- Japan

- /

- Semiconductors

- /

- TSE:3445

Discovering Hidden Opportunities in February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of rising inflation and potential shifts in trade policies, U.S. stock indexes are climbing toward record highs, with small-cap stocks lagging behind their larger counterparts. Amid this backdrop, investors may find hidden opportunities by focusing on stocks that exhibit strong fundamentals and resilience to economic fluctuations, particularly those overlooked within the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

RS Technologies (TSE:3445)

Simply Wall St Value Rating: ★★★★★★

Overview: RS Technologies Co., Ltd. specializes in silicon wafer reclamation and sales across various regions including Japan, Taiwan, China, Korea, the Americas, Europe, and other parts of Asia, with a market capitalization of ¥77.58 billion.

Operations: The company generates revenue primarily through silicon wafer reclamation and sales. It operates in multiple regions, contributing to its diverse revenue streams. The financial performance is reflected in its market capitalization of ¥77.58 billion.

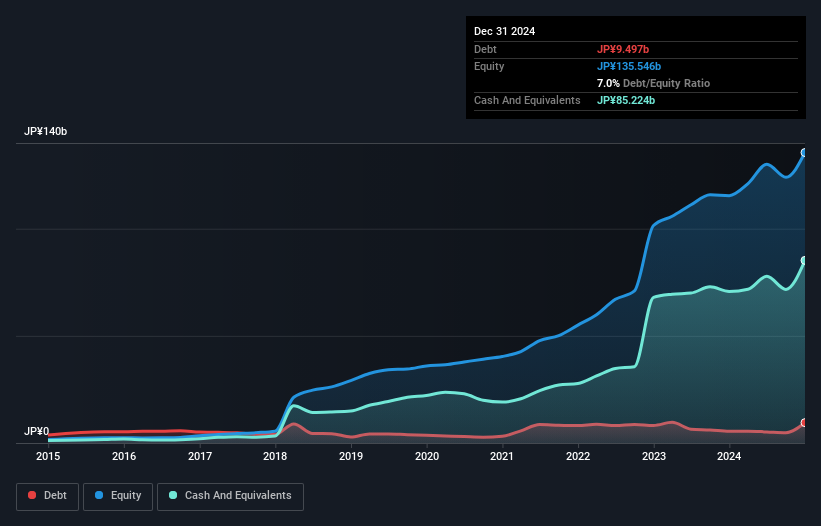

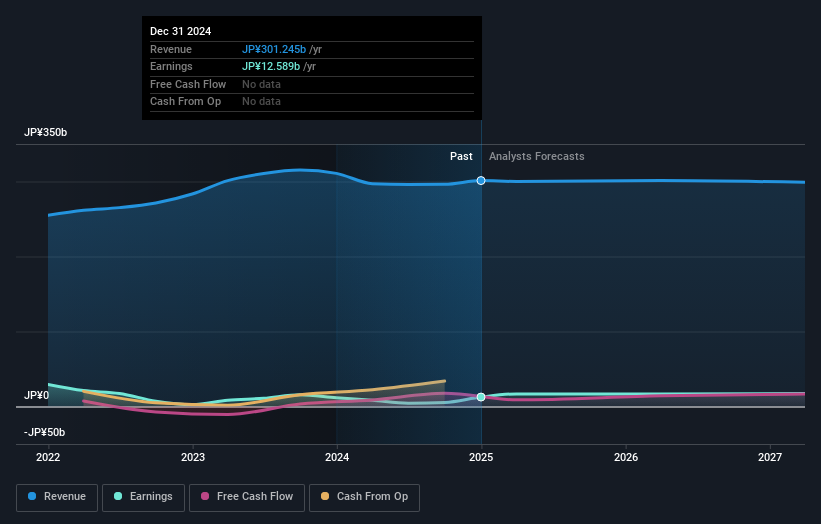

RS Technologies, a promising player in the semiconductor sector, is trading at 29.2% below its estimated fair value, suggesting potential upside. Over the past five years, earnings have grown impressively at 27.9% annually while reducing its debt to equity ratio from 10.1 to 7%. The company has high-quality earnings and generates positive free cash flow, indicating robust financial health. Although recent annual growth of 22.6% aligns with industry averages, future earnings are forecasted to grow at a steady rate of 5.24% per year. With fiscal year results expected soon, RS Technologies remains an intriguing prospect for investors seeking value in this space.

- Dive into the specifics of RS Technologies here with our thorough health report.

Gain insights into RS Technologies' historical performance by reviewing our past performance report.

Hokuetsu (TSE:3865)

Simply Wall St Value Rating: ★★★★★★

Overview: Hokuetsu Corporation is engaged in the manufacturing and sale of paper products across Japan, the United States, China, and other international markets with a market capitalization of ¥238.76 billion.

Operations: Hokuetsu generates revenue primarily through the sale of paper products in various international markets. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

Hokuetsu, a noteworthy player in its sector, has shown promising financial resilience despite facing a hefty ¥8.2B one-off loss affecting its 2024 results. Impressively, earnings grew by 7.7% over the past year, outpacing the Forestry industry average of 3.1%. The company’s debt to equity ratio improved significantly from 57.6% to 38.7% over five years, highlighting prudent financial management. With interest payments well-covered and a net debt to equity ratio at a satisfactory 30.2%, Hokuetsu seems well-positioned for future growth with earnings forecasted to rise by nearly 9% annually moving forward.

