Discovering October 2025's Undiscovered Gems in Global Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of a U.S. government shutdown and shifting economic indicators, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming larger indices like the S&P 500. In this dynamic environment, identifying potential "undiscovered gems" involves looking for companies that can capitalize on lower interest rates and demonstrate strong growth prospects despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiamen Jiarong TechnologyLtd | 8.85% | -14.73% | -26.28% | ★★★★★★ |

| China Post Technology | NA | -35.78% | 7.84% | ★★★★★★ |

| Shenzhen TVT Digital Technology | 2.19% | 9.31% | 27.82% | ★★★★★★ |

| Shandong Sacred Sun Power SourcesLtd | 18.69% | 12.95% | 39.68% | ★★★★★★ |

| SEC Electric Machinery | NA | -4.45% | -54.43% | ★★★★★★ |

| Changchai Company | NA | 0.32% | -6.09% | ★★★★★★ |

| Shanghai SK Automation TechnologyLtd | 40.52% | 30.23% | 20.53% | ★★★★★☆ |

| Guangzhou Ruili Kormee Automotive Electronic | 13.53% | 14.73% | 7.72% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 38.36% | 12.96% | 8.25% | ★★★★★☆ |

| ShenZhen QiangRui Precision Technology | 37.71% | 45.22% | 15.86% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

ISE Chemicals (TSE:4107)

Simply Wall St Value Rating: ★★★★★★

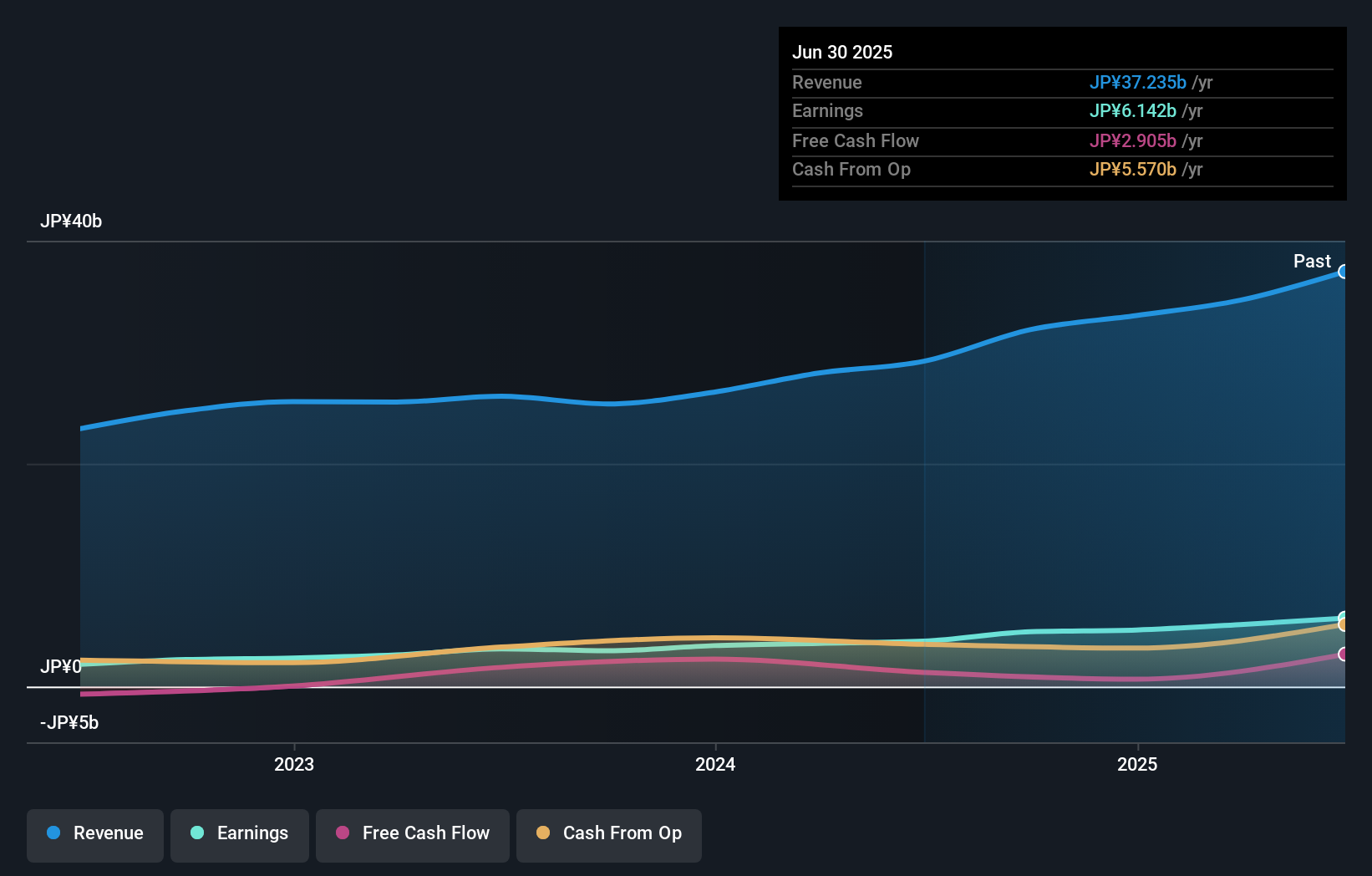

Overview: ISE Chemicals Corporation operates in the iodine and natural gas sector as well as the metallic compound industry in Japan, with a market capitalization of ¥154.16 billion.

Operations: ISE Chemicals generates revenue primarily from its iodine and natural gas business, which accounts for ¥32.24 billion, while the metallic compound business contributes ¥4.99 billion. The financial performance is influenced by the net profit margin trend.

This small-cap company in the chemicals sector has shown impressive earnings growth of 50.8% over the past year, outpacing the industry average of 3.1%. Its debt-to-equity ratio has improved from 2.4% to 1.3% over five years, indicating prudent financial management. With a volatile share price recently, investors might find this intriguing yet risky. The company enjoys high-quality earnings and covers its interest payments comfortably, suggesting robust operational health. Although it holds more cash than total debt, which is reassuring for stability, potential investors should weigh these strengths against market volatility concerns before making decisions.

- Navigate through the intricacies of ISE Chemicals with our comprehensive health report here.

Examine ISE Chemicals' past performance report to understand how it has performed in the past.

GMO internet (TSE:4784)

Simply Wall St Value Rating: ★★★★★☆

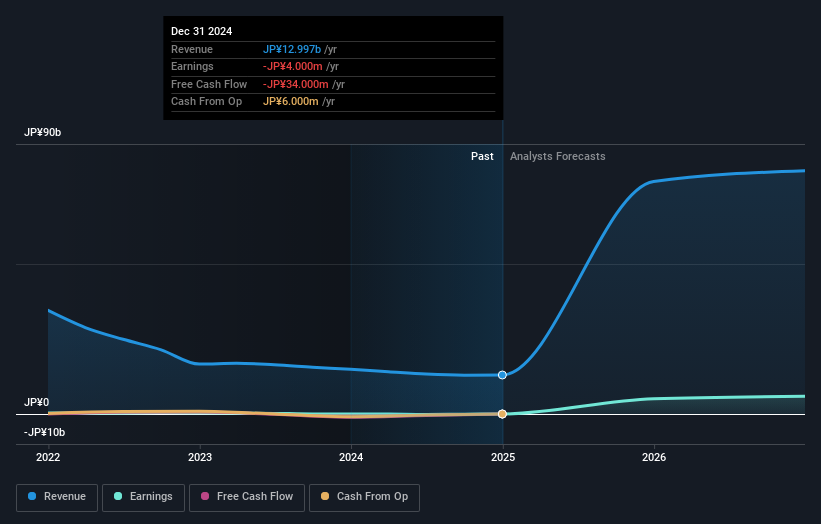

Overview: GMO Internet, Inc. operates in the internet infrastructure sector in Japan with a market capitalization of approximately ¥298.93 billion.

Operations: The company generates revenue primarily from its internet advertising business, which accounts for ¥12.53 billion. It has a market capitalization of approximately ¥298.93 billion.

GMO Internet, a promising player in the tech scene, has shown resilience with its debt well-covered by EBIT at 85.9 times and more cash than total debt. Despite recent shareholder dilution, the company boasts high-quality earnings and is trading at an attractive 77% below estimated fair value. Its recent profitability marks a significant turnaround, outpacing industry growth rates of 10%. With earnings forecasted to grow annually by over 50%, GMO's strategic move to implement quarterly dividends reflects its commitment to shareholder returns and future expansion plans. The stock’s volatility could present opportunities for savvy investors seeking growth potential.

- Get an in-depth perspective on GMO internet's performance by reading our health report here.

Understand GMO internet's track record by examining our Past report.

Sun (TSE:6736)

Simply Wall St Value Rating: ★★★★★☆

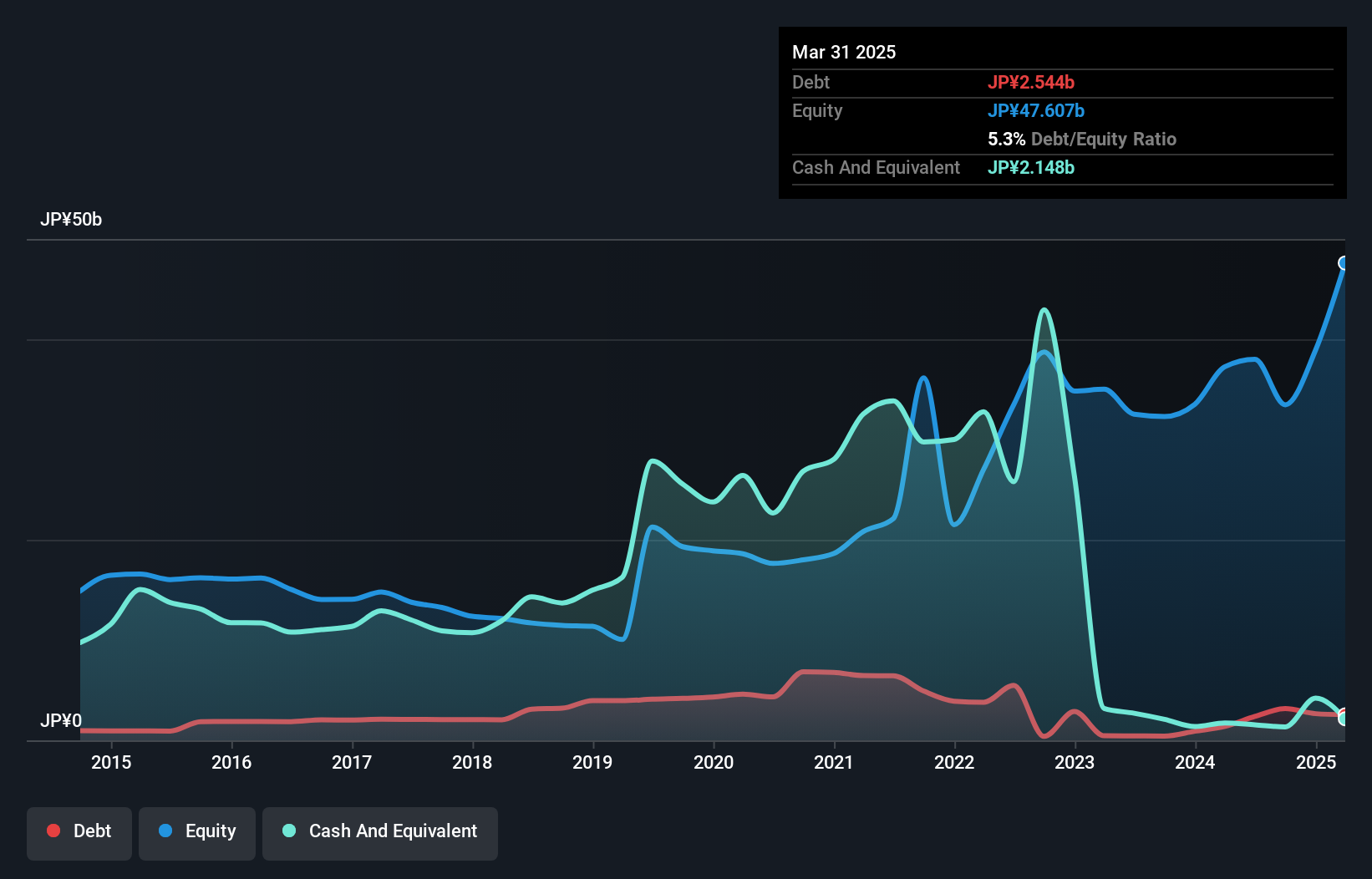

Overview: Sun Corporation operates in mobile data solutions, entertainment, and information technology sectors in Japan with a market capitalization of ¥192.39 billion.

Operations: Sun Corporation generates revenue primarily from its Entertainment Related Business, contributing ¥6.21 billion, followed by the New IT Related Business at ¥3.67 billion, and the Global Data Intelligence Business at ¥1.21 billion. The company's financial performance reflects a focus on these key segments without including any unallocated adjustments in the analysis.

Sun Corporation, a tech player with a ¥17.2 billion one-off gain impacting recent results, shows promise despite its volatile share price. The company's debt-to-equity ratio has significantly improved from 24.6% to 5.8% over five years, indicating stronger financial health. Recently becoming profitable, Sun's growth outpaces the industry average of 2.1%, showcasing its competitive edge in the market. With a price-to-earnings ratio of 10.9x below Japan's market average of 14.7x, it appears undervalued relative to peers and offers potential for value-seeking investors looking for opportunities in this sector's dynamic landscape.

- Click here and access our complete health analysis report to understand the dynamics of Sun.

Assess Sun's past performance with our detailed historical performance reports.

Make It Happen

- Click through to start exploring the rest of the 2928 Global Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4107

ISE Chemicals

Engages in the iodine and natural gas, and metallic compound businesses in Japan.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives