- Japan

- /

- Auto Components

- /

- TSE:5108

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. stocks reaching record highs amid optimism surrounding trade policies and AI investments, investors are increasingly looking for stable income sources in this dynamic environment. Dividend stocks, known for their potential to provide regular income and a degree of stability during market fluctuations, can be an attractive option for those seeking to balance growth with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

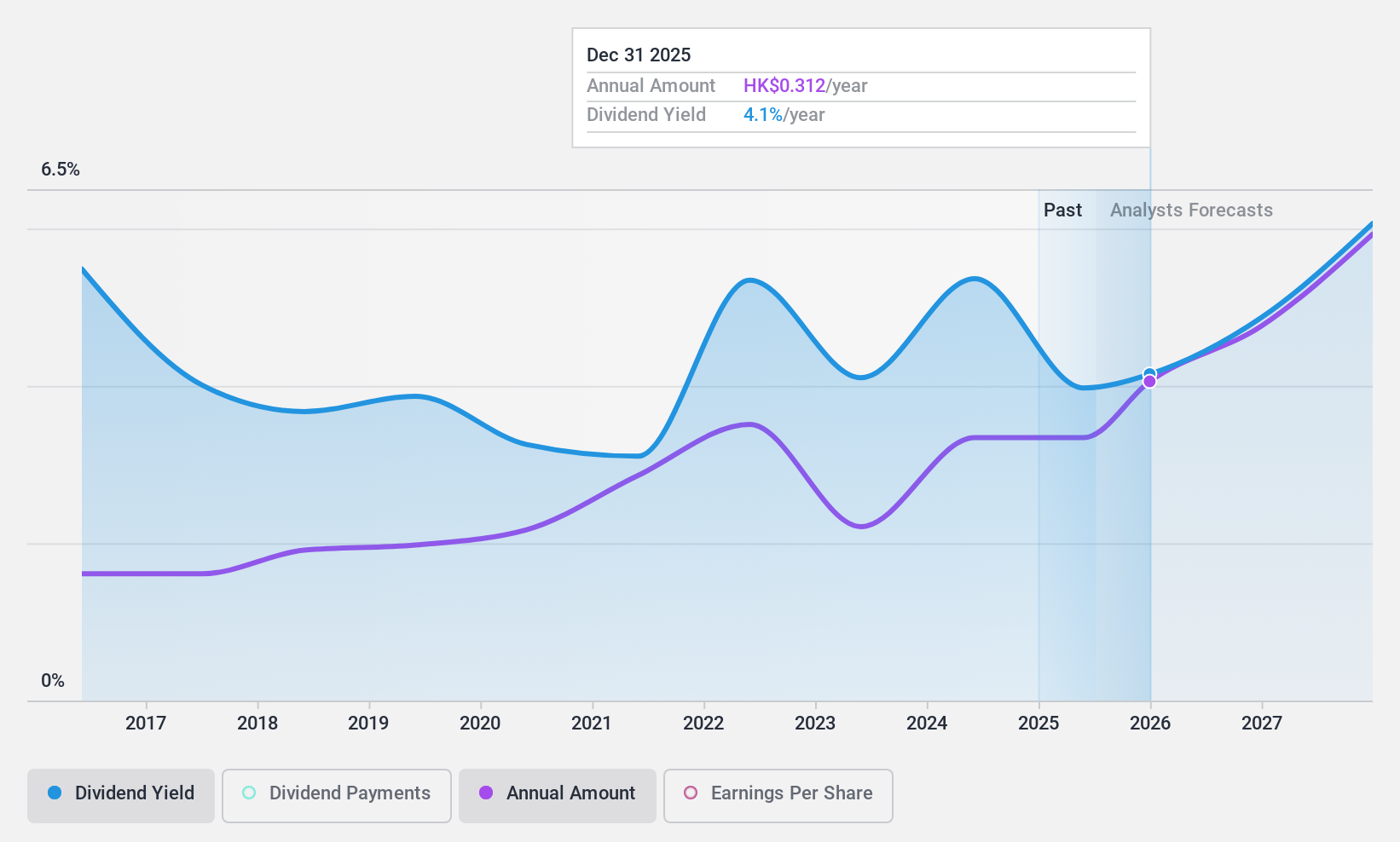

VSTECS Holdings (SEHK:856)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VSTECS Holdings Limited is an investment holding company that develops IT product channels and provides technical solution integration services in North Asia and South East Asia, with a market cap of HK$7.02 billion.

Operations: VSTECS Holdings Limited generates revenue from three primary segments: Cloud Computing (HK$3.44 billion), Enterprise Systems (HK$44.82 billion), and Consumer Electronics (HK$31.69 billion).

Dividend Yield: 5.2%

VSTECS Holdings' dividend payments have been volatile over the past decade, though they are well covered by earnings and cash flows with payout ratios of 41.1% and 48.9%, respectively. The stock is trading at a good value with a price-to-earnings ratio of 8x, below the Hong Kong market average. Recent board changes include appointing Mr. Yu Dingheng and Ms. Gao Yiyang as independent non-executive directors, potentially impacting governance dynamics moving forward.

- Click here and access our complete dividend analysis report to understand the dynamics of VSTECS Holdings.