Base (TSE:4481)

Simply Wall St Value Rating: ★★★★★★

Overview: Base Co., Ltd., along with its subsidiaries, is involved in computer software development and related activities in Japan, with a market capitalization of ¥56.53 billion.

Operations: Base Co., Ltd. generates revenue primarily from its computer software development activities in Japan. The company has a market capitalization of ¥56.53 billion.

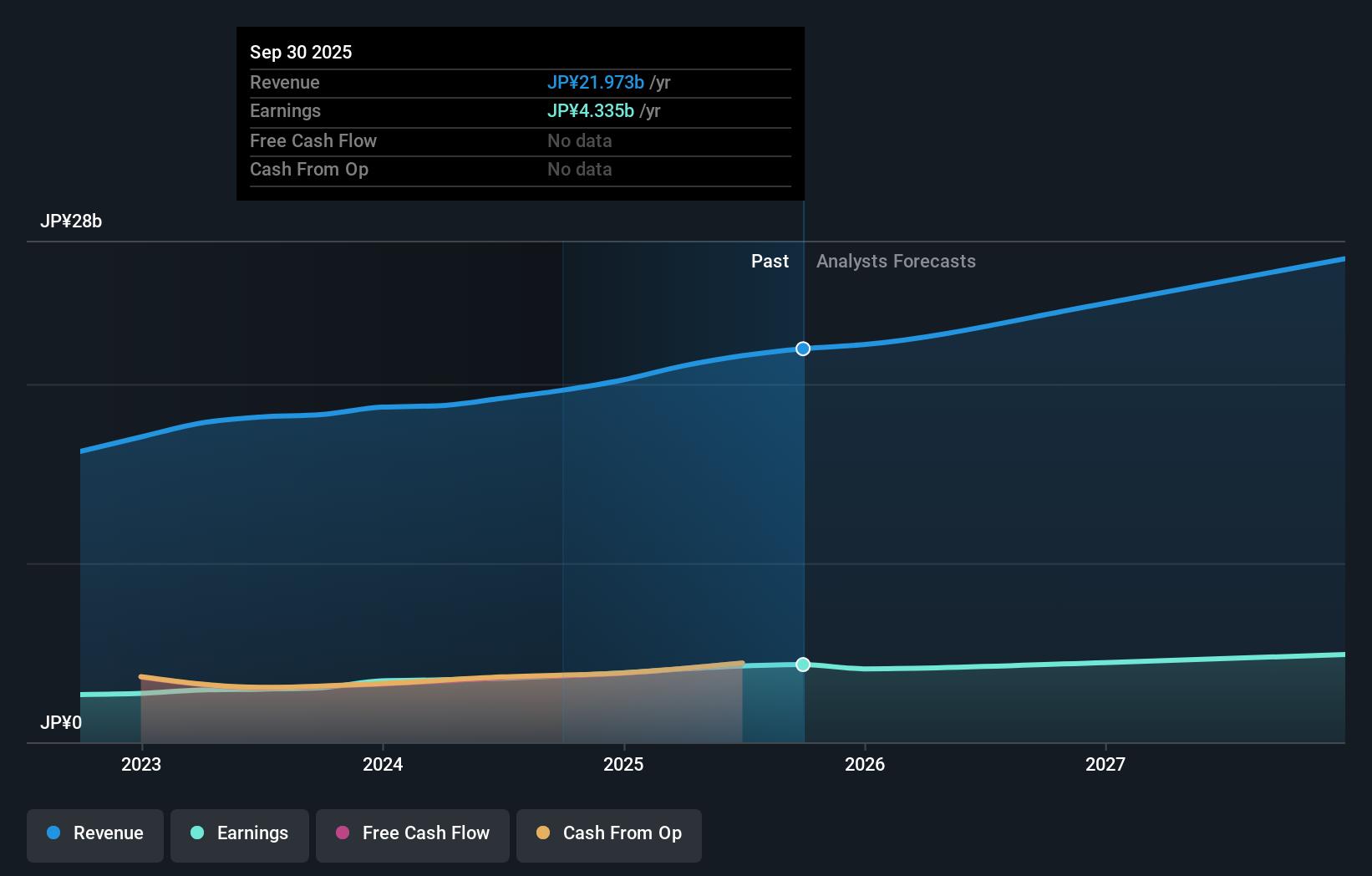

Base Co., Ltd. shines as a potential gem with its debt-free status, having reduced its debt to equity ratio from 25.1% five years ago to zero today. The company trades at an attractive 44.6% below estimated fair value and boasts high-quality earnings, reflecting strong financial health. Recent buybacks saw the company repurchase 320,900 shares for ¥999.83 million, enhancing shareholder value. Looking ahead, Base forecasts earnings growth of 9.82% annually and plans increased dividends for fiscal year-end 2025 at JPY 60 per share compared to JPY 52 previously, suggesting confidence in future profitability and cash flow strength.

- Unlock comprehensive insights into our analysis of Base stock in this health report.

Explore historical data to track Base's performance over time in our Past section.

Next Steps

- Dive into all 4716 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3445

RS Technologies

Provides silicon wafer reclamation and sale services in Japan, Taiwan, China, Korea, the Americas, Europe, and rest of Asia.

Flawless balance sheet and fair value.

Market Insights

Community Narratives