Rengo (TSE:3941): Valuation Insights Following Recent FTSE All-World Index Removal

Reviewed by Kshitija Bhandaru

If you’ve been watching Rengo (TSE:3941), the company’s recent removal from the FTSE All-World Index probably caught your eye. Index changes like this often spark immediate moves in stock price as institutional funds and index trackers adjust their holdings. This can create temporary volatility and shift how investors view the company’s outlook. Whether this delisting spells trouble or opportunity isn’t always clear at first glance, but it’s certainly a moment that leaves investors weighing their next step.

Despite this index shakeup, Rengo’s stock has shown a mix of short-term swings and steady gains over the long haul. After dipping in the past week, the share price bounced by 2.6% in the month and jumped 24% in the past 3 months, offsetting a mild one-year loss. Taking a step back, the company has managed to deliver a total return of 22% over three years and 33% over five years, while also notching healthy annual revenue and net income growth. There is clear evidence of longer-term resilience even amid headline noise.

With the stock in flux after this index removal, is Rengo undervalued at current levels, or is the market already factoring in all the future growth risk?

Price-to-Earnings of 11.2x: Is it justified?

Rengo currently trades at a Price-to-Earnings (P/E) ratio of 11.2x, which is slightly higher than the Japanese Packaging industry average of 10.6x. This suggests that the stock is valued at a premium relative to its sector peers, potentially reflecting investor expectations for future growth or stability.

The P/E ratio compares a company’s current share price to its earnings per share. This offers a snapshot of how the market values its profitability. For packaging companies like Rengo, P/E ratios are widely used to assess attractiveness because steady cash flows and long-term contracts make earnings an important benchmark.

Although Rengo's P/E is above its industry average, it is below the average for peer companies at 11.6x. This may indicate better value compared to direct competitors. However, the market appears cautious about the company’s recent profit trends and is not pricing in aggressive future growth.

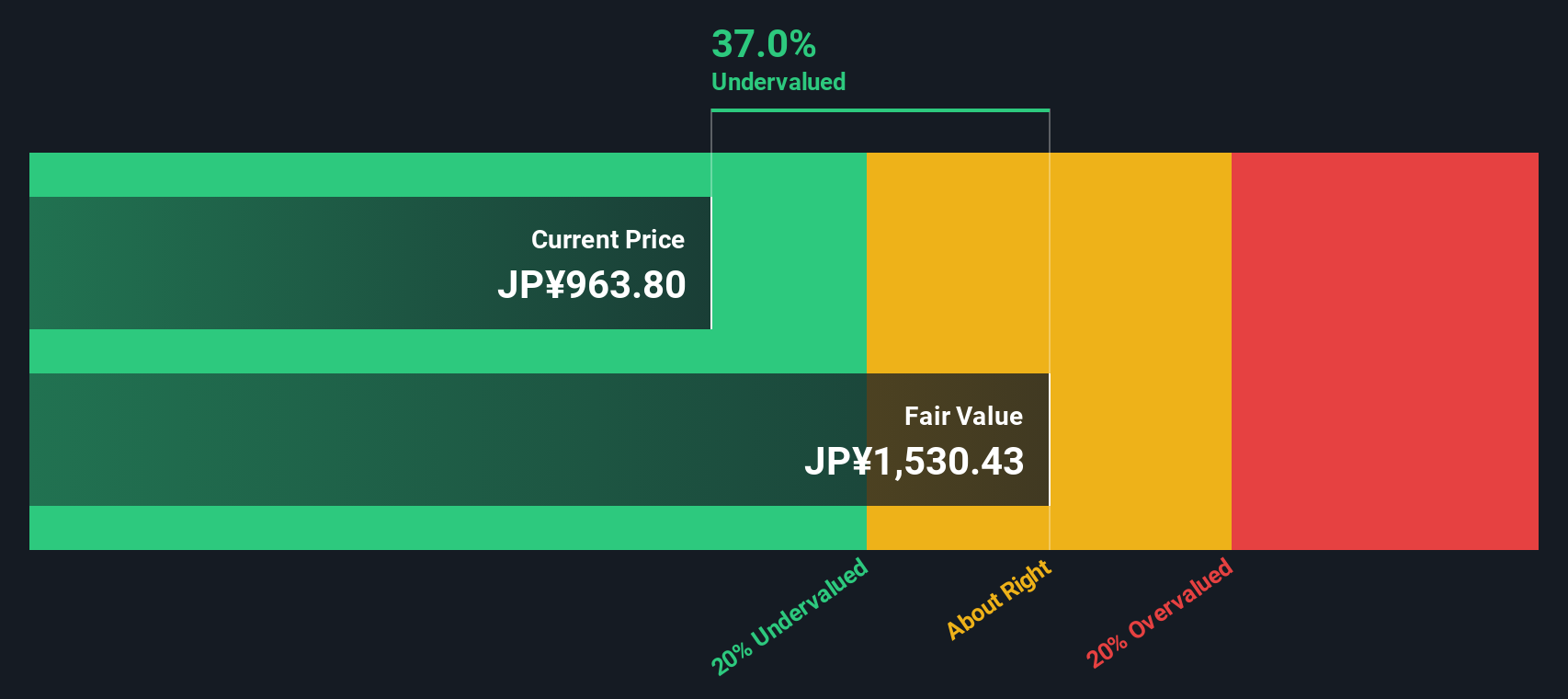

Result: Fair Value of ¥1,515.69 (UNDERVALUED)

See our latest analysis for Rengo.However, persistent profit volatility and a potential slowdown in revenue growth could quickly challenge the current view that Rengo is undervalued.

Find out about the key risks to this Rengo narrative.Another View: Discounted Cash Flow Perspective

While market pricing shows Rengo as undervalued compared to sector peers, our DCF model also suggests the company is undervalued based on its future cash flows. However, does this method capture all the risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rengo Narrative

If you see things differently or want to dive into your own research, it’s simple to craft your own perspective on Rengo with just a few clicks. Do it your way

A great starting point for your Rengo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. With the Simply Wall Street Screener, you can quickly zero in on standout themes shaping tomorrow’s market leaders.

- Boost your potential returns by adding undervalued stocks based on cash flows to your watchlist. These stocks are trading below their intrinsic value and could offer strong upside.

- Tap into the unstoppable growth of artificial intelligence by screening AI penny stocks, which are at the forefront of the AI revolution.

- Secure income and stability in your portfolio with dividend stocks with yields > 3%. This tool highlights companies delivering reliable dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3941

Rengo

Manufactures and sells paperboard and packaging-related products in Asia, Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026