As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are increasingly looking for opportunities in growth stocks, which have shown resilience amid broader market fluctuations. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Solara Active Pharma Sciences (NSEI:SOLARA)

Simply Wall St Growth Rating: ★★★★☆☆

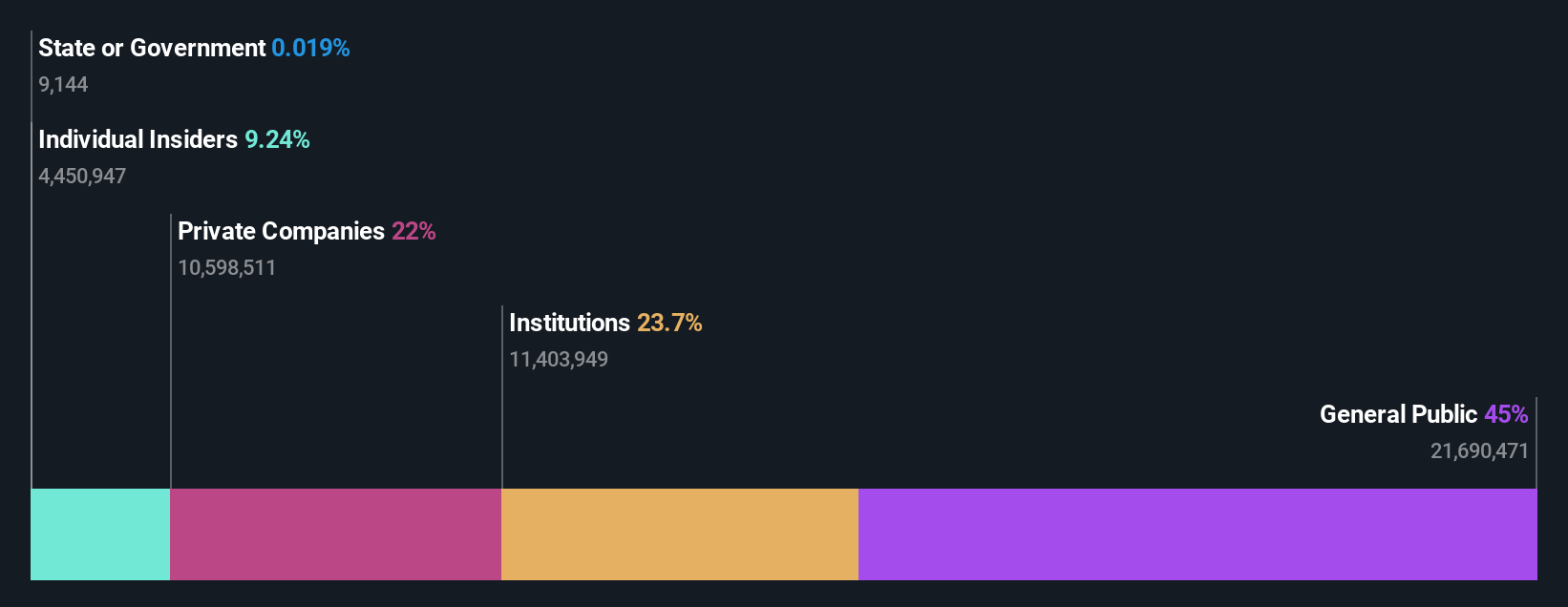

Overview: Solara Active Pharma Sciences Limited is engaged in the manufacturing, processing, formulation, and distribution of active pharmaceutical ingredients (API) across India and various international markets, with a market cap of ₹37.10 billion.

Operations: The company's revenue is primarily derived from its active pharmaceutical ingredient segment, amounting to ₹12.22 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 95.4% p.a.

Solara Active Pharma Sciences is trading at a significant discount to its estimated fair value, suggesting potential upside. While the company has experienced shareholder dilution, insider activity shows more buying than selling recently. Revenue growth is forecasted at 13.3% annually, outpacing the Indian market average but below 20%. Solara is expected to achieve profitability within three years with strong earnings growth of approximately 95% per year, though its future Return on Equity remains modest at 10.4%.

- Dive into the specifics of Solara Active Pharma Sciences here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Solara Active Pharma Sciences is priced lower than what may be justified by its financials.

Jinlei Technology (SZSE:300443)

Simply Wall St Growth Rating: ★★★★★☆

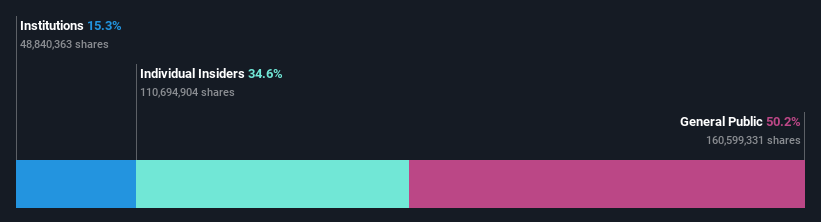

Overview: Jinlei Technology Co., Ltd. develops, produces, and sells wind turbine spindles as well as various castings and forgings both in China and internationally, with a market cap of CN¥7.73 billion.

Operations: Jinlei Technology generates revenue through the development, production, and sale of wind turbine spindles along with diverse castings and forgings on both domestic and international fronts.

Insider Ownership: 34.6%

Earnings Growth Forecast: 44.9% p.a.

Jinlei Technology's revenue is forecast to grow at 32.7% annually, surpassing the Chinese market average of 13.9%, with earnings expected to rise by 44.9% per year. However, recent financial results show a decline in net income and profit margins compared to last year, with current profit margins at 12.2%. Despite a volatile share price and low future Return on Equity projections, its Price-To-Earnings ratio of 34.1x is slightly below the industry average.

- Click to explore a detailed breakdown of our findings in Jinlei Technology's earnings growth report.

- The analysis detailed in our Jinlei Technology valuation report hints at an inflated share price compared to its estimated value.

Stella Chemifa (TSE:4109)

Simply Wall St Growth Rating: ★★★★☆☆

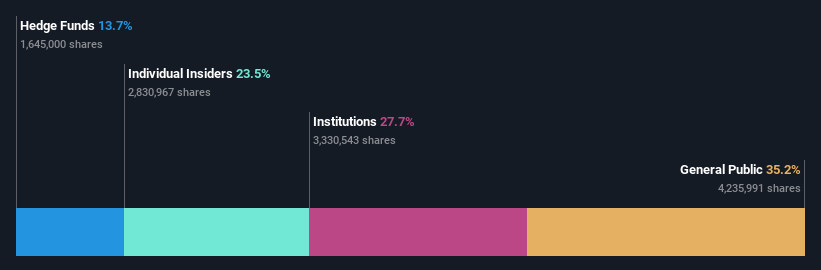

Overview: Stella Chemifa Corporation manufactures and sells inorganic fluorine compounds both in Japan and internationally, with a market cap of ¥54.25 billion.

Operations: The company generates revenue from High-Purity Chemical sales amounting to ¥27.44 billion and Transportation services totaling ¥7.60 billion.

Insider Ownership: 23.5%

Earnings Growth Forecast: 23.5% p.a.

Stella Chemifa's earnings are projected to grow significantly at 23.5% annually, outpacing the Japanese market average of 8.8%, although revenue growth is slower at 9.6%. Despite trading at a substantial discount to its estimated fair value, the company's dividend sustainability is questionable with a reduced year-end payout forecasted. Recent insider activity data is lacking, and while past earnings have increased by 17.6%, future Return on Equity remains uncertain.

- Get an in-depth perspective on Stella Chemifa's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Stella Chemifa is trading beyond its estimated value.

Where To Now?

- Dive into all 1527 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SOLARA

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives