A Look at Air Water (TSE:4088) Valuation as Special Committee Probes Accounting Concerns

Reviewed by Kshitija Bhandaru

Air Water (TSE:4088) has set up a Special Investigating Committee to look into concerns about deferred loss recognition in its accounting, involving about 2.5 billion yen. This move raises questions regarding the company’s recent financial disclosures.

See our latest analysis for Air Water.

Air Water’s latest accounting probe comes after a sharp pullback in its share price. The stock dropped nearly 19% over the past month but is still up about 10% for the year to date. Looking at the longer term, the company has delivered a robust 8.4% one-year total shareholder return and an impressive 40% over three years. However, recent volatility suggests investors are re-evaluating risk as events unfold.

If this kind of market shake-up has you wondering what other opportunities might be out there, it’s worth exploring fast growing stocks with high insider ownership.

With Air Water’s valuation still showing a substantial discount to analyst price targets, the key question for investors is whether current uncertainty offers a compelling entry point or if the market already reflects growth expectations.

Price-to-Earnings of 9.6x: Is it justified?

Air Water is currently trading at a price-to-earnings (P/E) ratio of 9.6x, which marks it as relatively undervalued compared to both sector and market benchmarks. With a last close price of ¥2105, the figures suggest the stock is being priced lower than the broader market and its industry peers.

The price-to-earnings ratio compares a company’s current share price to its earnings per share. For the chemicals sector, which often features moderate and steady growth, P/E is a key benchmark for how much investors are willing to pay for each unit of current profit.

What makes Air Water’s current valuation intriguing? The stock’s P/E stands not just below the overall Japanese market average of 14.4x, but is also well below the chemicals industry average of 12.6x and the peer average of 19.5x. Based on regression analysis, the estimated fair P/E ratio for Air Water should be around 15.5x, indicating meaningful upside if market perceptions shift closer to that level.

Explore the SWS fair ratio for Air Water

Result: Price-to-Earnings of 9.6x (UNDERVALUED)

However, ongoing accounting investigations and recent share price volatility could signal deeper operational risks. These factors could potentially limit upside despite the apparent valuation discount.

Find out about the key risks to this Air Water narrative.

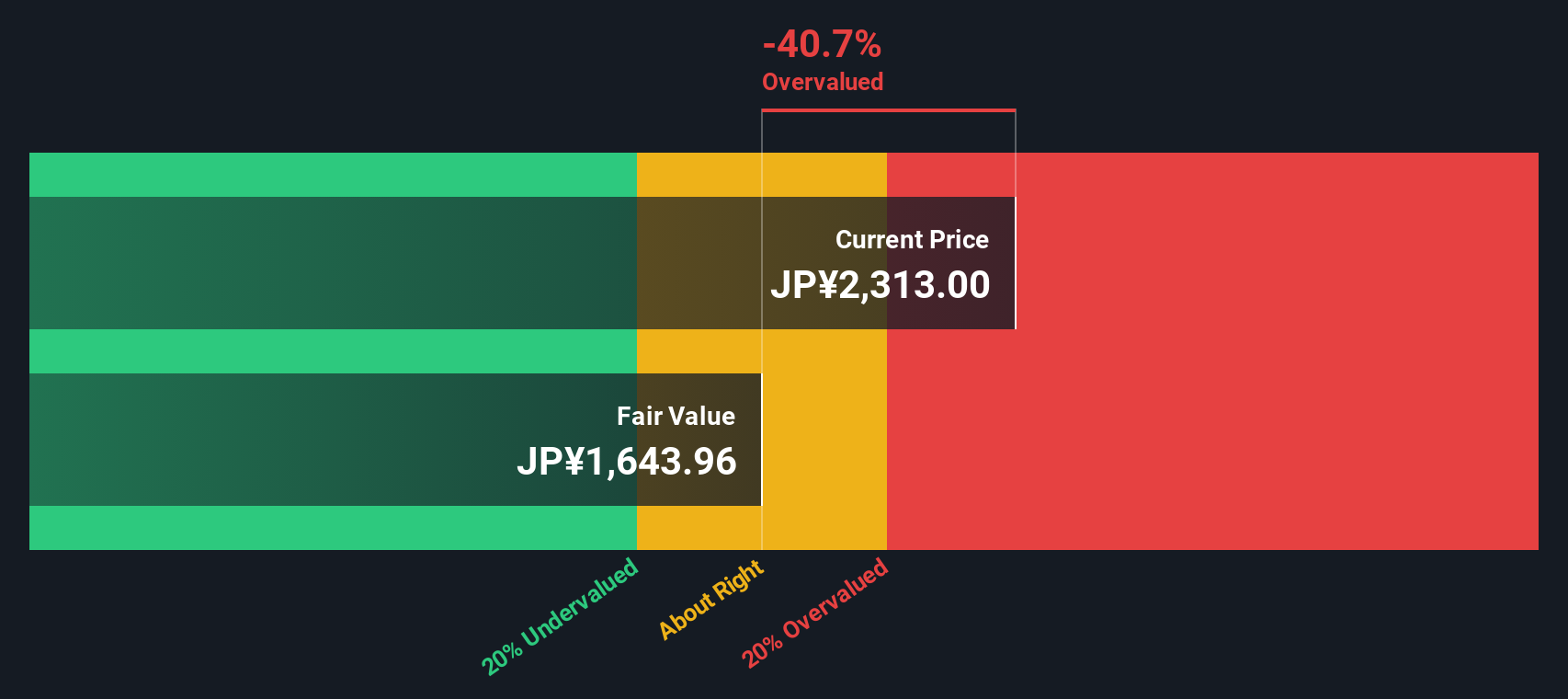

Another View: Discounted Cash Flow Puts a Different Spin on Value

While the current P/E ratio points to Air Water being undervalued, our DCF model estimates a fair value of ¥1584.76 per share, which is well below today’s market price of ¥2105. This suggests the stock could be overvalued based on cash flow analysis. Which valuation best reflects future prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Water for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Water Narrative

If you think there’s more to this story or want to do your own deep dive, you can build your own perspective in just a few minutes by using Do it your way.

A great starting point for your Air Water research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. If you want to uncover new opportunities and stay ahead of the curve, make sure you check out these top stock picks now:

- Capitalize on the rising trend of AI by checking out these 25 AI penny stocks, which features market-shaking innovations that could define the next decade.

- Tap into high-yield potential with these 18 dividend stocks with yields > 3%, highlighting companies that deliver attractive dividends above 3% to support your portfolio’s cash flow.

- Ride the next evolution in healthcare by exploring these 33 healthcare AI stocks, a resource for innovators blending life sciences and transformative artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4088

Air Water

Engages in manufacturing selling products and services related to industrial gas, chemical, medical, energy, agriculture and food products, logistics, seawater, and other businesses in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives