As global markets grapple with tariff fears, inflation, and growth concerns, investors are witnessing a significant sell-off in U.S. stocks, with major indices experiencing notable declines. Amid this backdrop of uncertainty and fluctuating economic indicators, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.10% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.08% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.86% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.84% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 1447 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

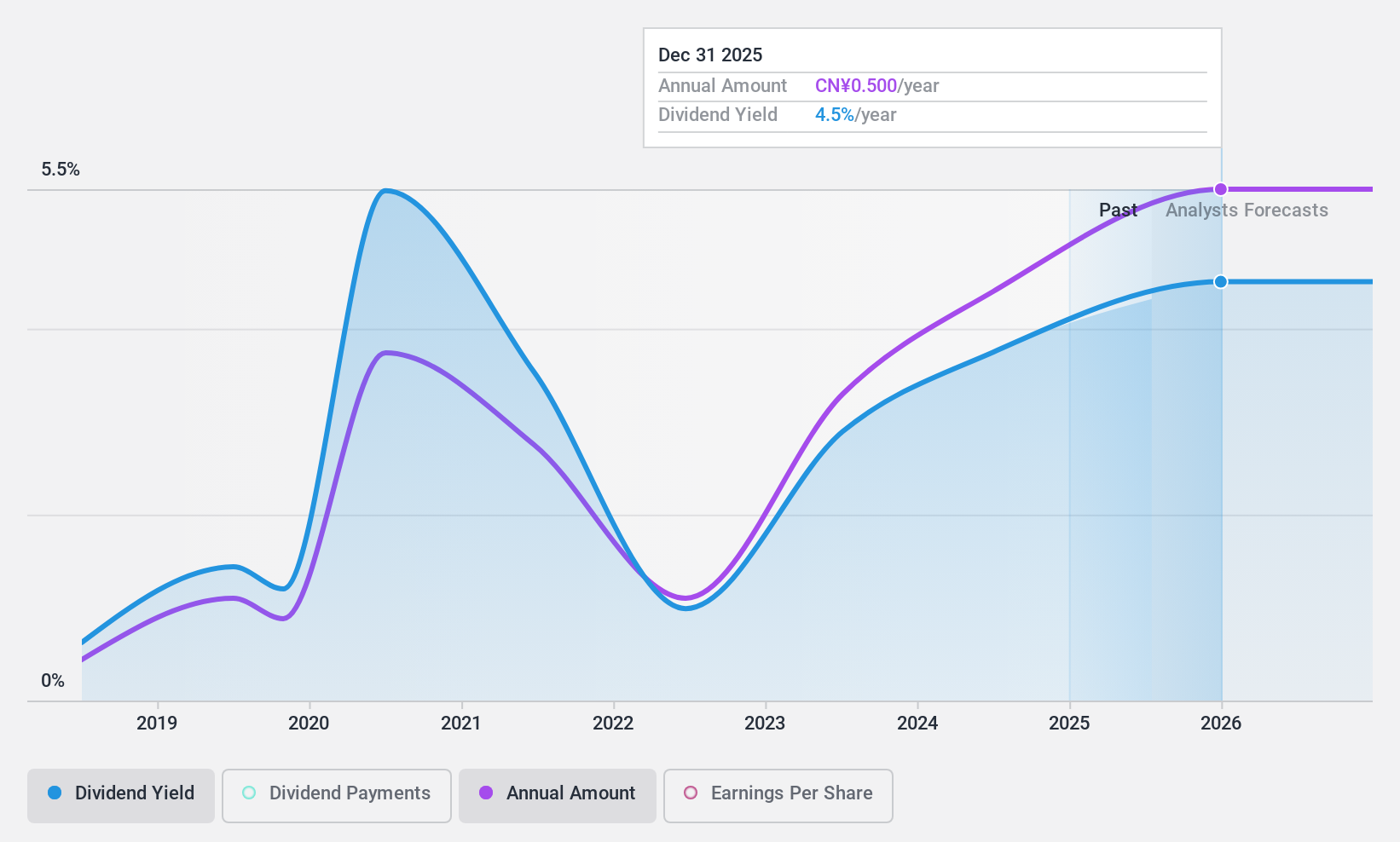

Jinduicheng Molybdenum (SHSE:601958)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinduicheng Molybdenum Co., Ltd. is involved in the research, development, production, and sale of molybdenum products globally and has a market cap of approximately CN¥34.49 billion.

Operations: Jinduicheng Molybdenum Co., Ltd. generates revenue primarily through its global activities in the research, development, production, and sale of molybdenum series and trading of molybdenum-related products.

Dividend Yield: 3.6%

Jinduicheng Molybdenum offers a compelling dividend profile, with its dividends well-covered by both earnings and cash flows, boasting payout ratios of 43.7% and 37.4%, respectively. Trading at 37.4% below estimated fair value, it presents good relative value compared to peers. However, the dividend history is marked by volatility and unreliability over the past decade despite recent growth trends. Its current yield of 3.63% ranks in the top quartile within China's market.

- Dive into the specifics of Jinduicheng Molybdenum here with our thorough dividend report.

