Little Excitement Around Rengo Co., Ltd.'s (TSE:3941) Earnings

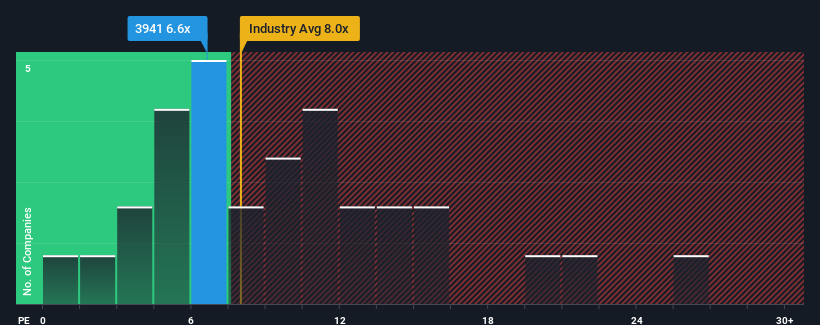

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may consider Rengo Co., Ltd. (TSE:3941) as a highly attractive investment with its 6.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Rengo has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Rengo

Is There Any Growth For Rengo?

In order to justify its P/E ratio, Rengo would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 59% gain to the company's bottom line. EPS has also lifted 10.0% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 3.2% each year over the next three years. That's shaping up to be materially lower than the 9.3% each year growth forecast for the broader market.

In light of this, it's understandable that Rengo's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Rengo's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Rengo maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Rengo is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3941

Rengo

Manufactures and sells paperboard and packaging-related products in Japan and internationally.

Very undervalued with excellent balance sheet and pays a dividend.