Wuhan Zhongyuan Huadian Science & TechnologyLtd And 2 Other Undiscovered Gems With Solid Fundamentals

Reviewed by Simply Wall St

As global markets experience a surge, with major indices like the S&P 500 reaching new heights amid optimism for softer tariffs and AI advancements, investors are increasingly turning their attention to smaller-cap stocks that have been overshadowed by larger peers. In this context, identifying stocks with solid fundamentals becomes crucial as they offer potential stability and growth opportunities amidst fluctuating economic indicators and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| TCM Biotech International | 10.23% | 9.33% | -1.73% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Standard Foods | 7.90% | -3.40% | -24.36% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

We'll examine a selection from our screener results.

Wuhan Zhongyuan Huadian Science & TechnologyLtd (SZSE:300018)

Simply Wall St Value Rating: ★★★★★★

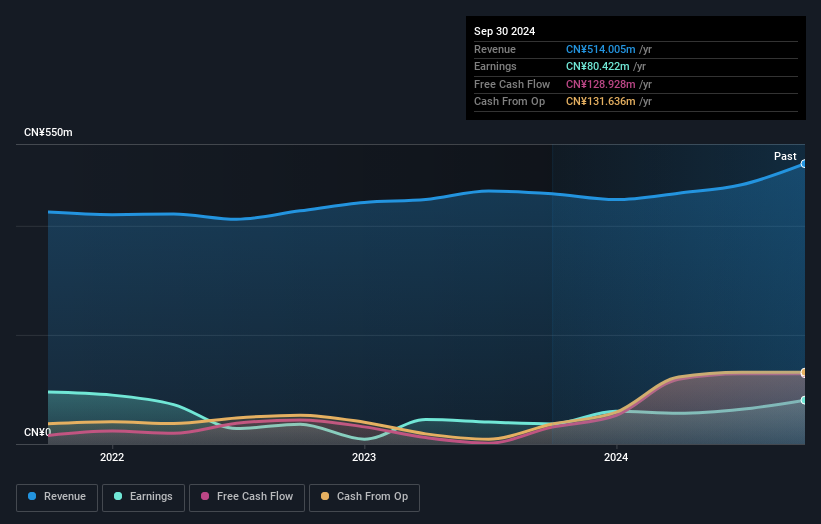

Overview: Wuhan Zhongyuan Huadian Science & Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.35 billion.

Operations: Wuhan Zhongyuan Huadian Science & Technology Co., Ltd. generates revenue primarily from its technology sector operations. The company's financial performance is influenced by its ability to manage costs effectively, impacting its profitability metrics such as net profit margin.

Wuhan Zhongyuan Huadian Science & Technology Ltd. stands out with its impressive earnings growth of 118% over the past year, significantly surpassing the Electrical industry's average of 0.8%. This company is trading at a notable 46% below its estimated fair value, suggesting potential undervaluation in the market. With no debt on its books currently and a history of reducing debt from a previous ratio of 0.3 five years ago, financial stability appears strong. The high-quality earnings further underline its robust performance, positioning it as an intriguing prospect for those seeking overlooked opportunities in this sector.

Talant Optronics (Suzhou) (SZSE:301045)

Simply Wall St Value Rating: ★★★★★☆

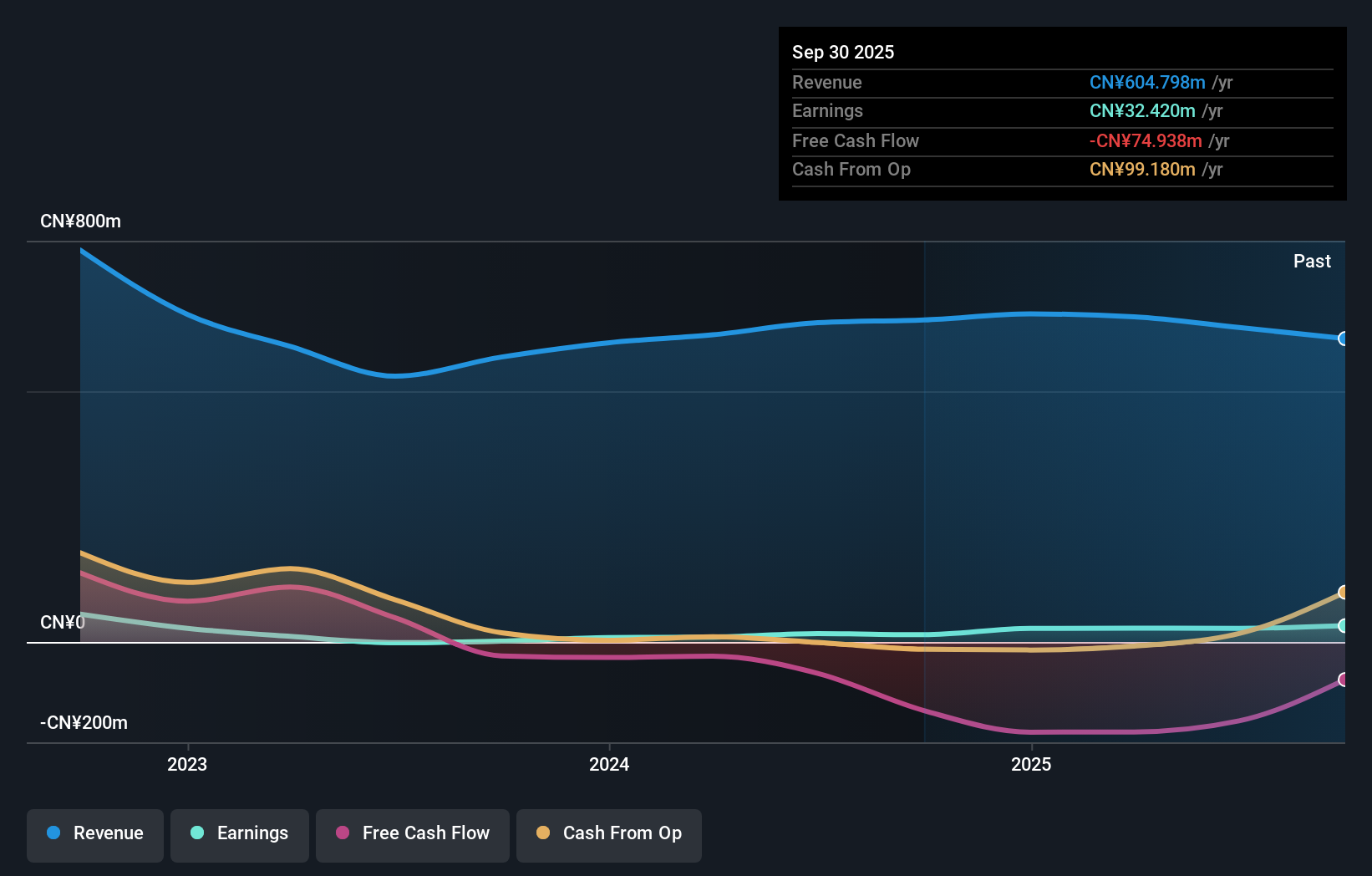

Overview: Talant Optronics (Suzhou) Co., Ltd. focuses on the research, development, production, and sale of photoelectric light guide plates and related components both in China and internationally, with a market cap of approximately CN¥2.57 billion.

Operations: Talant Optronics derives its revenue primarily from the computer peripherals segment, which generated CN¥642.10 million.

Talant Optronics, a smaller player in the electronics industry, has shown impressive growth with earnings surging by 866.5% over the past year, outpacing the sector's average of 2.3%. The company's debt-to-equity ratio improved significantly from 31.5% to 9.4% over five years, indicating a stronger balance sheet position. Despite not being free cash flow positive recently, Talant Optronics remains profitable with high-quality non-cash earnings and sufficient interest coverage. Recent developments include a CNY 99.52 million stake acquisition by Shanghai Fortune Asset Management and Fengchi Hengfeng No.1 Private Equity Fund, highlighting market confidence in its future prospects.

Nippon Soda (TSE:4041)

Simply Wall St Value Rating: ★★★★★☆

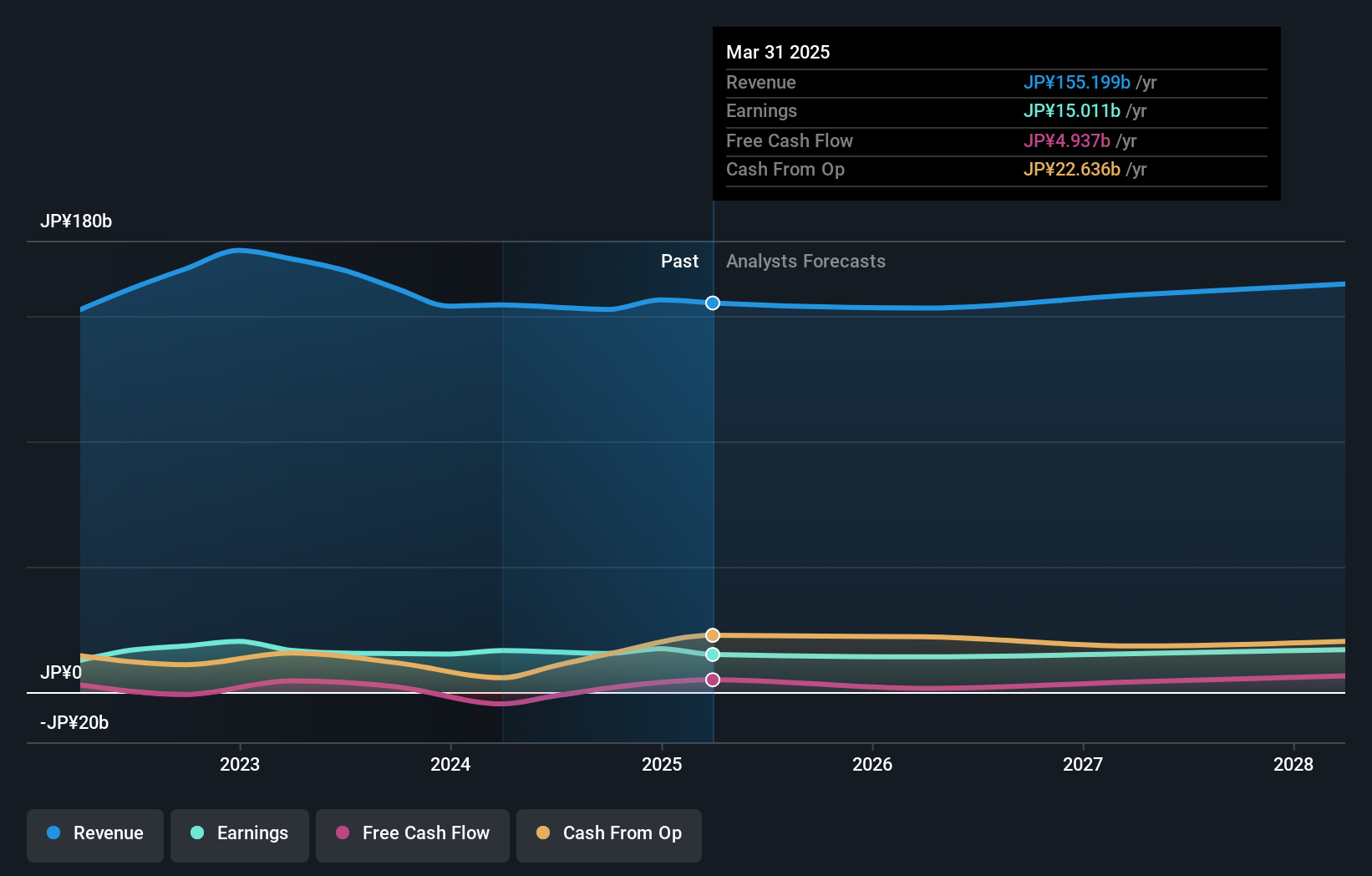

Overview: Nippon Soda Co., Ltd. is engaged in the development, production, processing, importation, marketing, sale, and export of chemicals and agrochemicals both domestically in Japan and internationally with a market capitalization of approximately ¥156.92 billion.

Operations: The company's revenue streams are primarily derived from its Trading Company Business, Chemicals Business, and Agriculture Chemicals Business, with ¥51.54 billion, ¥50.26 billion, and ¥49.86 billion respectively. The Eco Solution segment contributes ¥9.71 billion in revenue while the Engineering segment adds another ¥21.44 billion.

Nippon Soda, a nimble player in the chemicals sector, is making strategic moves with its recent alliance with Kyulux to tap into the booming OLED market. This partnership aligns with its vision to diversify and enhance corporate value through innovation. Financially, Nippon Soda shows resilience; it has a satisfactory net debt to equity ratio of 12.2% and boasts high-quality earnings despite a modest earnings growth of 0.5% over the past year compared to industry peers at 13.7%. The company revised its full-year guidance upwards, forecasting net sales of ¥153 billion and operating profit of ¥13.5 billion for FY2025.

- Delve into the full analysis health report here for a deeper understanding of Nippon Soda.

Explore historical data to track Nippon Soda's performance over time in our Past section.

Summing It All Up

- Access the full spectrum of 4662 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Soda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4041

Nippon Soda

Develops, produces, processes, imports, markets, sells, and exports chemicals, agrochemicals, and other products in Japan and internationally.

Excellent balance sheet average dividend payer.