company is debt-free and boasts a price-to-earnings ratio of 32.5x, which is favorable compared to the CN market average of 45.1x. Despite not being free cash flow positive recently, earnings have grown by 8.2% over the past year and are forecasted to increase by 13.72% annually, outpacing the leisure industry's -1.5%. With high-quality earnings and no debt concerns since reducing its debt from five years ago when it had an 8.8% debt-to-equity ratio, Wenzhou Yuanfei seems well-positioned for future growth in its niche market segment.

- Take a closer look at Wenzhou Yuanfei pet toy products' potential here in our health report.

Understand Wenzhou Yuanfei pet toy products' track record by examining our Past report.

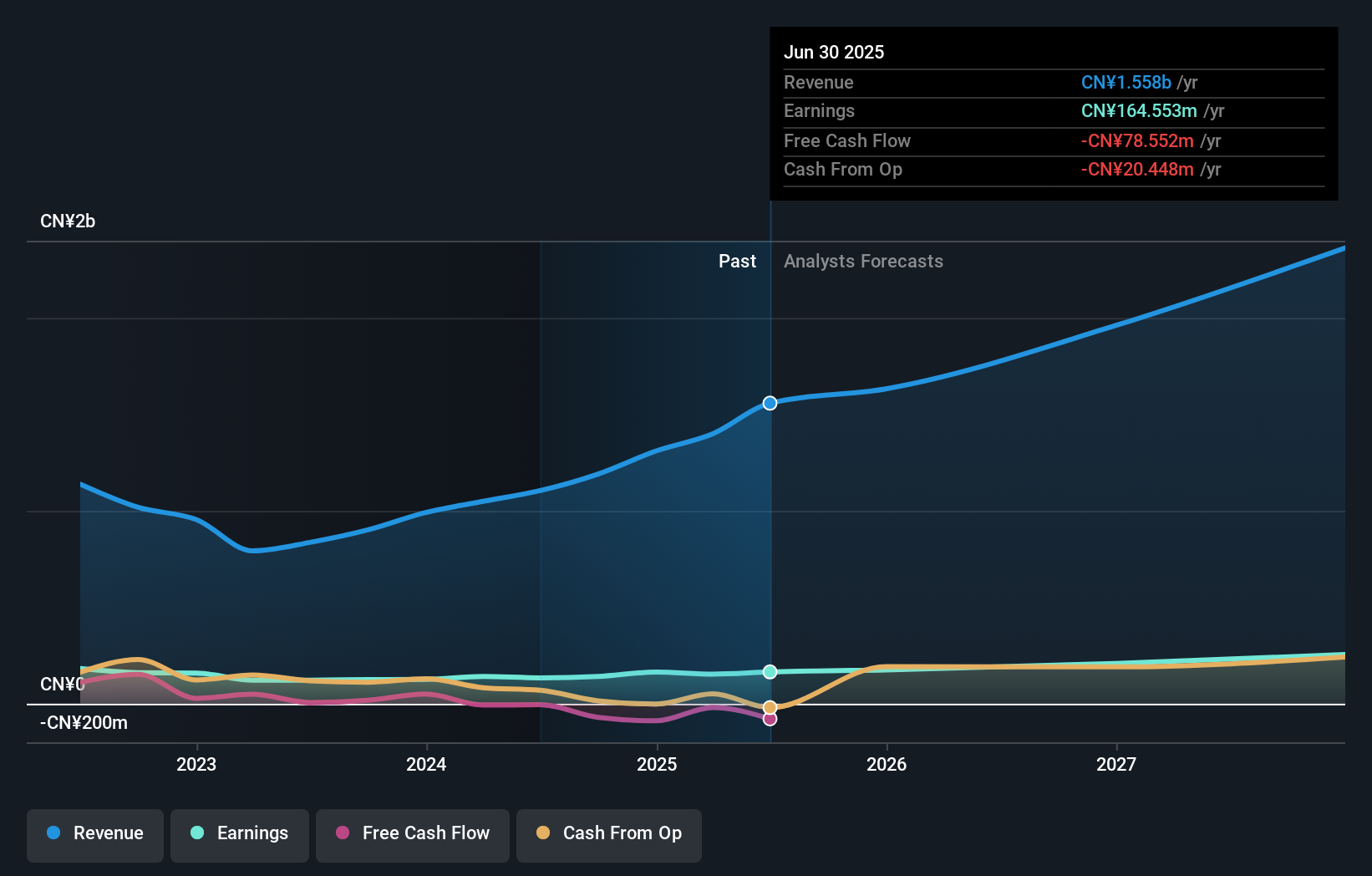

Sichuan Gold (SZSE:001337)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Gold Co., Ltd. is involved in the gold mining industry and has a market capitalization of CN¥10.94 billion.

Operations: Sichuan Gold generates revenue primarily from the production and sale of gold concentrate and alloy gold, amounting to CN¥639.83 million. The company's financial performance is significantly influenced by this revenue stream.

Sichuan Gold, a promising name in the metals and mining sector, has been making waves with its impressive 17.7% earnings growth over the past year, outpacing the industry's -2.3%. The company boasts high-quality earnings and operates without debt, eliminating concerns over interest payments. Its price-to-earnings ratio of 44.1x is slightly more attractive than the broader CN market at 45.1x. Free cash flow remains positive, with recent figures showing US$153 million as of September 2025. An upcoming meeting on September 12 aims to amend company bylaws, potentially shaping future governance and strategy decisions.

- Click to explore a detailed breakdown of our findings in Sichuan Gold's health report.

Review our historical performance report to gain insights into Sichuan Gold's's past performance.

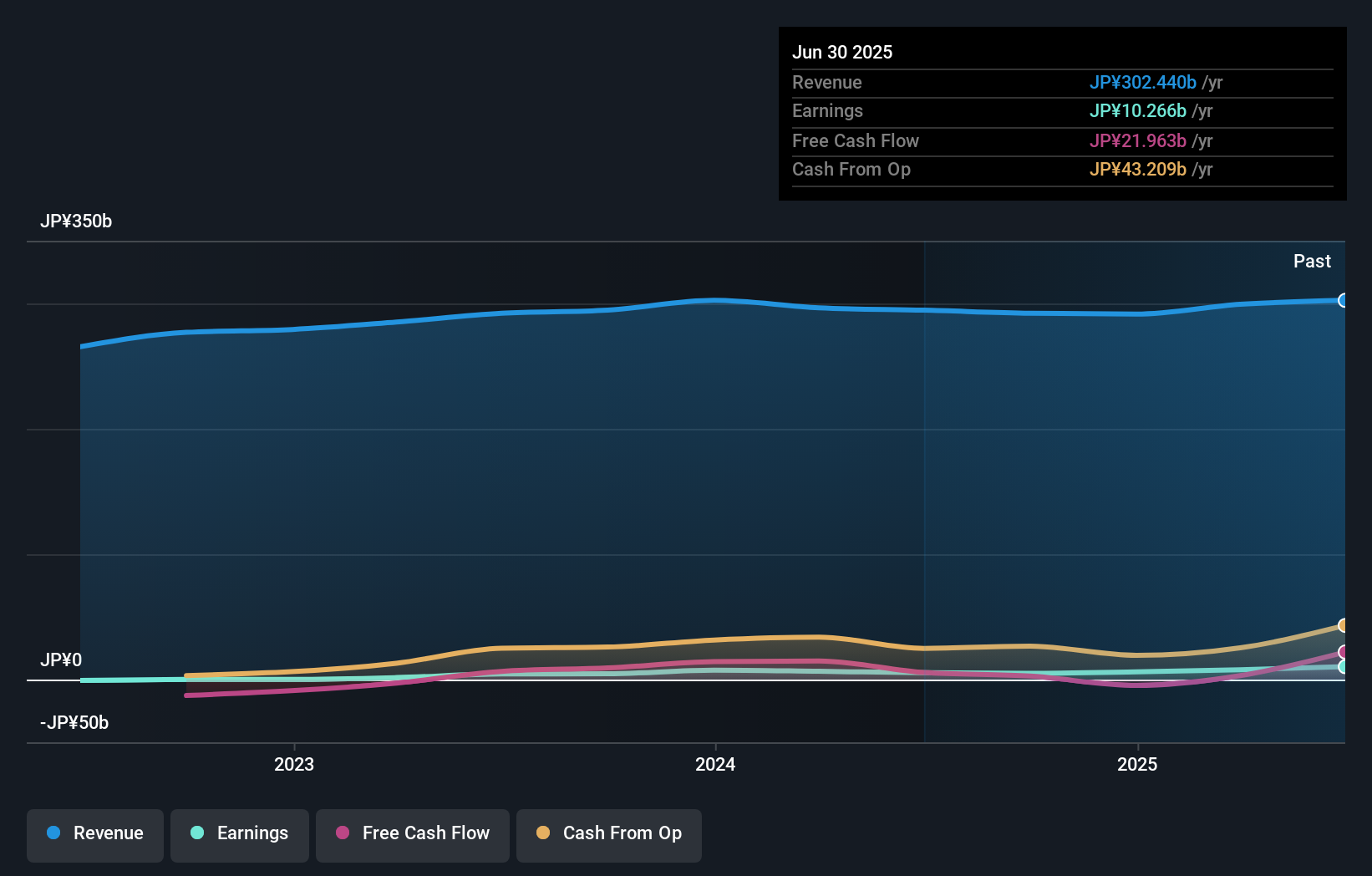

Aichi Steel (TSE:5482)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aichi Steel Corporation manufactures and sells steel, forged products, and electro-magnetic products in Japan with a market cap of ¥188.49 billion.

Operations: Aichi Steel generates revenue primarily from the sale of steel, forged products, and electro-magnetic products. The company has a market capitalization of ¥188.49 billion.

Aichi Steel, a notable player in the industry, has shown impressive growth with earnings up 88.8% over the past year, outpacing its sector's performance. The company's EBIT covers interest payments 173 times over, indicating robust financial health. Its net debt to equity ratio stands at a satisfactory 21.5%. Recent guidance revisions highlight expected revenue of ¥148 billion and operating profit of ¥6 billion for the first half of fiscal year ending March 2026, reflecting higher sales volume and lower purchase prices. Aichi also announced special dividends totaling ¥76 per share for fiscal year 2025 as part of shareholder returns strategy.

- Navigate through the intricacies of Aichi Steel with our comprehensive health report here.

Evaluate Aichi Steel's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 2395 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001337

Flawless balance sheet with solid track record.

Market Insights

Community Narratives