3 Dividend Stocks Offering Up To 3.8% Yield For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of recent rate cuts and political uncertainties, investors are closely watching how these factors influence stock performance. With U.S. stocks experiencing a volatile week due to cautious Federal Reserve commentary and looming government shutdown fears, many are turning their attention to dividend stocks as a potential source of steady income amidst market fluctuations. In such an environment, selecting dividend stocks with reliable yields can offer stability and income generation for portfolios looking to weather economic shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

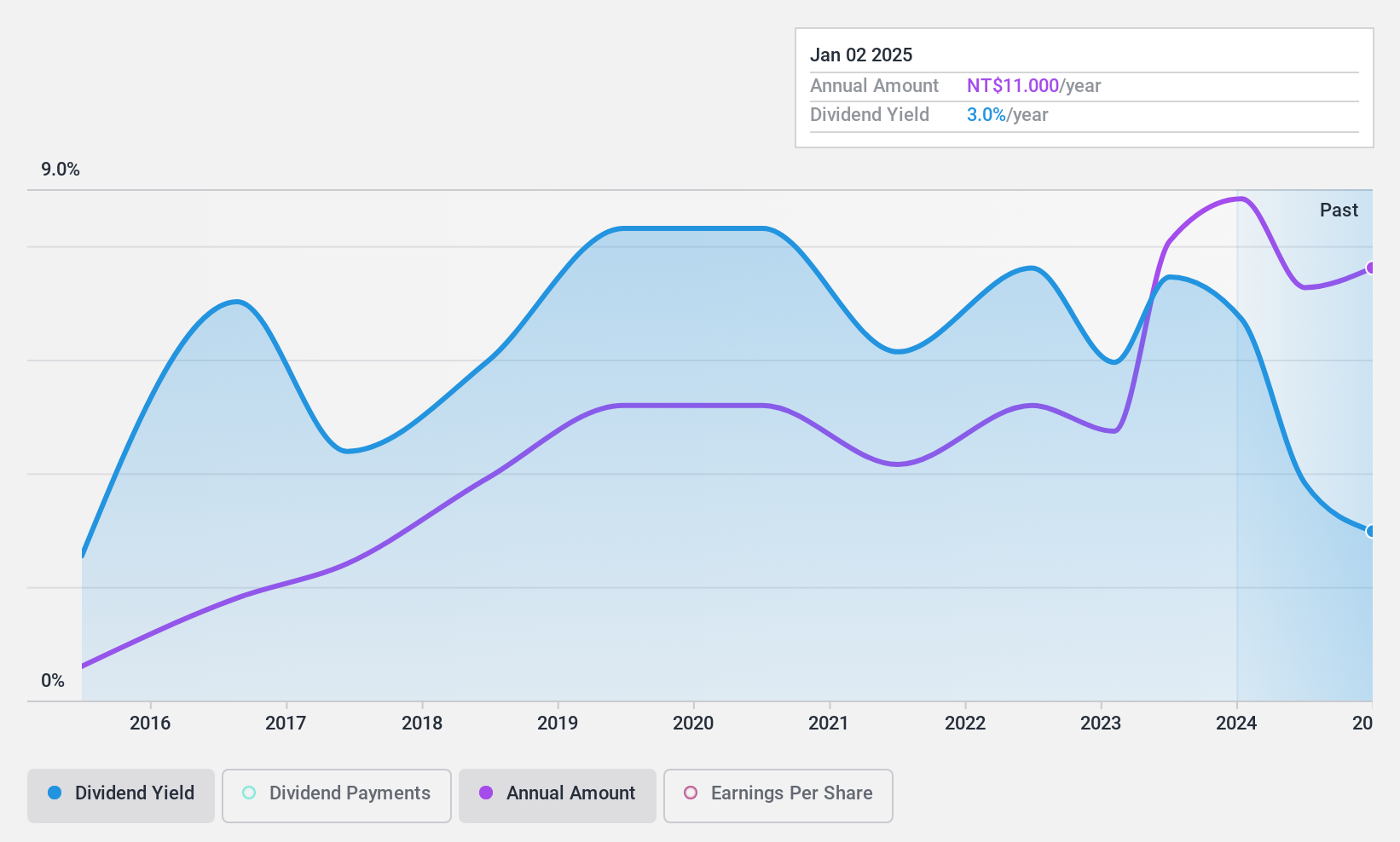

Acter Group (TPEX:5536)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian countries with a market cap of NT$45.17 billion.

Operations: Acter Group Corporation Limited generates its revenue from engineering services primarily in Mainland China (NT$12.95 billion), followed by Taiwan (NT$11.97 billion) and other Asian countries (NT$3.09 billion).

Dividend Yield: 3%

Acter Group's dividend yield of 3.02% is below the top 25% in the Taiwan market, yet its payout ratio of 61.6% suggests dividends are well-covered by earnings and cash flows. Despite a history of volatility, recent increases and TWD 5 per share distribution indicate growth potential. Financially, Acter reported strong Q3 results with net income rising to TWD 627.96 million from TWD 507.61 million year-on-year, supporting dividend sustainability amidst improving revenue figures.

- Get an in-depth perspective on Acter Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Acter Group's share price might be on the expensive side.

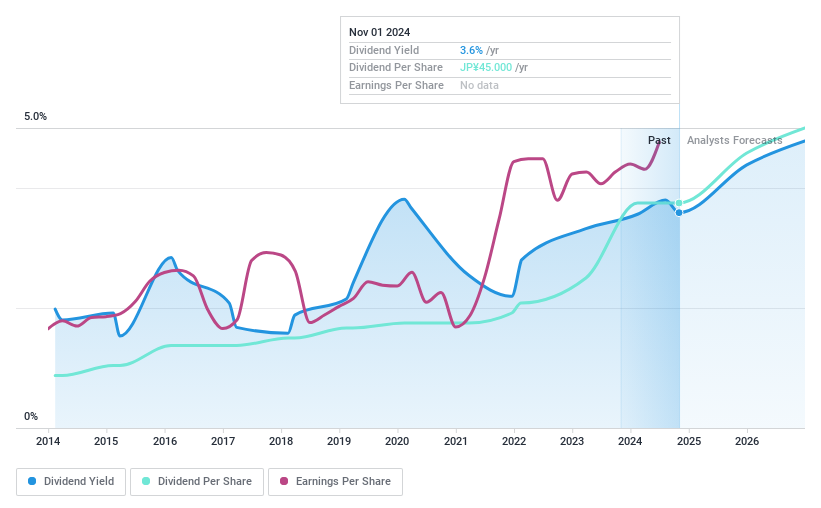

Kuriyama Holdings (TSE:3355)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuriyama Holdings Corporation operates through its subsidiaries in industrial, construction, sports facility, and other materials businesses both in Japan and internationally, with a market cap of ¥24.43 billion.

Operations: Kuriyama Holdings Corporation generates revenue through its North America segment with ¥43.01 billion, Asian Business - Industry Materials at ¥17.74 billion, Asian Business - Sports and Construction Materials at ¥9.46 billion, Europe, South America and Oceania Business contributing ¥6.83 billion, and Asian Business - Others at ¥0.95 billion.

Dividend Yield: 3.6%

Kuriyama Holdings offers a stable dividend yield of 3.62%, slightly below the top 25% in the JP market. Its low payout ratios—31.9% for earnings and 17.8% for cash flows—ensure dividends are well-covered, indicating sustainability. Over the past decade, dividends have consistently grown without volatility, supported by a favorable price-to-earnings ratio of 6.4x compared to the market average of 13.5x, suggesting good value relative to peers and industry standards.

- Take a closer look at Kuriyama Holdings' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kuriyama Holdings shares in the market.

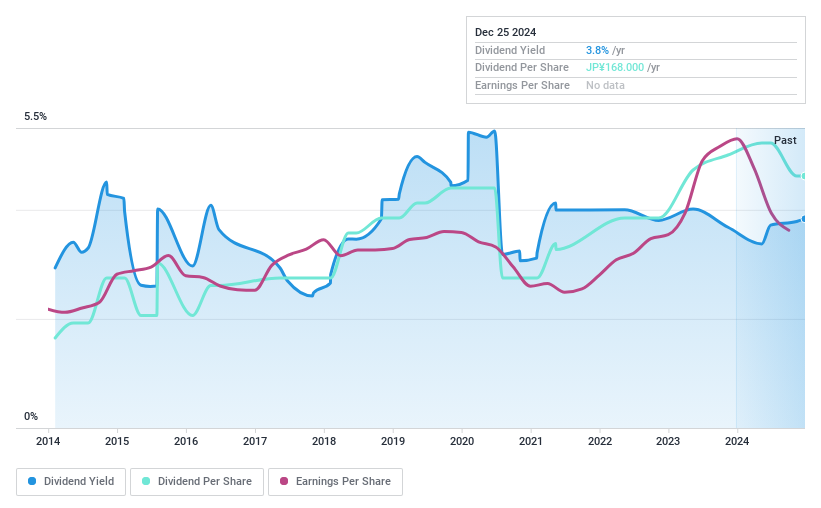

Yuasa Trading (TSE:8074)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yuasa Trading Co., Ltd. operates in the lifestyle and industry support sectors in Japan, with a market cap of ¥926.55 billion.

Operations: Yuasa Trading Co., Ltd.'s revenue is derived from its operations in the lifestyle and industry support sectors within Japan.

Dividend Yield: 3.8%

Yuasa Trading's dividend yield of 3.81% ranks in the top 25% of JP market payers, yet recent volatility and a high cash payout ratio (99.9%) raise concerns about sustainability. The recent reduction in dividends from ¥86 to ¥72 per share highlights these challenges. Despite a low earnings payout ratio (22.4%), dividends aren't fully covered by cash flows, indicating potential risks for investors seeking reliable income streams, although the price-to-earnings ratio of 10.3x suggests some value compared to the market average.

- Click here to discover the nuances of Yuasa Trading with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Yuasa Trading is priced higher than what may be justified by its financials.

Key Takeaways

- Explore the 1950 names from our Top Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuriyama Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3355

Kuriyama Holdings

Through its subsidiaries, engages in industrial, construction, sports facility, and other materials businesses in Japan and internationally.

Flawless balance sheet established dividend payer.