- China

- /

- Real Estate

- /

- SZSE:000048

Top Dividend Stocks In Global For March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflation concerns, and fluctuating growth prospects, investors are seeking stability amid the volatility. With major indices like the S&P 500 and Nasdaq Composite experiencing significant declines, dividend stocks can offer a reliable income stream and potential resilience in uncertain times. A good dividend stock typically combines a strong track record of consistent payouts with solid fundamentals that can withstand economic pressures.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.10% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.84% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.79% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

Click here to see the full list of 1438 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Universal Robina (PSE:URC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Robina Corporation is a branded food product company with operations in the Philippines and internationally, and it has a market cap of ₱153.67 billion.

Operations: Universal Robina Corporation generates revenue from two main segments: Branded Consumer Food, contributing ₱62.97 billion, and Agro-Industrial and Commodity Food, which accounts for ₱133.22 billion.

Dividend Yield: 5.1%

Universal Robina's dividends have grown steadily over the past decade, supported by a payout ratio of 75.8% and a cash payout ratio of 66.6%, indicating sustainability from both earnings and cash flows. Although its dividend yield of 5.29% is below the top quartile in the Philippine market, it remains reliable with minimal volatility. Recent leadership changes, including new roles for key executives like Ms. Jesselyn Panis and Ms. Anna Milagros David, may influence strategic directions impacting future performance.

- Take a closer look at Universal Robina's potential here in our dividend report.

- The valuation report we've compiled suggests that Universal Robina's current price could be inflated.

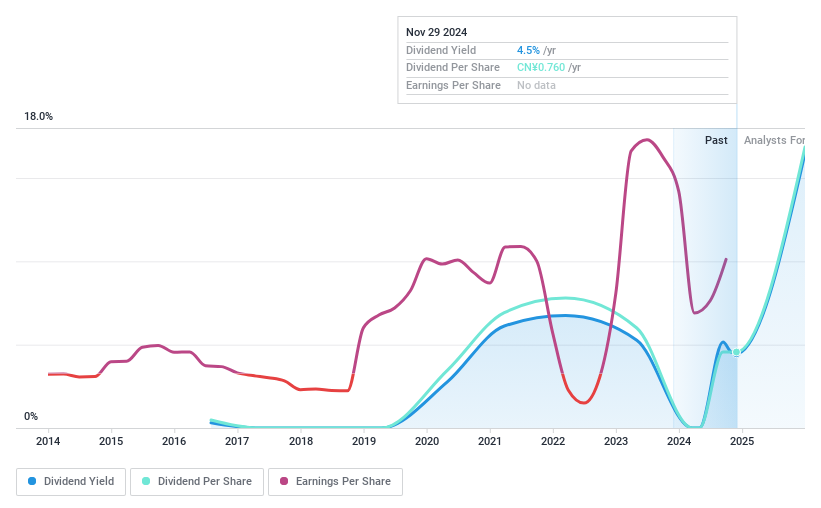

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors in China, with a market capitalization of CN¥8.08 billion.

Operations: Shenzhen Kingkey Smart Agriculture Times Co., Ltd generates revenue from its operations in the real estate and breeding sectors within China.

Dividend Yield: 4.7%

Shenzhen Kingkey Smart Agriculture Times Ltd.'s dividend yield of 4.95% ranks in the top 25% within the Chinese market, though its nine-year history shows volatility and unreliability, with annual drops over 20%. Despite a low payout ratio of 18.2%, indicating dividends are well covered by earnings, a high cash payout ratio of 75.3% suggests potential pressure on cash flows. The recent completion of a share buyback plan could impact future dividend strategies.

- Navigate through the intricacies of Shenzhen Kingkey Smart Agriculture TimesLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that Shenzhen Kingkey Smart Agriculture TimesLtd's share price might be on the cheaper side.

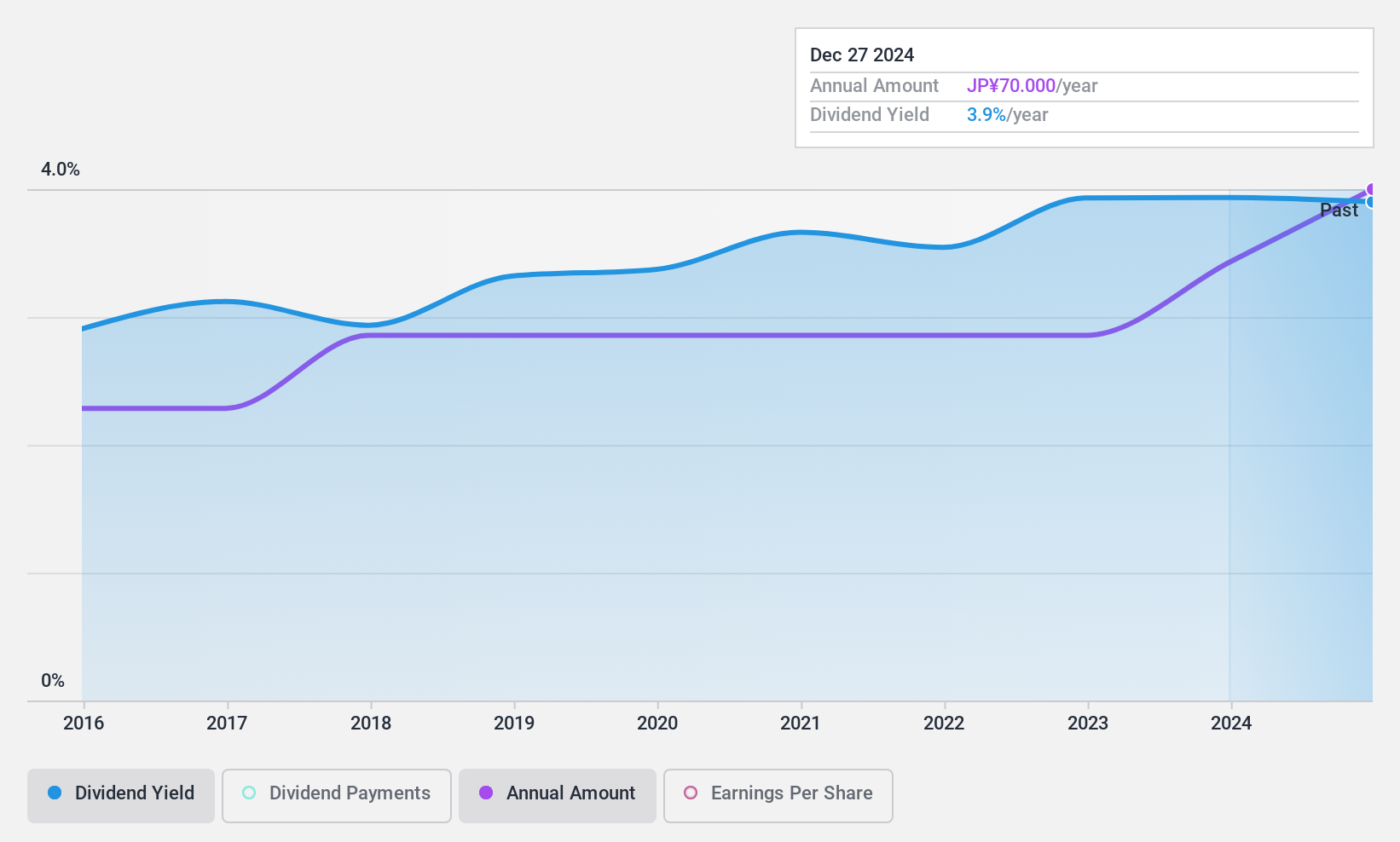

Dynapac (TSE:3947)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dynapac Co., Ltd. and its subsidiaries manufacture and sell packaging materials both in Japan and internationally, with a market cap of ¥18.90 billion.

Operations: Dynapac Co., Ltd. generates revenue primarily from its Packaging Materials segment, amounting to ¥65.86 billion, and also engages in Real Estate Leasing, contributing ¥360.62 million.

Dividend Yield: 3.9%

Dynapac's dividend yield of 3.88% places it in the top 25% of Japanese dividend payers, supported by a low payout ratio of 23.3%, indicating strong coverage by earnings. However, dividends are not covered by free cash flows, raising sustainability concerns. Despite this, Dynapac has delivered stable and growing dividends over the past decade with little volatility. The company’s price-to-earnings ratio of 6.9x suggests it may be undervalued compared to the broader market at 13.1x.

- Click to explore a detailed breakdown of our findings in Dynapac's dividend report.

- The analysis detailed in our Dynapac valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 1435 Top Global Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000048

Shenzhen Kingkey Smart Agriculture TimesLtd

Engages in the real estate and breeding businesses in China.

Proven track record with adequate balance sheet and pays a dividend.