The board of UBE Corporation (TSE:4208) has announced that it will pay a dividend of ¥55.00 per share on the 3rd of December. This makes the dividend yield 4.7%, which will augment investor returns quite nicely.

UBE Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even in the absence of profits, UBE is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Looking forward, earnings per share is forecast to rise by 26.3% over the next year. The company seems to be going down the right path, but it will take a little bit longer than a year to cross over into profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

See our latest analysis for UBE

Dividend Volatility

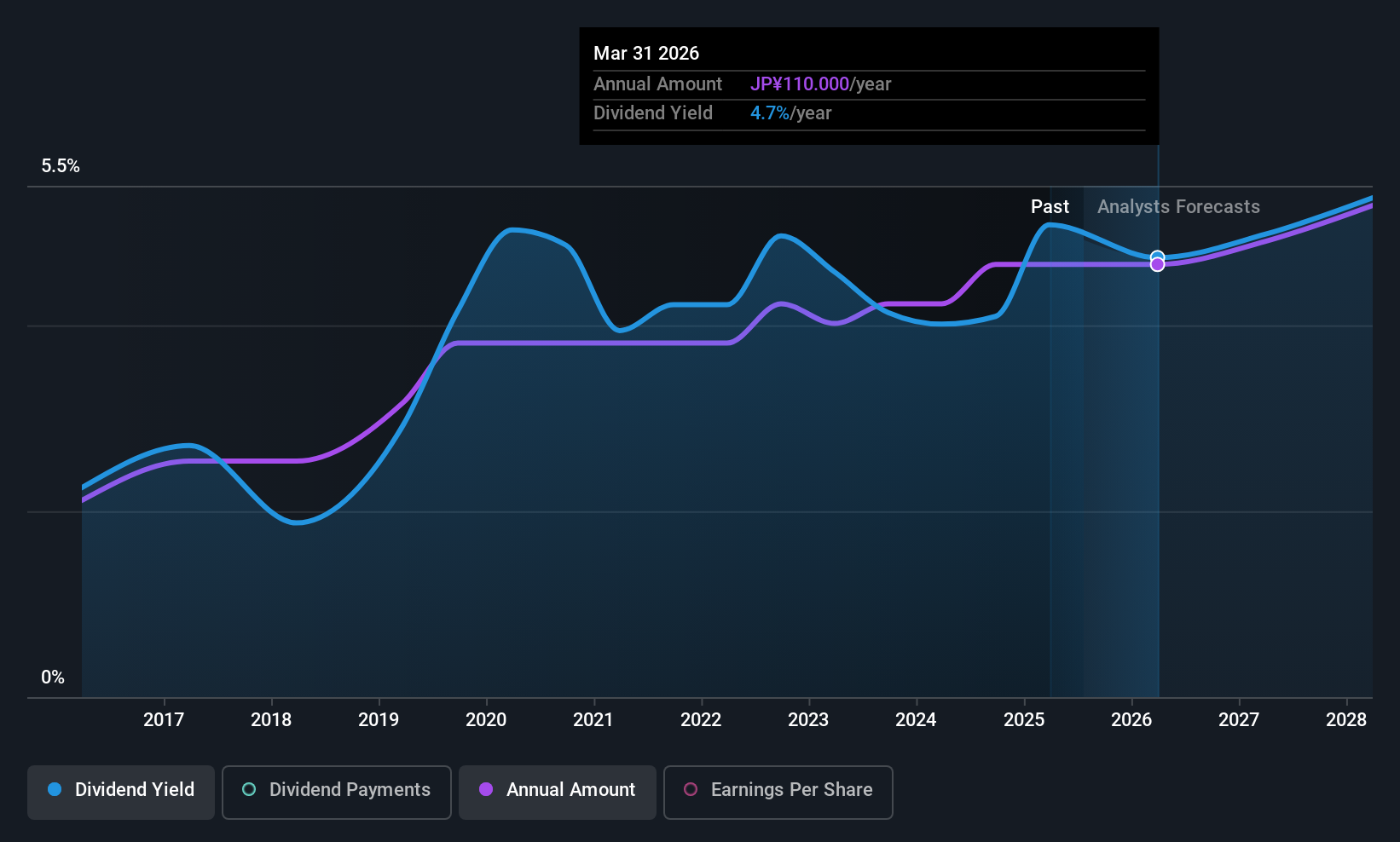

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the annual payment back then was ¥50.00, compared to the most recent full-year payment of ¥110.00. This works out to be a compound annual growth rate (CAGR) of approximately 8.2% a year over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. UBE might have put its house in order since then, but we remain cautious.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though UBE's EPS has declined at around 20% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

We're Not Big Fans Of UBE's Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 2 warning signs for UBE that investors should take into consideration. Is UBE not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4208

UBE

Engages in the materials and machinery businesses in Japan, Asia, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives