As global markets react to the recent U.S. election results and economic policy shifts, major indices like the S&P 500 have surged to record highs, reflecting investor optimism about potential growth and tax reforms. In this dynamic environment, dividend stocks continue to attract attention for their ability to provide a steady income stream, making them an appealing option for investors seeking stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Globeride (TSE:7990) | 4.17% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Guangdong Provincial Expressway Development (SZSE:000429)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangdong Provincial Expressway Development Co., Ltd. operates expressways and bridges in China through its subsidiaries, with a market cap of CN¥21.57 billion.

Operations: Guangdong Provincial Expressway Development Co., Ltd. generates its revenue primarily from the development and operation of expressways and bridges in China.

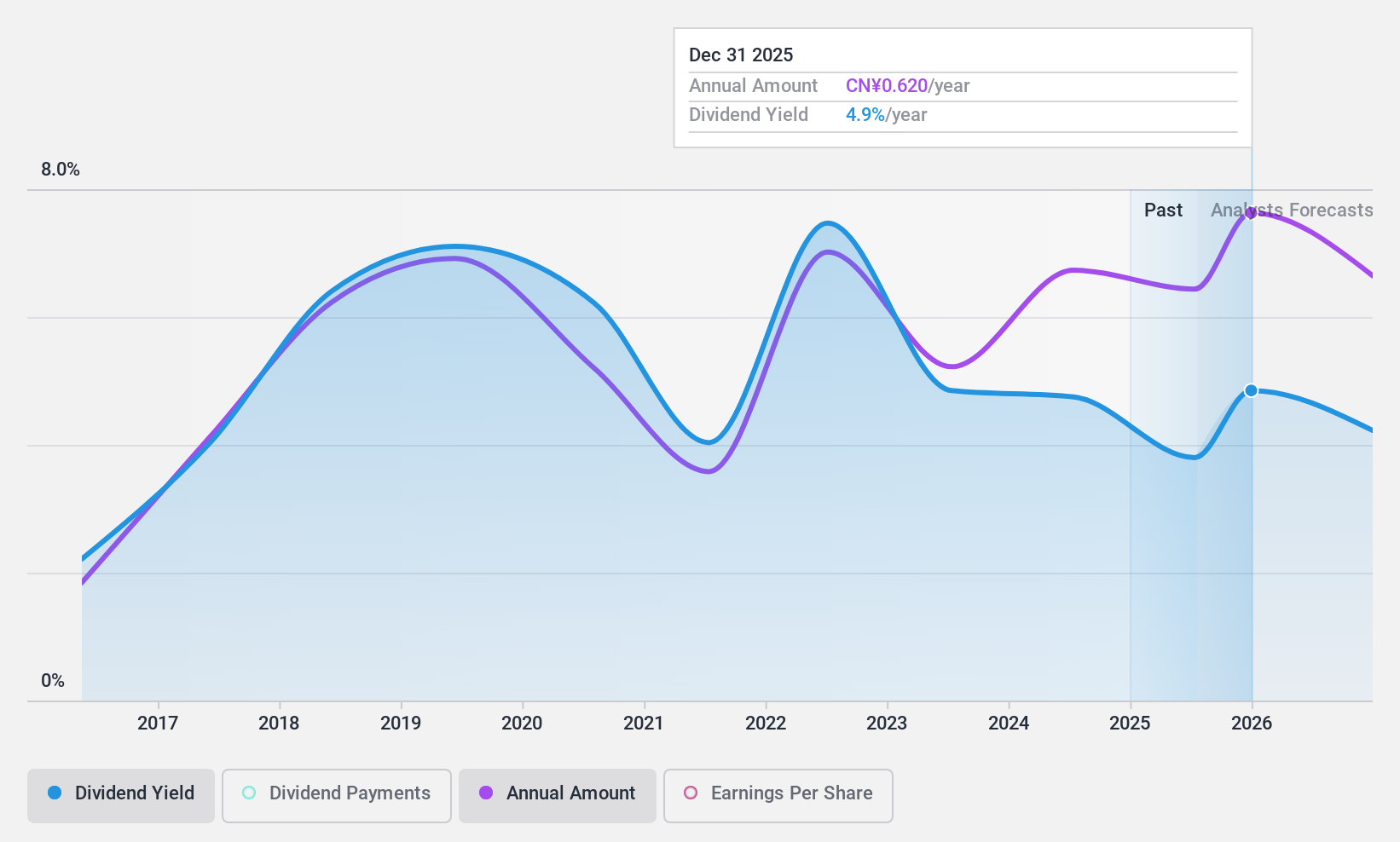

Dividend Yield: 4.8%

Guangdong Provincial Expressway Development's dividend yield of 4.77% ranks in the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio of 99.3%. Despite reasonable earnings coverage with a payout ratio of 70.1%, dividends are not well-supported by free cash flows and have been volatile over the past decade. Recent earnings show stable net income at CNY 1,356.4 million for nine months ended September 2024 despite declining sales.

- Click here to discover the nuances of Guangdong Provincial Expressway Development with our detailed analytical dividend report.

- According our valuation report, there's an indication that Guangdong Provincial Expressway Development's share price might be on the cheaper side.

Nippon Soda (TSE:4041)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Soda Co., Ltd. is involved in the development, production, processing, importation, marketing, sale, and export of chemicals and agrochemicals both in Japan and internationally with a market cap of ¥141.97 billion.

Operations: Nippon Soda Co., Ltd.'s revenue segments include the development and sale of chemicals and agrochemicals both domestically and internationally.

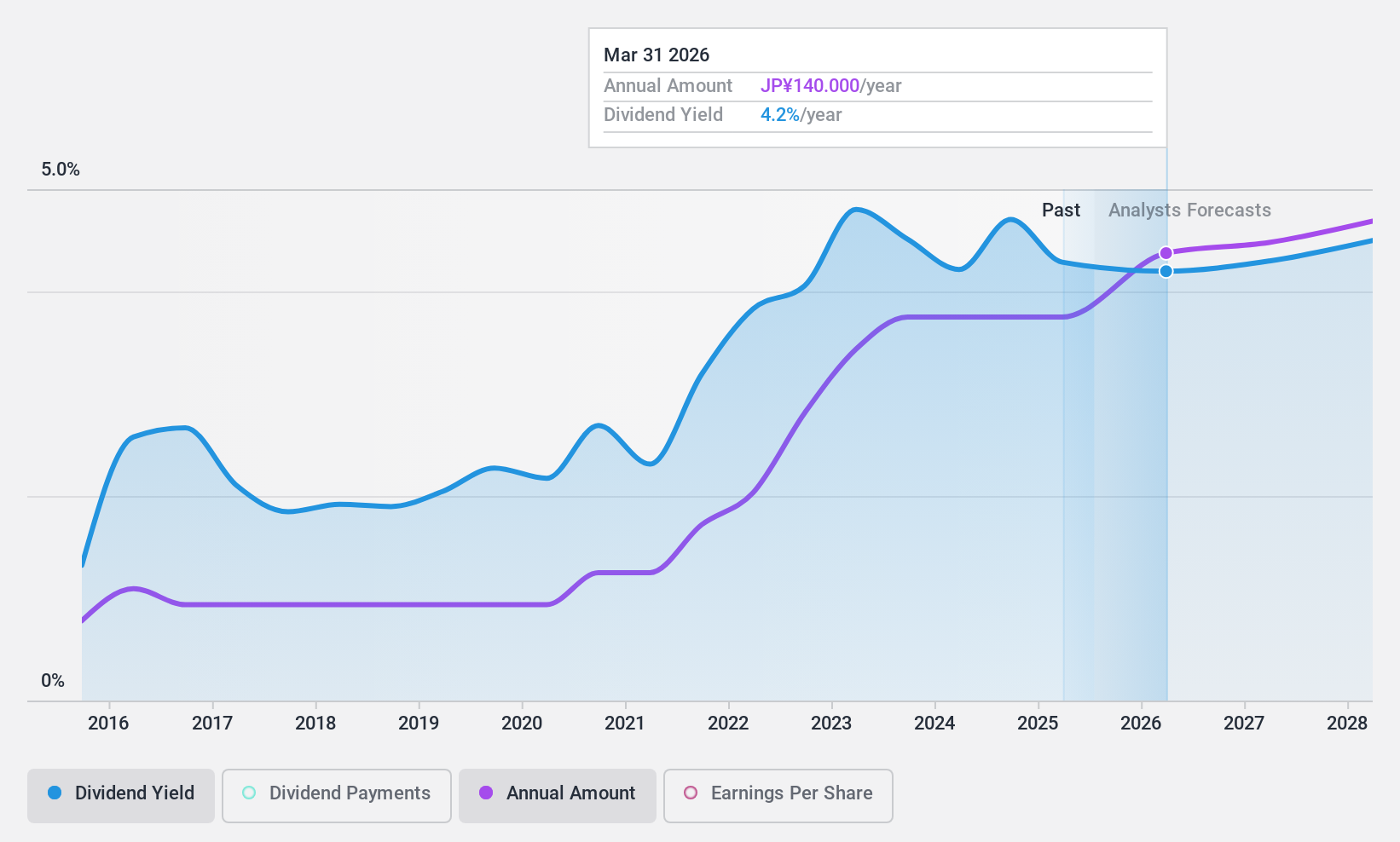

Dividend Yield: 4.6%

Nippon Soda's dividend yield of 4.65% places it among the top 25% in Japan, but its sustainability is challenged by a lack of free cash flow coverage. Despite a low payout ratio of 41.1%, dividends have been volatile over the past decade, with periods of significant drops. The company's earnings have grown significantly at 25.4% annually over five years, yet future earnings are projected to decline by an average of 2.7%.

- Click here and access our complete dividend analysis report to understand the dynamics of Nippon Soda.

- Upon reviewing our latest valuation report, Nippon Soda's share price might be too pessimistic.

Hisaka Works (TSE:6247)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisaka Works, Ltd. manufactures and sells industrial machinery globally, with a market cap of ¥27.54 billion.

Operations: Hisaka Works, Ltd. generates revenue through its key segments: Valve at ¥5.11 billion, Heat Exchanger at ¥15.27 billion, and Process Engineering at ¥13.13 billion.

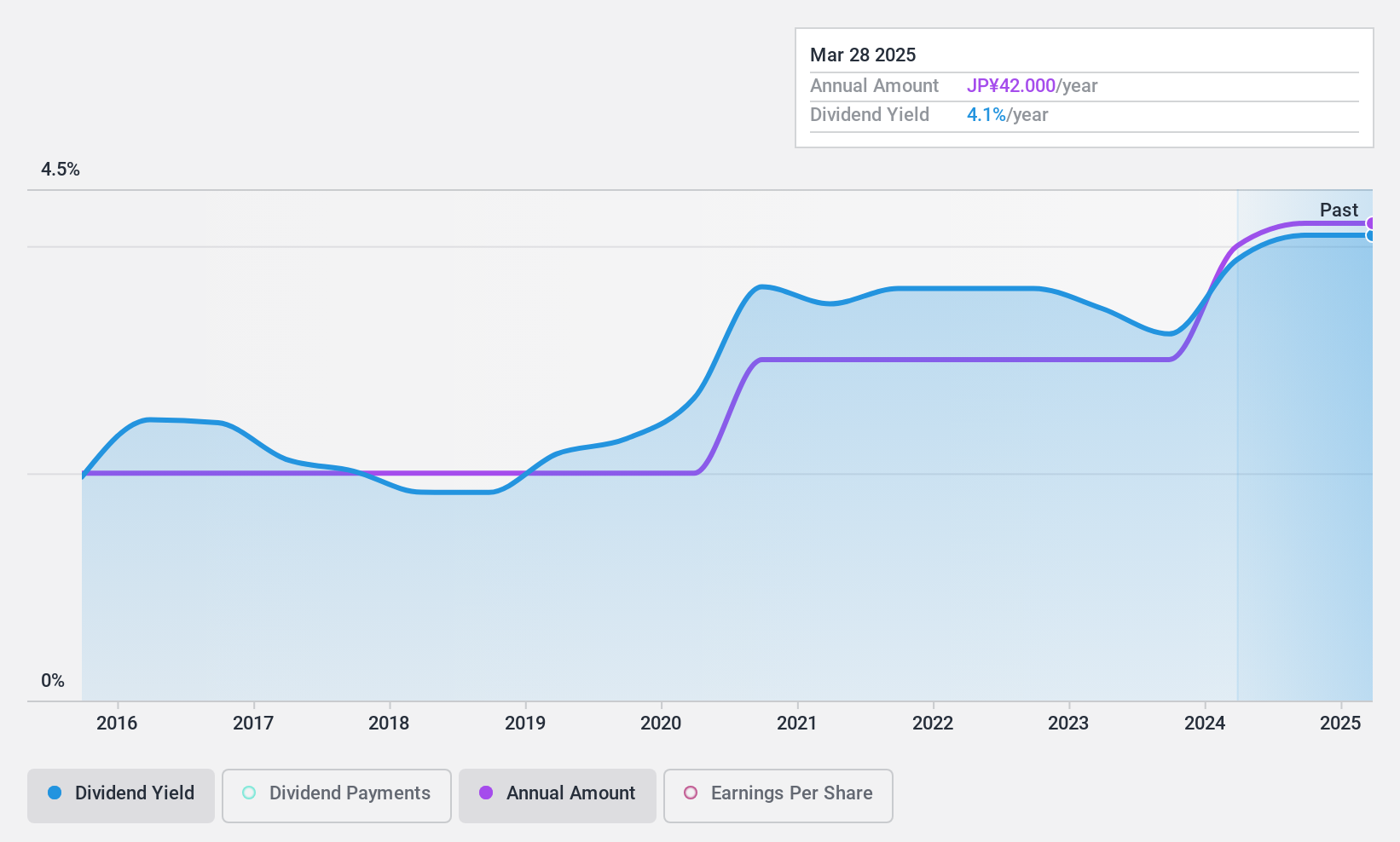

Dividend Yield: 4.2%

Hisaka Works offers a dividend yield of 4.18%, ranking in the top 25% in Japan, supported by a low payout ratio of 49.4%. However, the dividend isn't covered by free cash flows, raising sustainability concerns despite stable and growing dividends over the past decade. The company's recent share buyback for ¥389.03 million could signal confidence but doesn't address cash flow issues. Its P/E ratio of 11.8x suggests good value relative to the market average.

- Click to explore a detailed breakdown of our findings in Hisaka Works' dividend report.

- Our valuation report here indicates Hisaka Works may be overvalued.

Summing It All Up

- Click here to access our complete index of 1955 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hisaka Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6247

Hisaka Works

Engages in the manufacture and sale of industrial machinery worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives