As global markets grapple with uncertainty surrounding the incoming Trump administration's policies and fluctuating interest rates, investors are keenly observing sector-specific impacts, such as deregulation hopes benefiting financials and energy shares. Amidst this backdrop of economic shifts and policy changes, dividend stocks present a compelling option for those seeking steady income streams; they often offer stability in volatile times due to their regular payouts and potential for long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Channel Well TechnologyLtd (TPEX:3078)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Channel Well Technology Co., Ltd. is engaged in the manufacturing, processing, trading, and sale of power supplies and electronic components across Taiwan, Asia, the United States, Europe, and other international markets with a market cap of NT$13.85 billion.

Operations: Channel Well Technology Co., Ltd. generates revenue through its activities in manufacturing, processing, trading, and selling power supplies and electronic components across various regions including Taiwan, Asia, the United States, Europe, and other international markets.

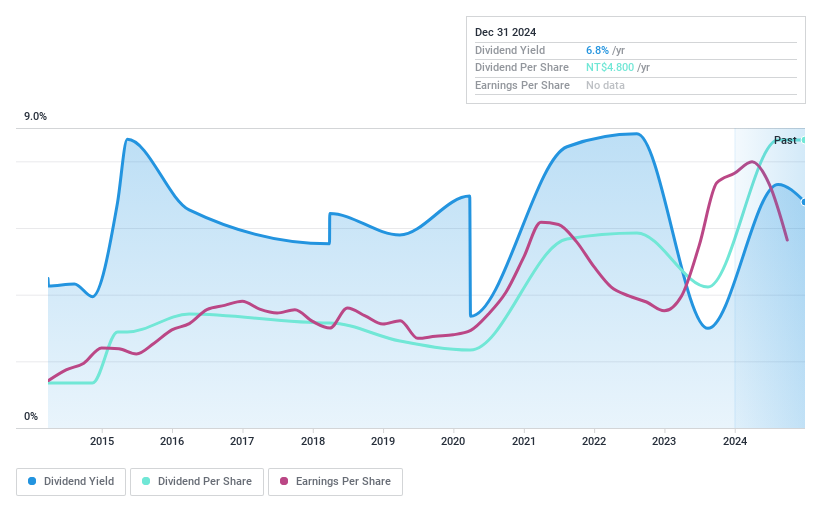

Dividend Yield: 7.5%

Channel Well Technology Ltd. offers a high dividend yield of 7.52%, placing it in the top 25% of payers in Taiwan, but this is not well covered by earnings with a payout ratio of 95.8%. The dividends have been volatile and unreliable over the past decade, despite some growth. Recent earnings show a decline, with third-quarter net income dropping to TWD 241.09 million from TWD 575.85 million year-over-year, raising concerns about dividend sustainability amidst lower sales and profits.

- Navigate through the intricacies of Channel Well TechnologyLtd with our comprehensive dividend report here.

- The analysis detailed in our Channel Well TechnologyLtd valuation report hints at an deflated share price compared to its estimated value.

Mitsui Chemicals (TSE:4183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui Chemicals, Inc. operates globally in sectors such as mobility, life and health care, basic and green materials, and ICT, with a market cap of ¥647.92 billion.

Operations: Mitsui Chemicals generates revenue from its key segments, including ¥570.13 billion from Mobility Solutions, ¥294.21 billion from Life & Healthcare Solutions, ¥810.42 billion from Basic & Green Materials, and ¥241.26 billion from ICT Solutions.

