- Japan

- /

- Paper and Forestry Products

- /

- TSE:3877

Al Rajhi REIT Fund And 2 Other Compelling Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty with interest rate adjustments and mixed performances across major indices, investors are increasingly looking for stability in their portfolios. Dividend stocks, known for providing consistent income streams, can be particularly appealing in such environments where market volatility and inflation concerns persist.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund is a Sharia-compliant investment fund listed on Tadawul, focusing on generating periodic income through investments in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.35 billion.

Operations: The Al Rajhi REIT Fund's revenue primarily comes from its commercial real estate segment, amounting to SAR236.02 million.

Dividend Yield: 6.3%

Al Rajhi REIT Fund's dividend yield is among the top 25% in the Saudi Arabian market, yet its payments have been unstable and volatile over the past six years. Despite recent earnings growth of 185.5%, dividends have fallen since inception. The payout ratio stands at 75%, indicating coverage by earnings, but cash flow coverage is tighter at 86.7%. Shareholder dilution occurred last year, and the stock trades significantly below estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Al Rajhi REIT Fund.

- Our expertly prepared valuation report Al Rajhi REIT Fund implies its share price may be lower than expected.

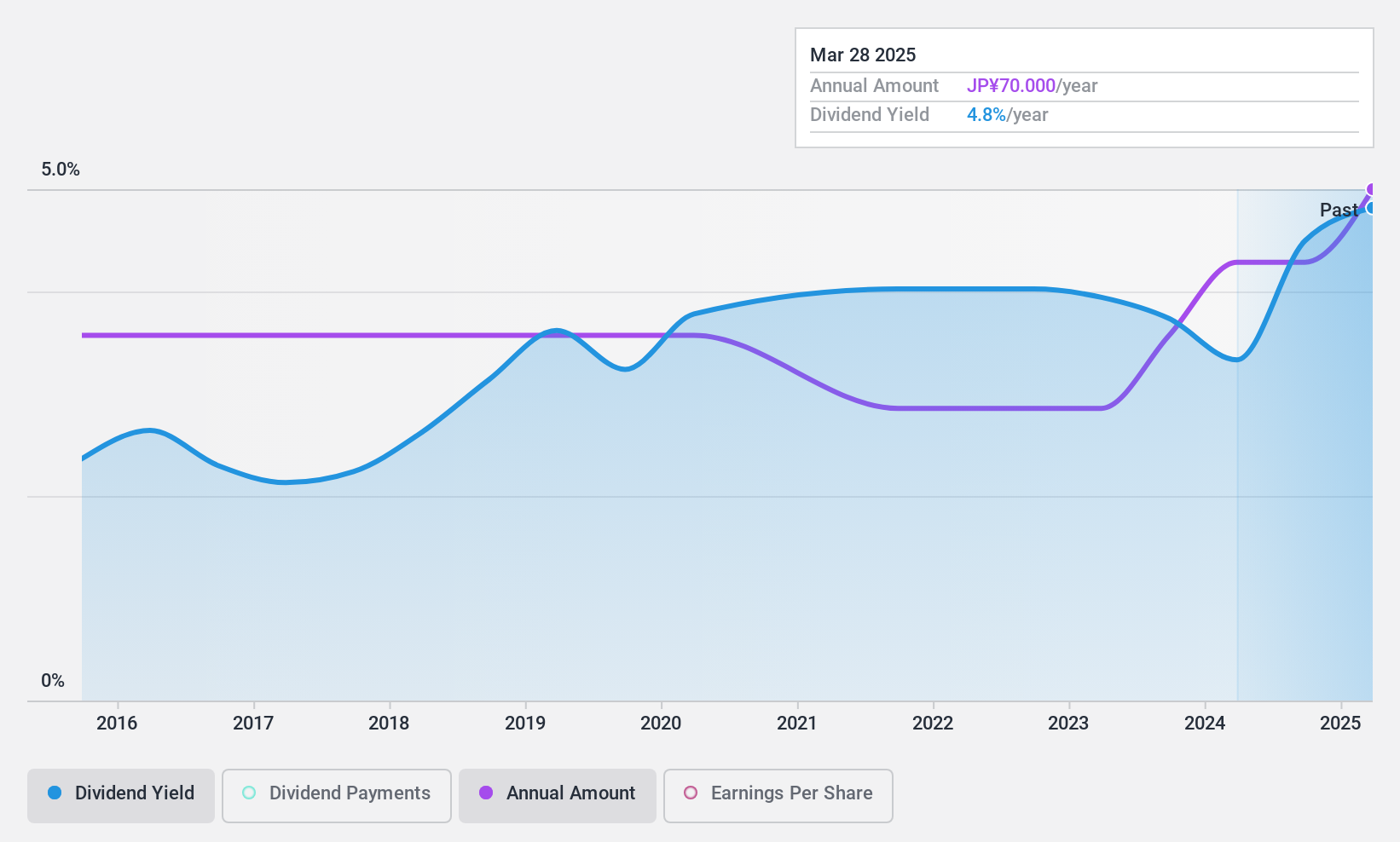

Chuetsu Pulp & Paper (TSE:3877)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chuetsu Pulp & Paper Co., Ltd. is engaged in the production, processing, and sale of paper, pulp, and related by-products both in Japan and internationally, with a market cap of ¥18.93 billion.

Operations: Chuetsu Pulp & Paper Co., Ltd.'s revenue is derived from its operations in producing and selling paper, pulp, and related by-products.

Dividend Yield: 4.8%

Chuetsu Pulp & Paper's dividend yield ranks in the top 25% of Japan’s market, but its payments have been volatile over the past decade. Recent guidance forecasts net sales of ¥112 billion and profit attributable to owners at ¥3.4 billion for fiscal year ending March 2025. The dividend payout ratio is low at 12.2%, suggesting strong earnings coverage, although high debt levels pose financial risks. The company announced a second-quarter dividend increase to ¥35 per share.

- Click to explore a detailed breakdown of our findings in Chuetsu Pulp & Paper's dividend report.

- The analysis detailed in our Chuetsu Pulp & Paper valuation report hints at an deflated share price compared to its estimated value.

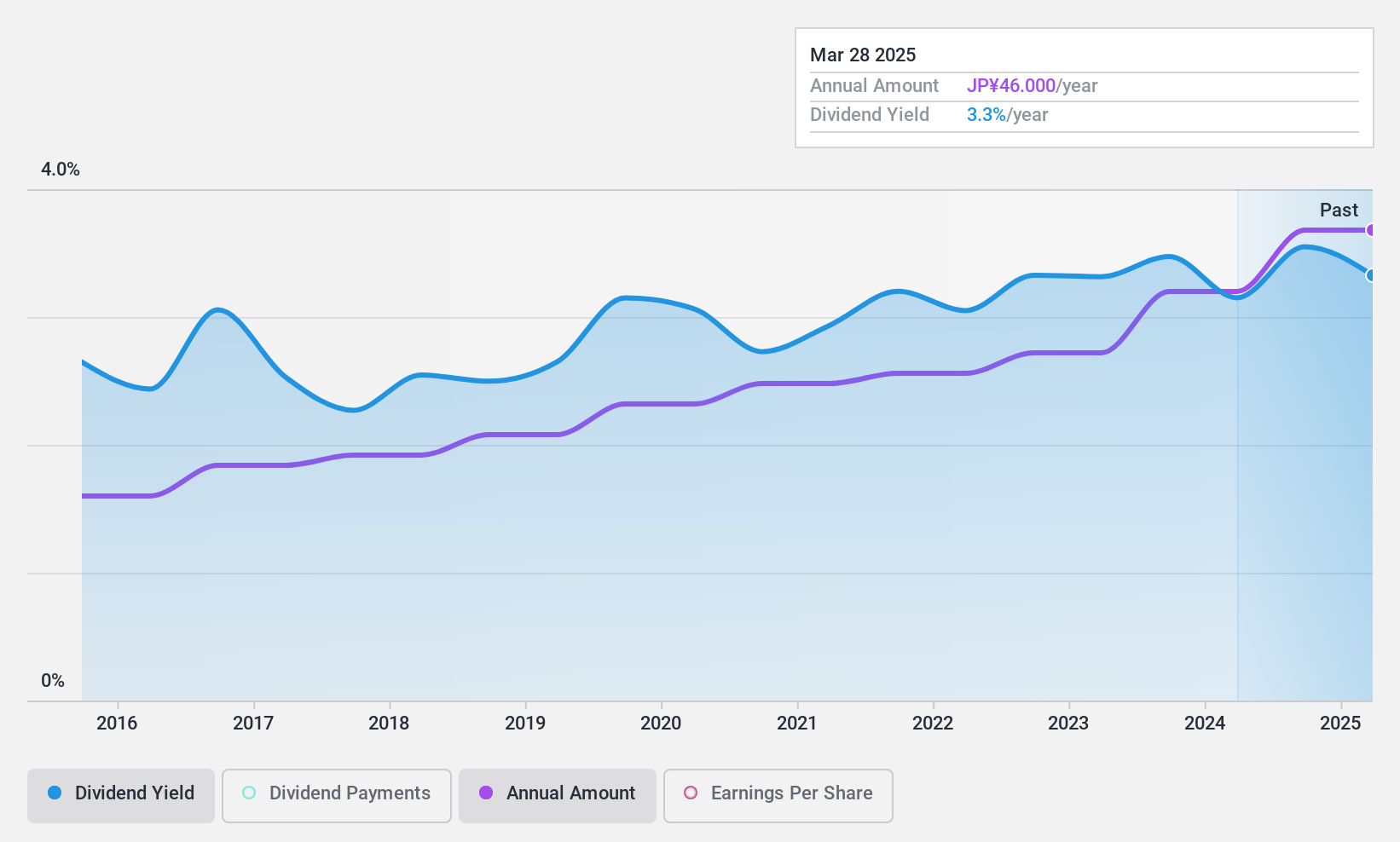

Kondotec (TSE:7438)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kondotec Inc. operates in the manufacture, procurement, import, sale, wholesale, and export of industrial materials mainly within the retail hardware sector both in Japan and internationally, with a market cap of ¥34.65 billion.

Operations: Kondotec Inc.'s revenue segments include Industrial Materials at ¥37.76 billion, Scaffolding Construction at ¥8.54 billion, Steel Structure Materials at ¥21.21 billion, and Electrical Equipment Materials at ¥11.08 billion.

Dividend Yield: 3.4%

Kondotec offers a stable dividend yield of 3.39%, though it falls short of Japan's top 25% payers. Its dividends are well-covered, with a payout ratio of 33.8% and cash payout ratio at 50.2%. Earnings grew by 21.5% last year, supporting sustainable payouts that have increased over the past decade without volatility. Recent guidance projects net sales at ¥81.5 billion and profit at ¥3.3 billion for fiscal year ending March 2025, alongside a dividend increase to ¥23 per share for Q2.

- Dive into the specifics of Kondotec here with our thorough dividend report.

- Our valuation report unveils the possibility Kondotec's shares may be trading at a discount.

Turning Ideas Into Actions

- Discover the full array of 1967 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3877

Chuetsu Pulp & Paper

Produces, process, and sells paper, pulp, and related by-products in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives