- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6745

Undiscovered Gems Promising Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have faced particular challenges, reflecting broader investor sentiment. Despite these headwinds, the U.S. economy's robust growth and resilient consumer spending offer a backdrop where undiscovered gems can emerge as promising stocks to watch. In such an environment, identifying companies with strong fundamentals and innovative potential becomes crucial for investors seeking opportunities in less-explored corners of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Baoding Technology | 64.72% | 34.64% | 46.42% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Investco Holding (IBSE:INVES)

Simply Wall St Value Rating: ★★★★★★

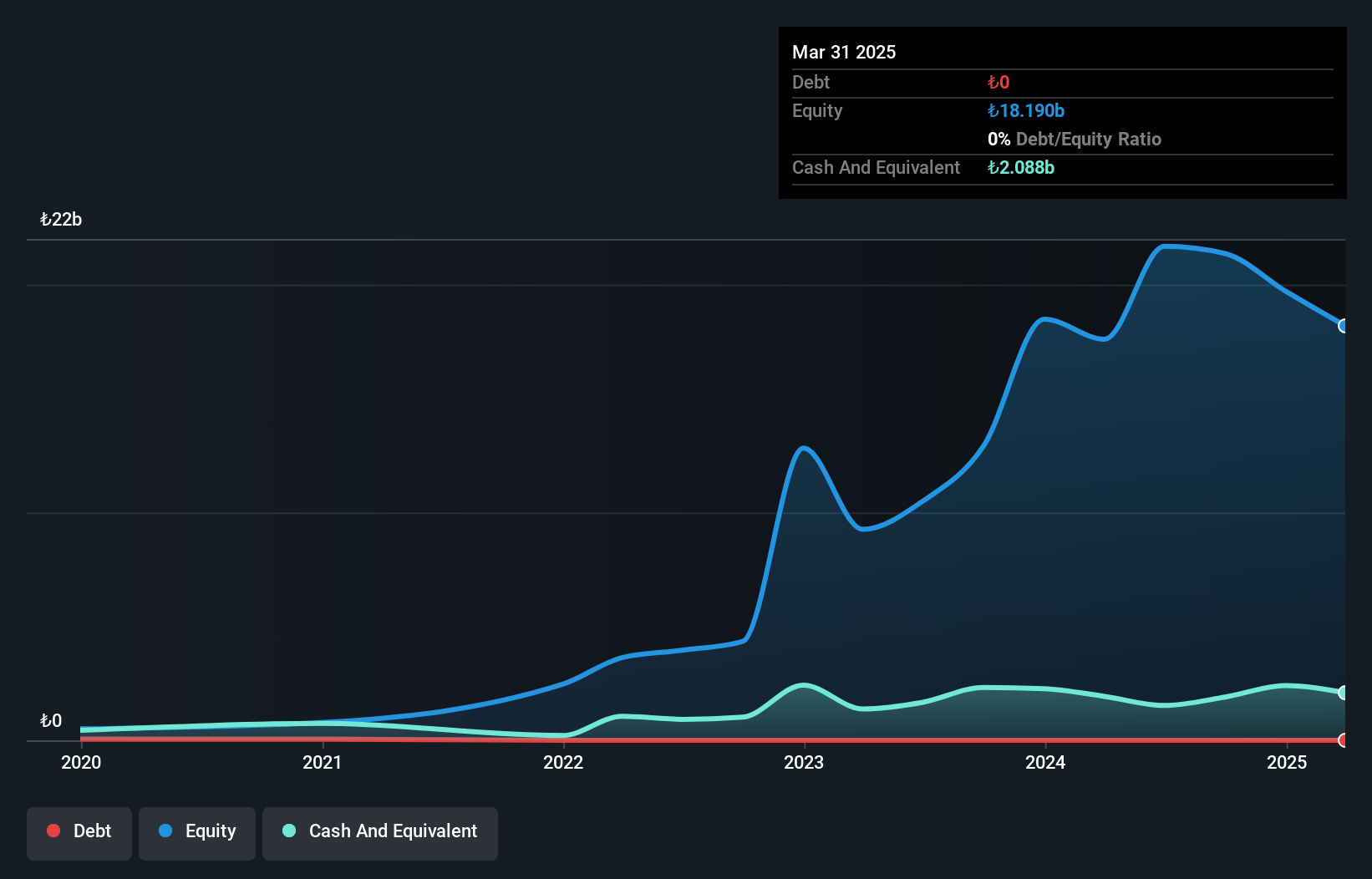

Overview: Investco Holding A.S. is an investment company based in Turkey with a market capitalization of TRY55.03 billion.

Operations: Investco Holding generates revenue primarily through its investment activities in Turkey. The company's cost structure includes various operational expenses that impact its profitability. The net profit margin has shown variability, reflecting changes in revenue and cost management over time.

Investco Holding, a niche player in the financial sector, showcases high-quality earnings but grapples with negative earnings growth of -53.8% over the past year, contrasting sharply with the industry average of 42.2%. Despite being debt-free and not burdened by interest payments, its recent performance highlights challenges; third-quarter sales plunged to TRY 2.03 billion from TRY 685 million last year, resulting in a net loss of TRY 1.96 billion compared to a previous loss of TRY 124 million. Over nine months, however, sales rose to TRY 4.87 billion from TRY 3.25 billion previously reported, signaling potential resilience amidst volatility.

Klaveness Combination Carriers (OB:KCC)

Simply Wall St Value Rating: ★★★★☆☆

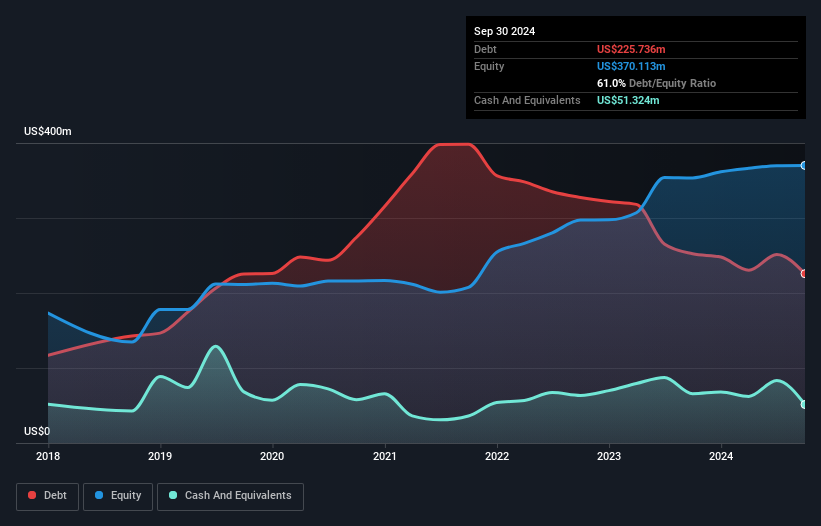

Overview: Klaveness Combination Carriers ASA owns and operates combination carriers serving the dry bulk shipping and product tanker industries across various global regions, with a market cap of NOK4.46 billion.

Operations: Klaveness Combination Carriers generates revenue primarily from its CABU and CLEANBU segments, contributing $149.91 million and $146.51 million, respectively.

Klaveness Combination Carriers, a nimble player in the shipping industry, has been making waves with its financial performance. Over the past five years, earnings have surged by 51.4% annually, showcasing robust growth despite not outpacing the industry's 31.1% rise last year. The company's net debt to equity ratio stands at a high 47.1%, yet interest payments are comfortably covered by EBIT at 7.8 times over. Recent results highlight revenue of US$72.73 million for Q3 2024 and net income of US$21.69 million, reflecting an improvement from previous figures while trading significantly below estimated fair value by 67%.

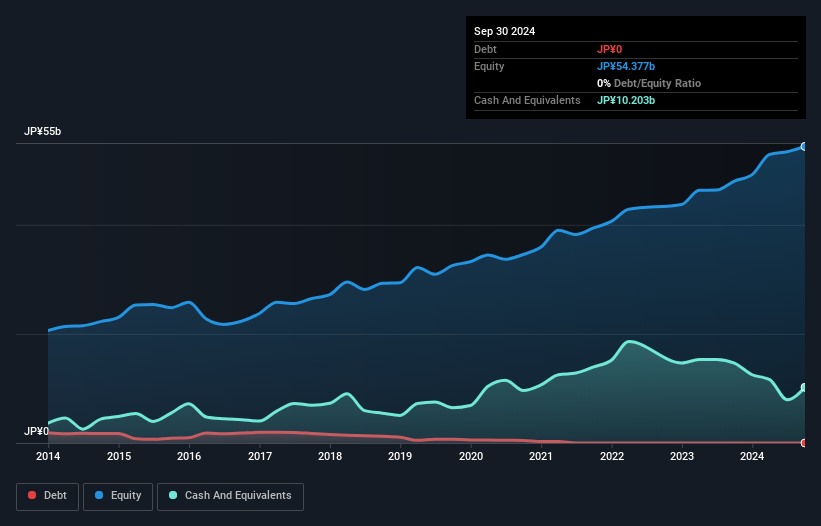

Hochiki (TSE:6745)

Simply Wall St Value Rating: ★★★★★★

Overview: Hochiki Corporation specializes in the research, development, manufacture, sale, consulting, engineering, design, and maintenance of fire alarm systems and related security solutions both in Japan and internationally with a market capitalization of approximately ¥64.48 billion.

Operations: Hochiki generates revenue from its core activities in fire alarm, information and communication, fire extinguishing, and security systems. The company's market capitalization is approximately ¥64.48 billion.

Hochiki, a smaller player in the electronics sector, has shown impressive earnings growth of 26% over the past year, outpacing the industry's -2.2%. With a price-to-earnings ratio of 10x, it trades favorably against the JP market's 13.5x average. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 2.2%, indicating prudent financial management. However, its free cash flow remains negative at A$-1 million as of September 2024 and recent capital expenditures were A$1.87 million which seems to impact liquidity but doesn't overshadow its strong profit trajectory and value proposition in the market.

- Delve into the full analysis health report here for a deeper understanding of Hochiki.

Gain insights into Hochiki's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 4620 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hochiki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6745

Hochiki

Engages in the research and development, manufacture, sale, consulting, engineering, design, and maintenance of fire alarm, information and communication, fire extinguishing, and security systems in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.