- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5214

Exploring Value Opportunities on the Japanese Exchange in July 2024

Reviewed by Simply Wall St

Amidst a challenging week for global markets, Japan's stock indices notably retreated, with the Nikkei 225 and TOPIX indices experiencing sharp declines. This downturn, influenced by a strengthening yen and pressure on technology stocks, sets a complex stage for investors looking at the Japanese market. In such conditions, identifying undervalued stocks requires a keen understanding of market fundamentals and resilience in sectors less affected by current economic headwinds.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Persol HoldingsLtd (TSE:2181) | ¥253.80 | ¥489.77 | 48.2% |

| Hibino (TSE:2469) | ¥2616.00 | ¥5183.10 | 49.5% |

| West Holdings (TSE:1407) | ¥2212.00 | ¥4185.46 | 47.2% |

| Sumco (TSE:3436) | ¥2503.50 | ¥4725.30 | 47% |

| Cyber Security Cloud (TSE:4493) | ¥2234.00 | ¥4310.60 | 48.2% |

| DKS (TSE:4461) | ¥3565.00 | ¥7049.48 | 49.4% |

| Visional (TSE:4194) | ¥7770.00 | ¥15075.24 | 48.5% |

| Macromill (TSE:3978) | ¥880.00 | ¥1694.77 | 48.1% |

| Bushiroad (TSE:7803) | ¥384.00 | ¥726.68 | 47.2% |

| PeptiDream (TSE:4587) | ¥2736.00 | ¥5323.25 | 48.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Asahi Kasei (TSE:3407)

Overview: Asahi Kasei Corporation operates in the chemical manufacturing sector and has a market capitalization of approximately ¥1.48 trillion.

Operations: The company's revenue is primarily derived from its Material, Housing, and Healthcare segments, generating ¥12.74 billion, ¥9.64 billion, and ¥5.54 billion respectively.

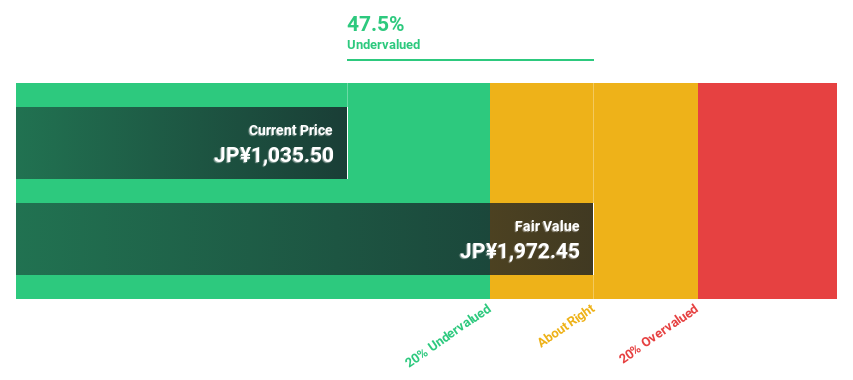

Estimated Discount To Fair Value: 42%

Asahi Kasei, with its recent advancements in technology and expansion into new markets, presents a compelling case for undervalued stocks based on cash flows. The company's introduction of a membrane system for producing sterile water and the construction of a lithium-ion battery separator plant highlight its strategic diversification. Despite slower forecasted revenue growth at 4.5% per year, earnings are expected to surge by 22.53% annually. Trading at ¥1065, significantly below the estimated fair value of ¥1836.74, Asahi Kasei appears undervalued by more than 20%.

- Our growth report here indicates Asahi Kasei may be poised for an improving outlook.

- Click here to discover the nuances of Asahi Kasei with our detailed financial health report.

AGC (TSE:5201)

Overview: AGC Inc., a global manufacturer and seller of glass, automotive, electronics, chemicals, and ceramics products, has a market capitalization of approximately ¥1.11 trillion.

Operations: The company's revenue is generated from its diverse operations in glass, automotive, electronics, chemicals, and ceramics sectors.

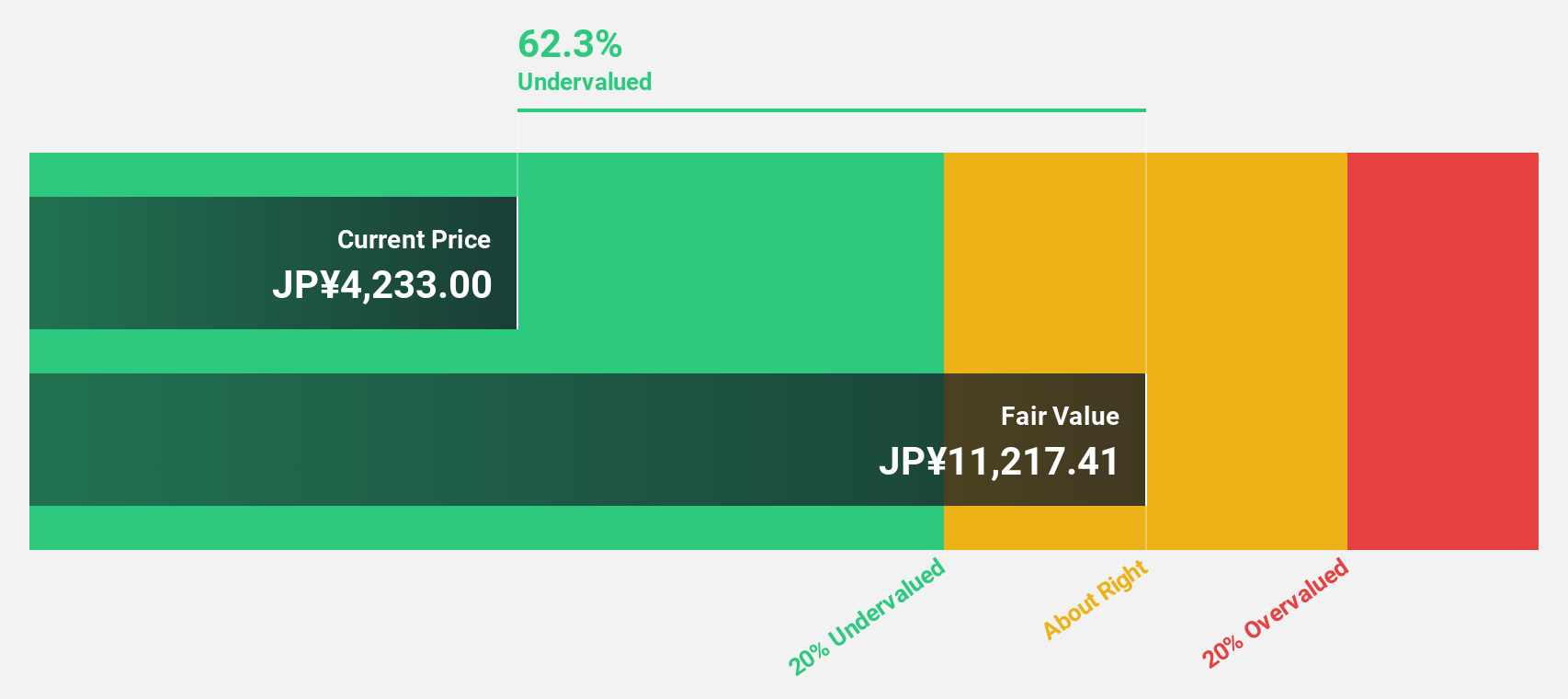

Estimated Discount To Fair Value: 36.2%

AGC Inc., known for its significant role in the materials industry, is currently trading at ¥5250, which is 36.2% below its estimated fair value of ¥8223.53, indicating a potential undervaluation based on cash flows. Despite a low forecasted return on equity at 8.2%, AGC's earnings are expected to grow by 33.77% annually, outpacing the Japanese market average growth rate significantly. However, its dividend sustainability is questionable as it is not well covered by earnings or free cash flows.

- According our earnings growth report, there's an indication that AGC might be ready to expand.

- Take a closer look at AGC's balance sheet health here in our report.

Nippon Electric Glass (TSE:5214)

Overview: Nippon Electric Glass Co., Ltd. is a company engaged in manufacturing and selling specialty glass products and glass-making machinery across regions including Japan, China, South Korea, the United States, and Europe, with a market capitalization of approximately ¥317.25 billion.

Operations: The company generates revenue through the sale of specialty glass products and glass-making machinery across key markets in Japan, China, South Korea, the United States, and Europe.

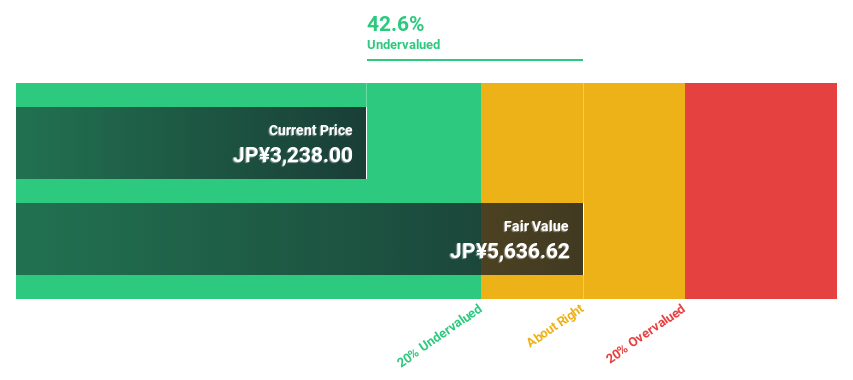

Estimated Discount To Fair Value: 35%

Nippon Electric Glass, priced at ¥3664, trades 35% below its calculated fair value of ¥5640.18, suggesting a significant undervaluation based on discounted cash flows. Expected to turn profitable within three years with an earnings growth rate of 28.64% annually, it outstrips the market's average. However, its dividend yield of 3.55% is poorly supported by both earnings and free cash flow, raising concerns about sustainability despite recent share buyback announcements aimed at enhancing shareholder returns.

- Insights from our recent growth report point to a promising forecast for Nippon Electric Glass' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Nippon Electric Glass.

Key Takeaways

- Gain an insight into the universe of 92 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Electric Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5214

Nippon Electric Glass

Manufactures and sells specialty glass products and glass making machinery in Japan, China, South Korea, the United States, Europe, and internationally.

Reasonable growth potential and fair value.