Arakawa Chemical Industries (TSE:4968) Is Paying Out A Dividend Of ¥24.00

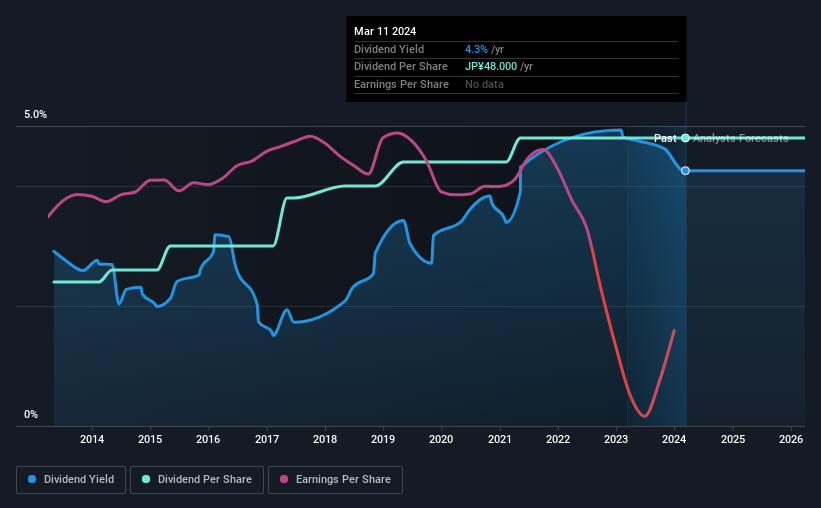

Arakawa Chemical Industries, Ltd. (TSE:4968) will pay a dividend of ¥24.00 on the 21st of June. Based on this payment, the dividend yield on the company's stock will be 4.3%, which is an attractive boost to shareholder returns.

See our latest analysis for Arakawa Chemical Industries

Arakawa Chemical Industries Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even in the absence of profits, Arakawa Chemical Industries is paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Earnings per share is forecast to rise by 134.3% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 106% over the next year.

Arakawa Chemical Industries Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of ¥24.00 in 2014 to the most recent total annual payment of ¥48.00. This works out to be a compound annual growth rate (CAGR) of approximately 7.2% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Earnings per share has been sinking by 59% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Arakawa Chemical Industries' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Although they have been consistent in the past, we think the payments are a little high to be sustained. We don't think Arakawa Chemical Industries is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Arakawa Chemical Industries that you should be aware of before investing. Is Arakawa Chemical Industries not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4968

Arakawa Chemical Industries

Manufactures and sells chemicals for functional coating agents, paper manufacturing, resins for printing inks and adhesives, materials for electronic materials, etc.

Established dividend payer and fair value.

Market Insights

Community Narratives