- Insights from our recent valuation report point to the potential undervaluation of VSTECS Holdings shares in the market.

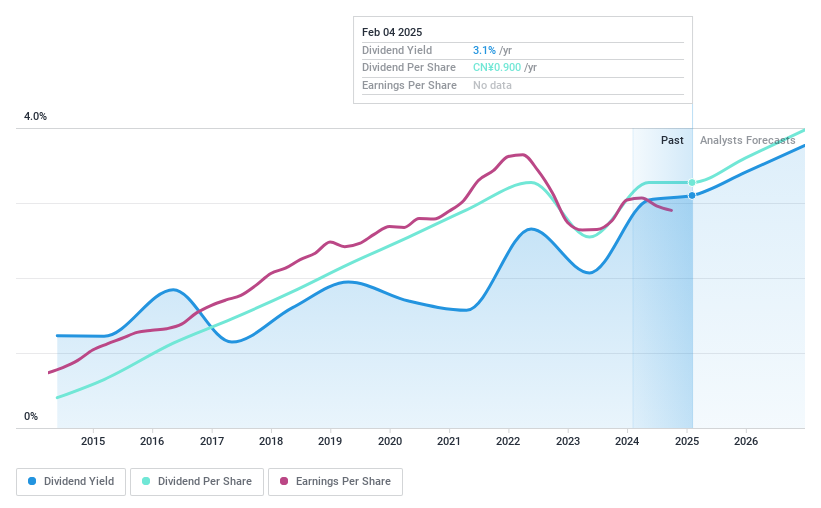

Hangzhou Hikvision Digital Technology (SZSE:002415)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hangzhou Hikvision Digital Technology Co., Ltd. is a leading provider of video surveillance products and solutions, with a market cap of approximately CN¥267.95 billion.

Operations: Hangzhou Hikvision Digital Technology Co., Ltd. generates revenue primarily through its research and development, production, and sales of video products and services, totaling approximately CN¥93.06 billion.

Dividend Yield: 3.1%

Hangzhou Hikvision Digital Technology's dividend yield of 3.1% is among the top 25% in China but has shown volatility over the past decade. While dividends have grown, they are not well covered by free cash flow, with a high cash payout ratio of 90.3%. A recent buyback program aims to reduce capital through share repurchases up to CNY 2.5 billion, potentially impacting future dividend sustainability and capital allocation strategies.

- Dive into the specifics of Hangzhou Hikvision Digital Technology here with our thorough dividend report.

- Our valuation report unveils the possibility Hangzhou Hikvision Digital Technology's shares may be trading at a discount.

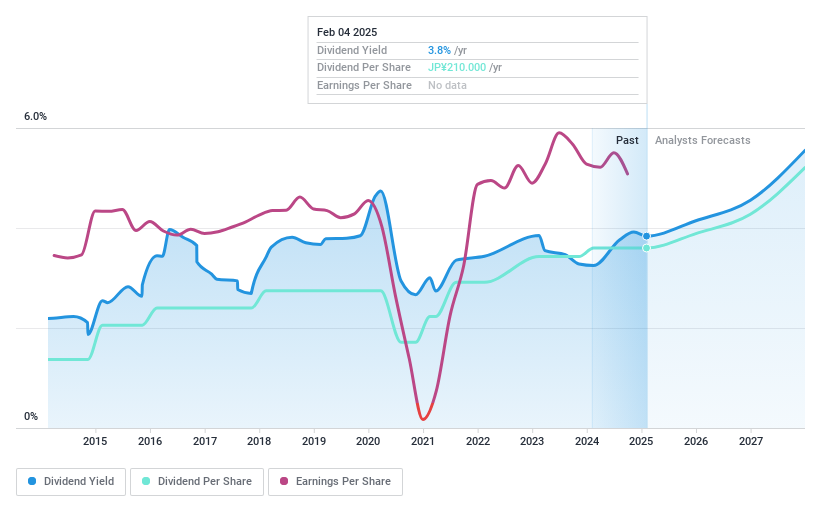

Bridgestone (TSE:5108)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bridgestone Corporation, along with its subsidiaries, is engaged in the manufacturing and sale of tires and rubber products, with a market cap of ¥3.69 trillion.

Operations: Bridgestone Corporation's revenue is primarily derived from its segments in the Americas (¥2.15 billion), Japan (¥1.23 billion), Europe/Russia/Middle East/India/Africa (¥0.85 billion), and China/Asia/Oceania (¥0.51 billion).

Dividend Yield: 3.9%

Bridgestone's dividend yield of 3.9% ranks in the top 25% of Japanese stocks, supported by a solid earnings payout ratio of 44.7%. Despite a history of volatility with over 20% annual drops, dividends have grown over the past decade and are covered by cash flows with a payout ratio of 68.1%. Recent earnings reports show strong financial performance, suggesting potential for continued dividend payments despite past instability.

- Click to explore a detailed breakdown of our findings in Bridgestone's dividend report.

- The valuation report we've compiled suggests that Bridgestone's current price could be quite moderate.

Make It Happen

- Investigate our full lineup of 1979 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5108

Flawless balance sheet established dividend payer.