- Our valuation report unveils the possibility Jinduicheng Molybdenum's shares may be trading at a discount.

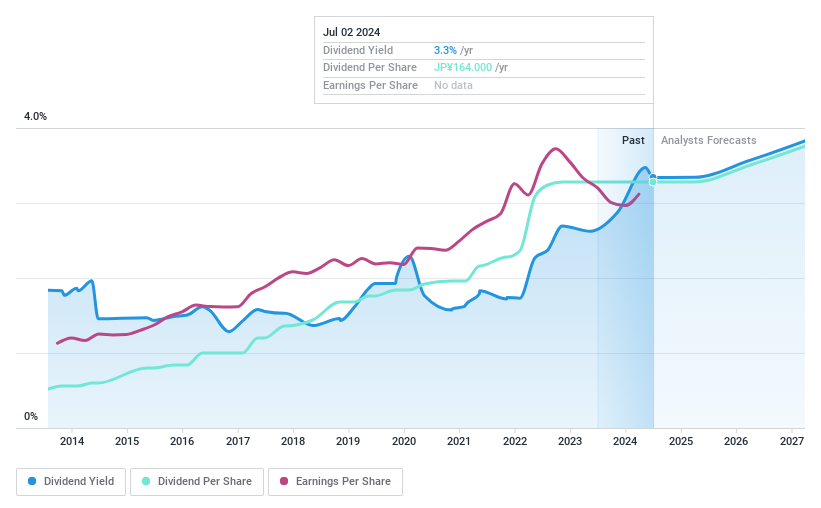

Nissan Chemical (TSE:4021)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissan Chemical Corporation operates in the chemicals, performance materials, agricultural chemicals, and pharmaceuticals sectors both in Japan and internationally, with a market cap of ¥620.22 billion.

Operations: Nissan Chemical Corporation's revenue is derived from its Trading segment at ¥113.79 billion, Performance Materials at ¥96.82 billion, Agricultural Chemicals at ¥87.44 billion, Chemicals at ¥36.12 billion, and Healthcare at ¥5.89 billion.

Dividend Yield: 3.6%

Nissan Chemical's dividend is well-supported by earnings and cash flow, with payout ratios of 51.7% and 78.4%, respectively, ensuring sustainability. The company has maintained stable and growing dividends over the past decade, though its yield of 3.59% is slightly below the top quartile in Japan's market (3.8%). Recent buyback plans totaling ¥3 billion aim to enhance capital flexibility amid a changing business environment, potentially benefiting shareholders through strategic capital management.

- Click here and access our complete dividend analysis report to understand the dynamics of Nissan Chemical.

- The analysis detailed in our Nissan Chemical valuation report hints at an inflated share price compared to its estimated value.

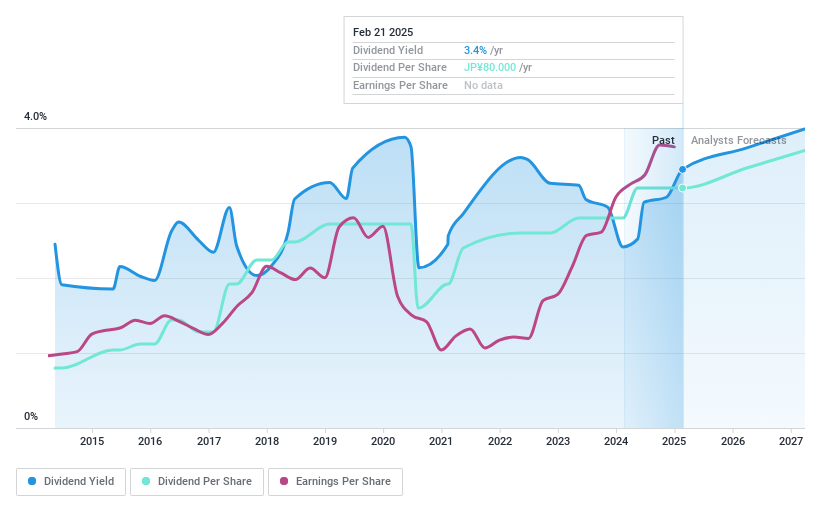

Espec (TSE:6859)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Espec Corp. manufactures and sells environmental test chambers globally, with a market cap of ¥53.64 billion.

Operations: Espec Corp.'s revenue primarily comes from its Equipment Business, generating ¥57.12 billion, followed by the Service Business at ¥7.92 billion.

Dividend Yield: 3.2%

Espec's dividend yield of 3.24% is below the top 25% in Japan, but its dividends are covered by earnings (32.4% payout ratio) and cash flows (69.1%). Despite a history of volatility with over a 20% annual drop, dividends have grown over the past decade. Trading at 43.1% below estimated fair value, Espec's earnings grew by 21.7% last year, suggesting potential for future dividend support despite an unstable track record.

- Take a closer look at Espec's potential here in our dividend report.

- Our expertly prepared valuation report Espec implies its share price may be lower than expected.

Make It Happen

- Investigate our full lineup of 1447 Top Global Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4021

Nissan Chemical

Engages in the chemicals, performance materials, agricultural chemicals, and pharmaceuticals businesses in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives