High Growth Tech And 2 Other Promising Stocks For Potential Portfolio Expansion

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility, with U.S. stocks declining amid cautious Federal Reserve commentary and political uncertainty surrounding a potential government shutdown. Smaller-cap indexes have been particularly affected, as concerns over interest rates and economic forecasts weigh on investor sentiment. In this environment, identifying promising stocks for portfolio expansion involves looking for companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. is engaged in the development and sale of electronic materials across various international markets, with a market cap of ₩1.16 trillion.

Operations: The company focuses on the development, production, and sale of electrical and electronic components, generating revenue of ₩208.25 billion. Its operations span several key international markets including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

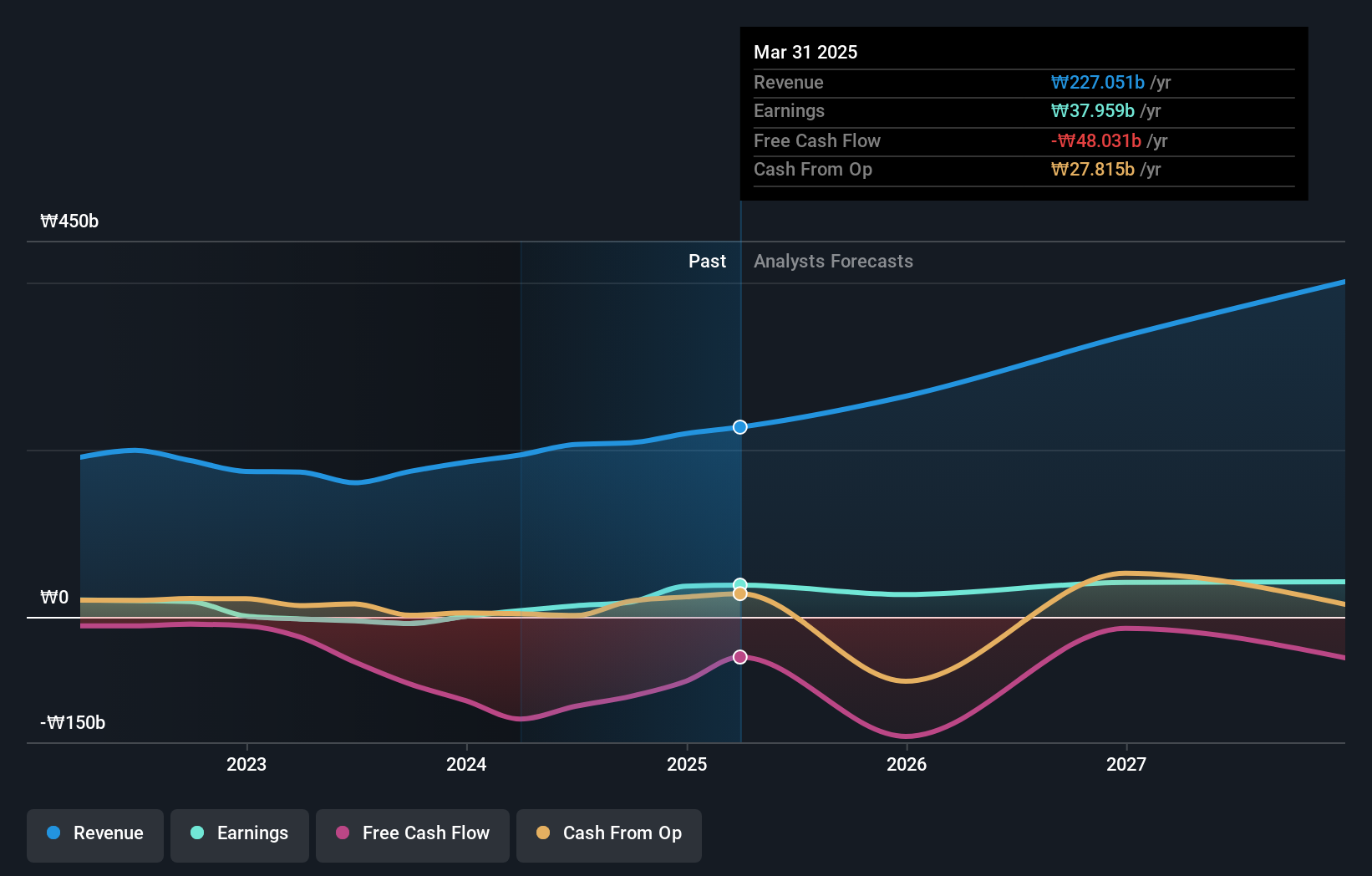

Daejoo Electronic Materials has demonstrated a robust turnaround, evidenced by its recent earnings report where quarterly net income soared to KRW 4.59 billion from KRW 102.6 million year-over-year, alongside a substantial increase in sales. This performance is underpinned by an aggressive R&D strategy, with the company channeling funds into innovation—a move reflecting in their projected annual revenue and earnings growth of 35.5% and 40.8%, respectively, outpacing broader market averages significantly. Moreover, Daejoo's participation in high-profile conferences like the Macquarie Asia Conference underscores its strategic efforts to enhance visibility and attract global investors, positioning it well within the competitive tech landscape despite previous financial challenges indicated by its struggle with debt coverage through operating cash flow.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SAKURA Internet Inc. is a Japanese company specializing in cloud computing services with a market capitalization of ¥171.80 billion.

Operations: The company generates revenue primarily from its Internet Infrastructure Business, amounting to ¥24.75 billion.

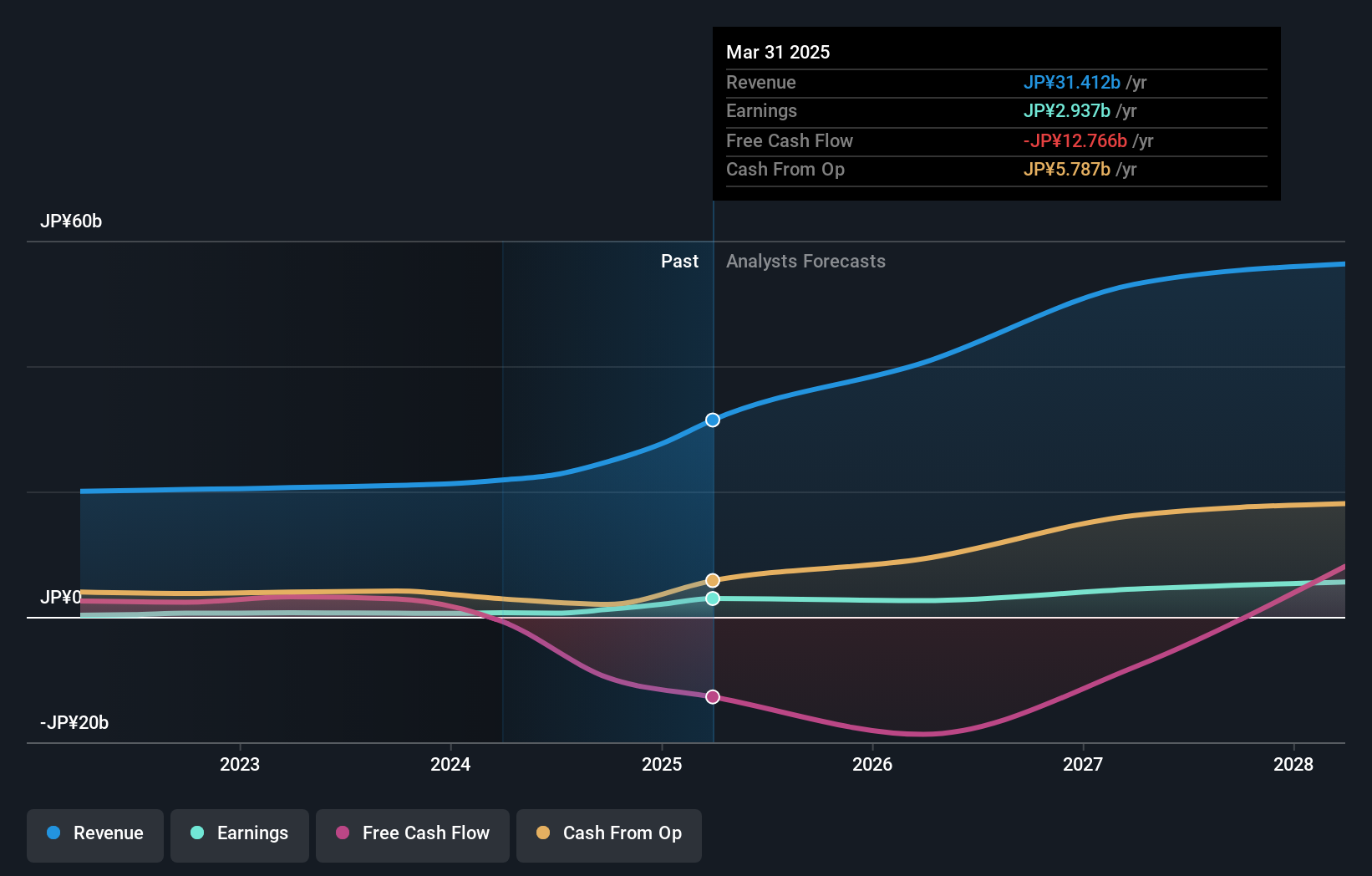

SAKURA Internet, amidst a volatile share price, has demonstrated significant financial growth with an expected annual revenue increase of 34.7% and earnings growth at 48.9%. This outpaces the broader Japanese market's projections substantially. The company's strategic focus on innovation is evident from its substantial R&D investments, reflecting in their latest earnings guidance for FY2025 with projected net sales reaching JPY 29 billion and an operating profit of JPY 2.6 billion. SAKURA's recent presentation at the KIS Global Investors Conference underscores its commitment to maintaining visibility and investor interest in a competitive landscape, positioning it as a promising entity in tech despite market fluctuations and shareholder dilution concerns over the past year.

- Dive into the specifics of SAKURA Internet here with our thorough health report.

Explore historical data to track SAKURA Internet's performance over time in our Past section.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market capitalization of approximately €360.48 million.

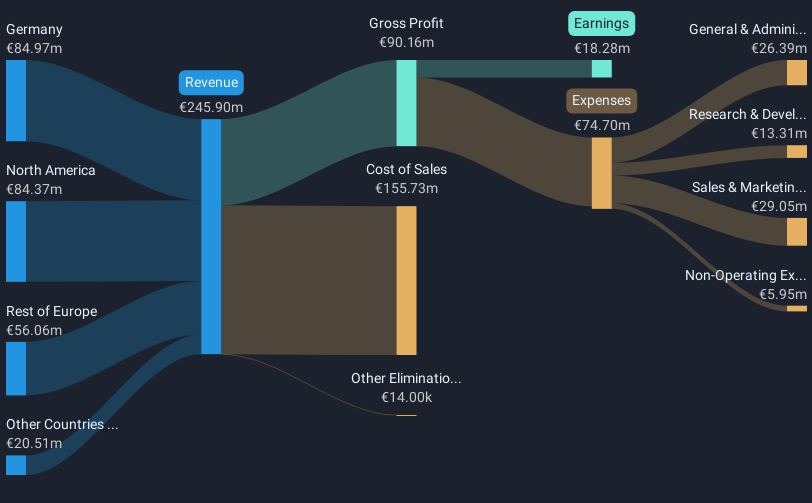

Operations: Init specializes in intelligent transportation systems for public transit, generating revenue primarily from wireless communications equipment, which amounted to approximately €245.89 million.

Init innovation in traffic systems SE has demonstrated resilience and growth in a challenging market, with its recent earnings report showing a sales increase to EUR 178.12 million from EUR 143.04 million year-over-year, marking significant progress. The company's commitment to research and development is underscored by its active participation in global conferences such as the UITP Africa & MENA Conference, highlighting its strategic focus on expanding its market presence internationally. Despite a slight dip in net income and earnings per share compared to the previous year, Init continues to outperform with revenue growth of 13.2% per year, surpassing the German market's average of 5.7%. This robust performance is complemented by an expected annual profit growth rate of 27.8%, positioning Init well for future advancements within the tech sector.

- Click to explore a detailed breakdown of our findings in init innovation in traffic systems' health report.

Understand init innovation in traffic systems' track record by examining our Past report.

Key Takeaways

- Embark on your investment journey to our 1271 High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3778

Solid track record with excellent balance sheet.

Market Insights

Community Narratives