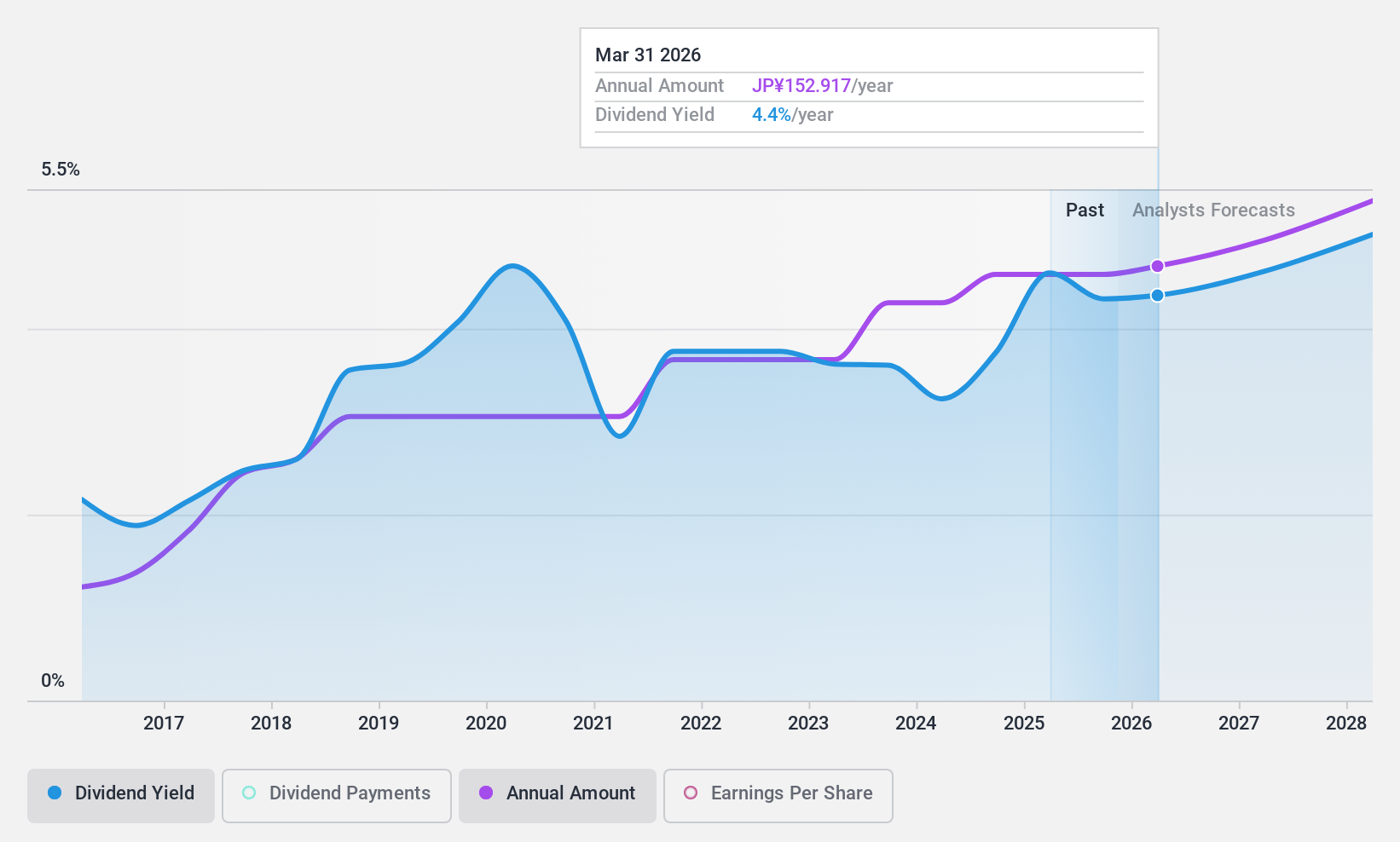

Dividend Yield: 4.2%

Mitsui Chemicals' dividend yield of 4.17% is among the top 25% in Japan, supported by a payout ratio of 53.5%, indicating coverage by earnings and cash flows. However, its dividend history has been unstable over the past decade despite some growth. The company's financial position is challenged by high debt levels and large one-off items affecting earnings quality. Recent efforts to consolidate ethylene facilities with Idemitsu Kosan aim to improve production efficiency amid a tough petrochemical market environment in Japan.

- Dive into the specifics of Mitsui Chemicals here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Mitsui Chemicals is trading behind its estimated value.

NS United Kaiun Kaisha (TSE:9110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NS United Kaiun Kaisha, Ltd., along with its subsidiaries, provides marine transportation services both in Japan and internationally, with a market cap of ¥95.09 billion.

Operations: NS United Kaiun Kaisha, Ltd.'s revenue is primarily derived from its Ocean Shipping Business, which accounts for ¥219.05 billion, and its Domestic Shipping Business, contributing ¥30.42 billion.

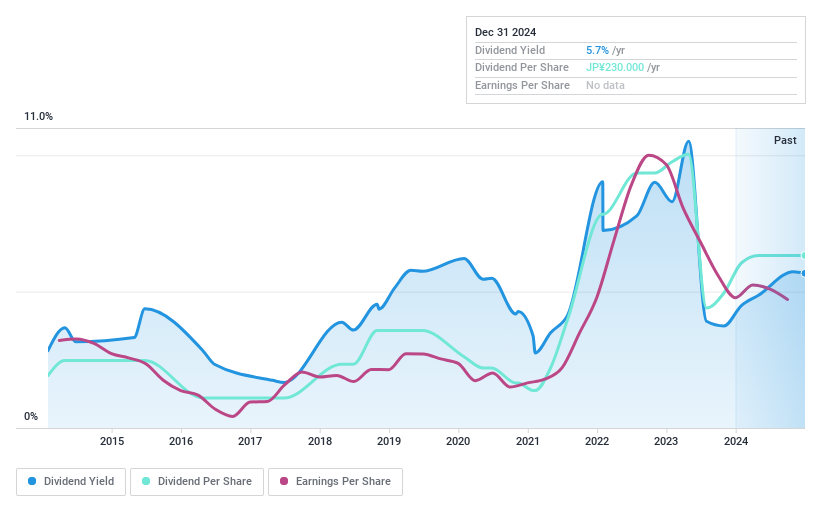

Dividend Yield: 5.5%

NS United Kaiun Kaisha's dividend yield is in the top 25% of Japanese stocks, supported by a low payout ratio of 21.9%, indicating strong coverage by earnings and cash flows. Trading at 53.9% below its estimated fair value suggests potential for price appreciation. Despite these positives, the company's dividend history has been volatile over the past decade, with instances of significant annual drops exceeding 20%.

- Unlock comprehensive insights into our analysis of NS United Kaiun Kaisha stock in this dividend report.

- Our valuation report here indicates NS United Kaiun Kaisha may be undervalued.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1965 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4183

Mitsui Chemicals

Engages in the mobility, life and health care, basic and green materials, ICT, and other businesses worldwide.

6 star dividend payer with excellent balance sheet.