As global markets grapple with cautious Federal Reserve commentary and looming political uncertainties, investors are navigating a landscape marked by interest rate cuts and mixed economic signals. Amidst these conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those seeking to weather market volatility while benefiting from regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.26% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Nihon Yamamura Glass (TSE:5210)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nihon Yamamura Glass Co., Ltd. is engaged in the production and sale of glass bottles and plastic closures both in Japan and internationally, with a market cap of ¥16.26 billion.

Operations: Nihon Yamamura Glass Co., Ltd.'s revenue is primarily derived from its Glass Bottle Related Business at ¥48.02 billion, followed by the Logistics-Related Business at ¥23.70 billion, Plastic Container Related Business at ¥8.49 billion, and New Glass Related Business at ¥2.85 billion.

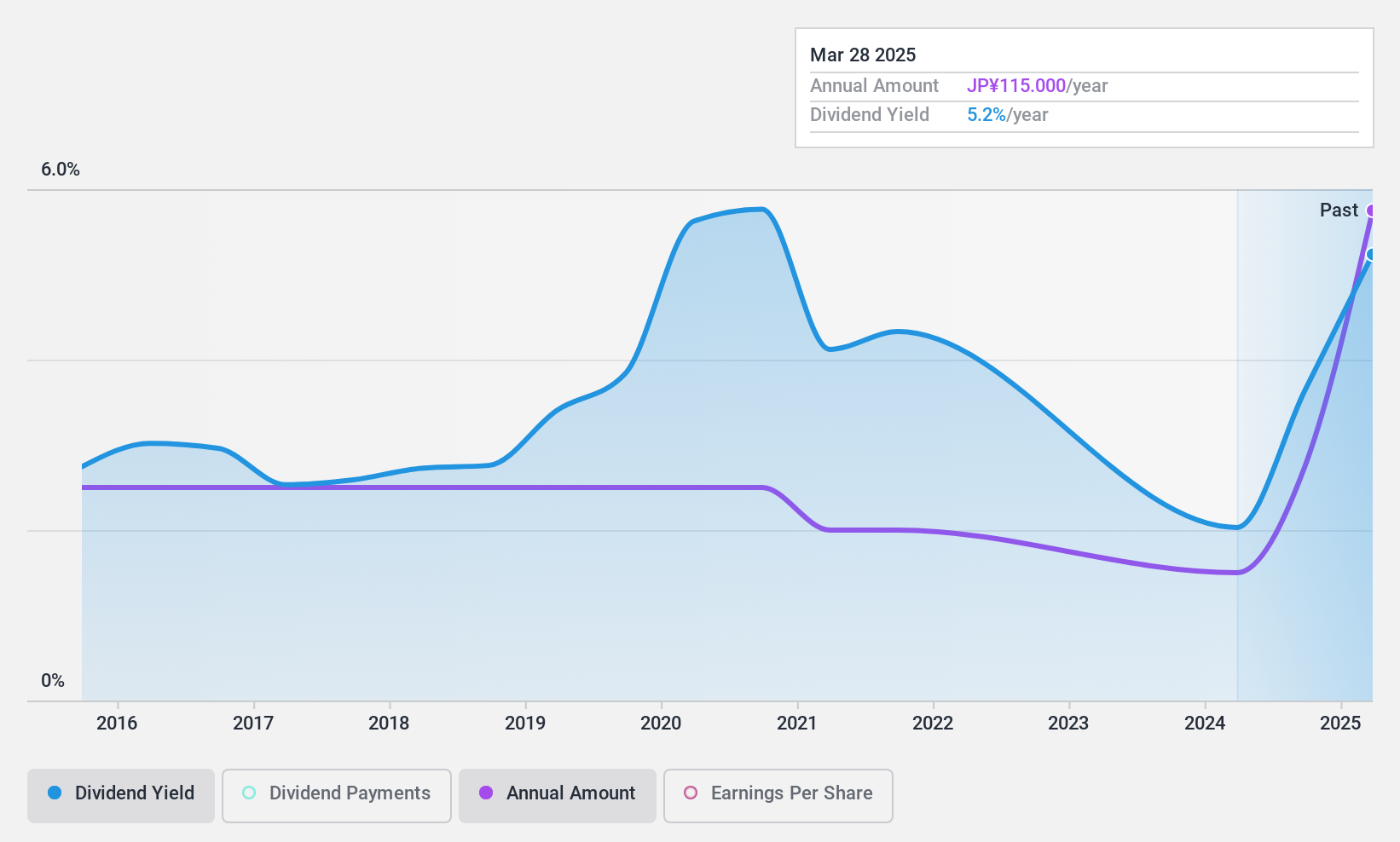

Dividend Yield: 3.7%

Nihon Yamamura Glass trades at a significant discount to its estimated fair value, offering potential value for investors. Despite a low dividend yield of 3.75%, the company's dividends are well-covered by both earnings and cash flows, with payout ratios of 17.7% and 47.4%, respectively. However, the dividend track record is unstable with volatility over the past decade, indicating some risk for income-focused investors despite past growth in payments.

- Dive into the specifics of Nihon Yamamura Glass here with our thorough dividend report.

- Our valuation report unveils the possibility Nihon Yamamura Glass' shares may be trading at a discount.

TYK (TSE:5363)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TYK Corporation is involved in the global manufacture and sale of functional refractories and ceramics, with a market cap of ¥18.31 billion.

Operations: TYK Corporation's revenue segments include the manufacture and sale of functional refractories and ceramics worldwide.

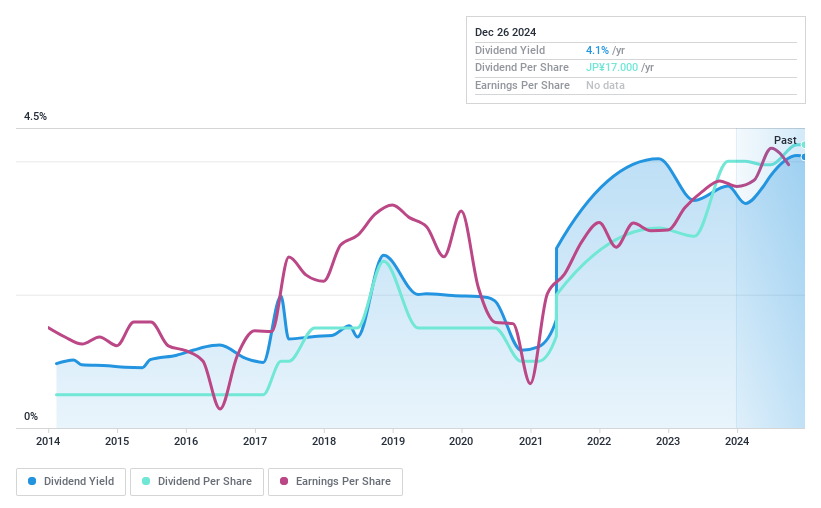

Dividend Yield: 4%

TYK's dividend yield of 4.05% ranks in the top 25% of JP market dividend payers, but its track record has been volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios of 29.3% and 23.4%, respectively. The stock trades at a significant discount to its estimated fair value, suggesting potential value despite concerns about the reliability of its dividend payments.

- Unlock comprehensive insights into our analysis of TYK stock in this dividend report.

- Upon reviewing our latest valuation report, TYK's share price might be too pessimistic.

SK-ElectronicsLTD (TSE:6677)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SK-Electronics CO., LTD. manufactures and sells large-format photomasks both in Japan and internationally, with a market cap of ¥19.31 billion.

Operations: SK-Electronics CO., LTD.'s revenue is primarily derived from its Large Photomask Business, contributing ¥25.64 billion, and its Solution Business, which adds ¥89.58 million.

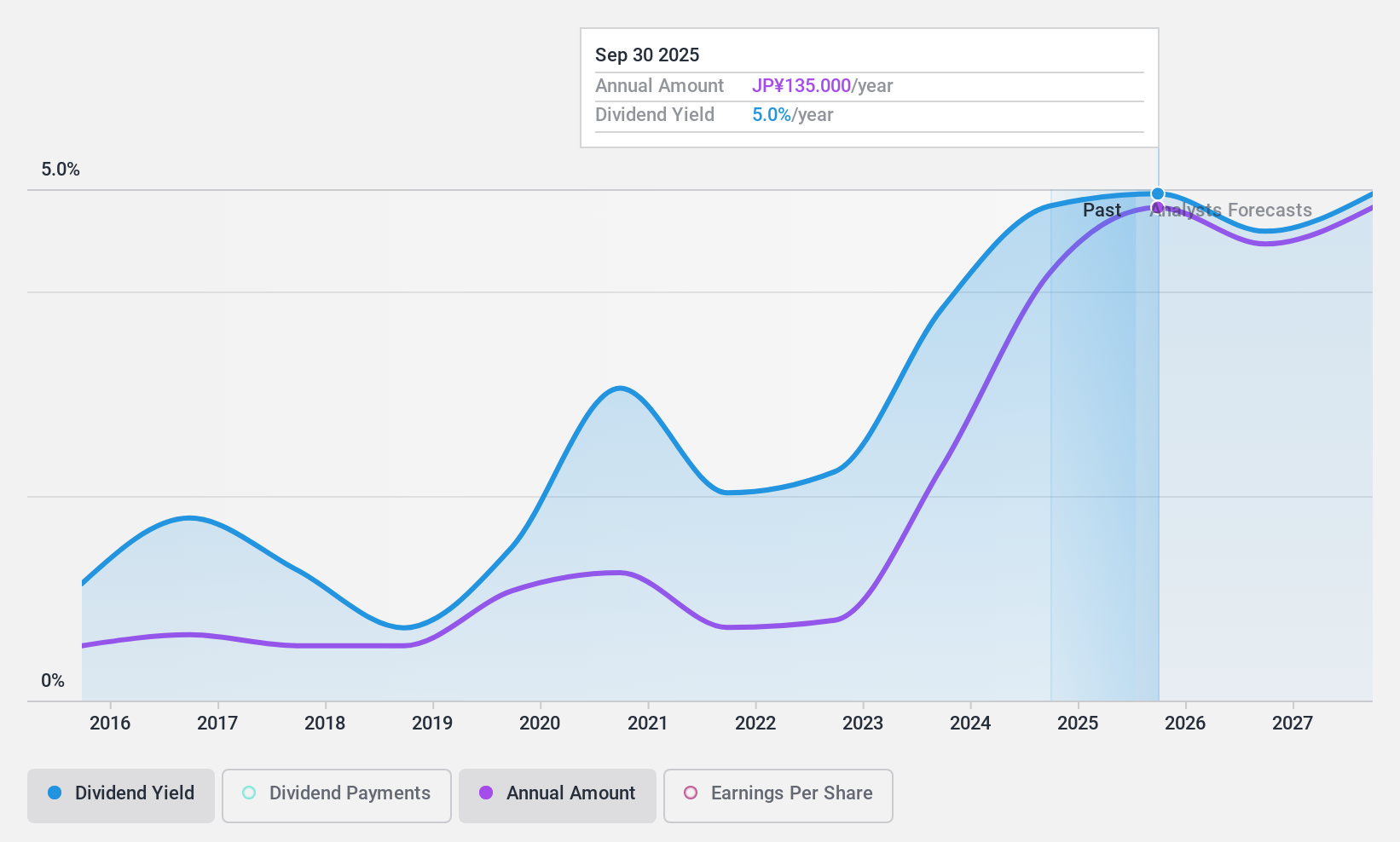

Dividend Yield: 5.9%

SK-Electronics offers a dividend yield of 5.85%, placing it among the top quartile in Japan, yet its dividends have been volatile over the past decade. The recent reduction from ¥162 to ¥109 per share highlights this instability. Despite a reasonable payout ratio of 61.7%, dividends aren't backed by free cash flow, raising sustainability concerns. The stock's P/E ratio of 8.5x suggests it's undervalued compared to peers, but earnings are expected to decline annually by 3.6% over three years.

- Click here and access our complete dividend analysis report to understand the dynamics of SK-ElectronicsLTD.

- The analysis detailed in our SK-ElectronicsLTD valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Get an in-depth perspective on all 1950 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Yamamura Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5210

Nihon Yamamura Glass

Produces and sells glass bottles and plastic closures in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.