Rengo (TSE:3941): Evaluating Valuation After Recent Share Activity

Reviewed by Simply Wall St

Price-to-Earnings of 11.4x: Is It Justified?

Rengo currently trades at a price-to-earnings (P/E) ratio of 11.4x, slightly above both its peer group and industry averages. This positions the stock as relatively expensive on this widely followed valuation metric.

The price-to-earnings ratio reflects how much investors are willing to pay for every yen of the company's earnings. It is a key gauge in evaluating whether a company's share price is high or low relative to its earnings. In the packaging sector, stable cash flows and margins often lead to tight P/E ranges.

The fact that Rengo carries a higher P/E multiple than its peers might suggest that investors expect stronger profitability or growth than the competition. However, recent performance and forecasts indicate that this premium may not be justified given the company's earnings trajectory relative to industry averages.

Result: Fair Value of ¥1,071.67 (OVERVALUED)

See our latest analysis for Rengo.However, slower revenue growth or unexpected shifts in packaging demand could quickly change investor sentiment and challenge the current valuation level.

Find out about the key risks to this Rengo narrative.Another View: The SWS DCF Model Perspective

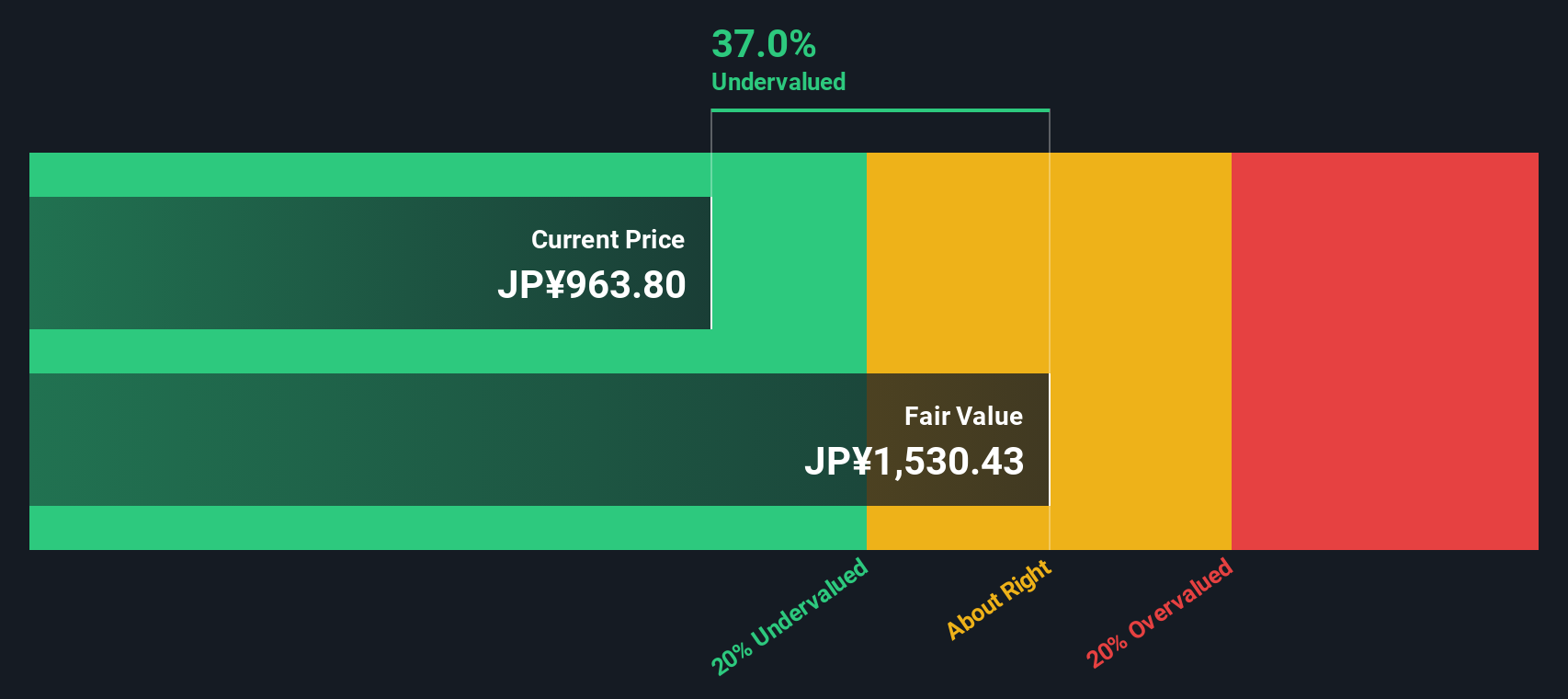

While the current market price appears elevated based on common valuation multiples, our DCF model presents a different perspective. The model indicates significant undervaluation, raising the question of whether the market is overlooking the long-term cash flow potential here.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rengo Narrative

If you see things differently or want to dig into the numbers yourself, you can explore and shape your own view in just a few minutes. Do it your way

A great starting point for your Rengo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizons by tapping into exciting themes and companies, handpicked to spark fresh thinking and reveal new opportunities you do not want to miss.

- Uncover overlooked gems with strong fundamentals by starting your search among penny stocks with strong financials. These stocks have the potential to surprise the market.

- Capture growth from tomorrow’s tech by checking out AI penny stocks that are driving AI-powered transformation across various industries.

- Boost your portfolio’s income stream with reliable payouts by exploring a suite of dividend stocks with yields > 3% with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:3941

Rengo

Manufactures and sells paperboard and packaging-related products in Asia, Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives