The past three years for Sumitomo Chemical Company (TSE:4005) investors has not been profitable

Sumitomo Chemical Company, Limited (TSE:4005) shareholders should be happy to see the share price up 19% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 31% in the last three years, falling well short of the market return.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

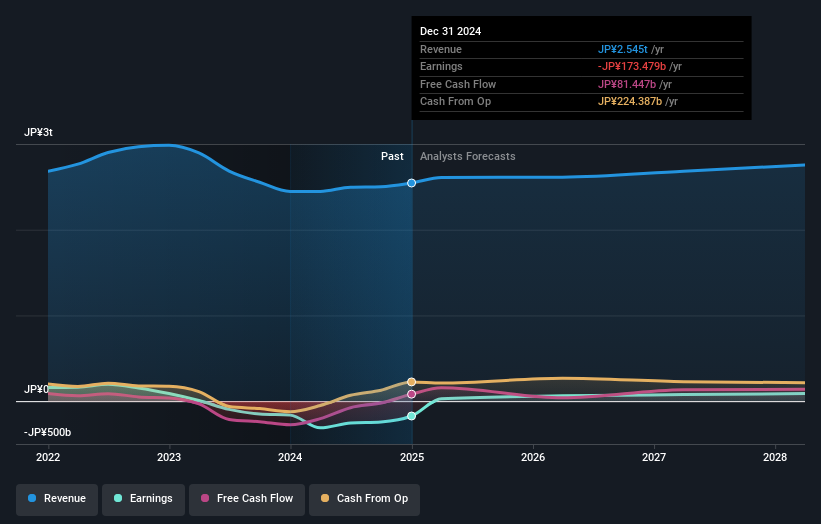

Given that Sumitomo Chemical Company didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, Sumitomo Chemical Company's revenue dropped 5.5% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 10%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Sumitomo Chemical Company's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Sumitomo Chemical Company's TSR for the last 3 years was -25%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Sumitomo Chemical Company shareholders have received a total shareholder return of 8.3% over the last year. And that does include the dividend. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Sumitomo Chemical Company (1 is a bit unpleasant!) that you should be aware of before investing here.

But note: Sumitomo Chemical Company may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4005

Sumitomo Chemical Company

Engages in Chemicals & Plastics, energy and functional materials, IT-related chemicals, health and crop sciences, pharmaceuticals, and other businesses worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives