Stock Analysis

- Japan

- /

- Trade Distributors

- /

- TSE:8014

3 High Yield Dividend Stocks On The Japanese Exchange With Yields Starting At 3%

Reviewed by Simply Wall St

Amid a challenging week for Japan's stock markets, with significant losses noted across major indices and pressure on technology stocks, investors may find solace in the relative stability and potential income offered by high-yield dividend stocks. In such turbulent times, these stocks can be appealing due to their potential to provide steady income streams against a backdrop of market volatility and economic uncertainty.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.87% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.79% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.57% | ★★★★★★ |

| Globeride (TSE:7990) | 3.81% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.46% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.16% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.64% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.59% | ★★★★★★ |

| Innotech (TSE:9880) | 4.26% | ★★★★★★ |

Click here to see the full list of 407 stocks from our Top Japanese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

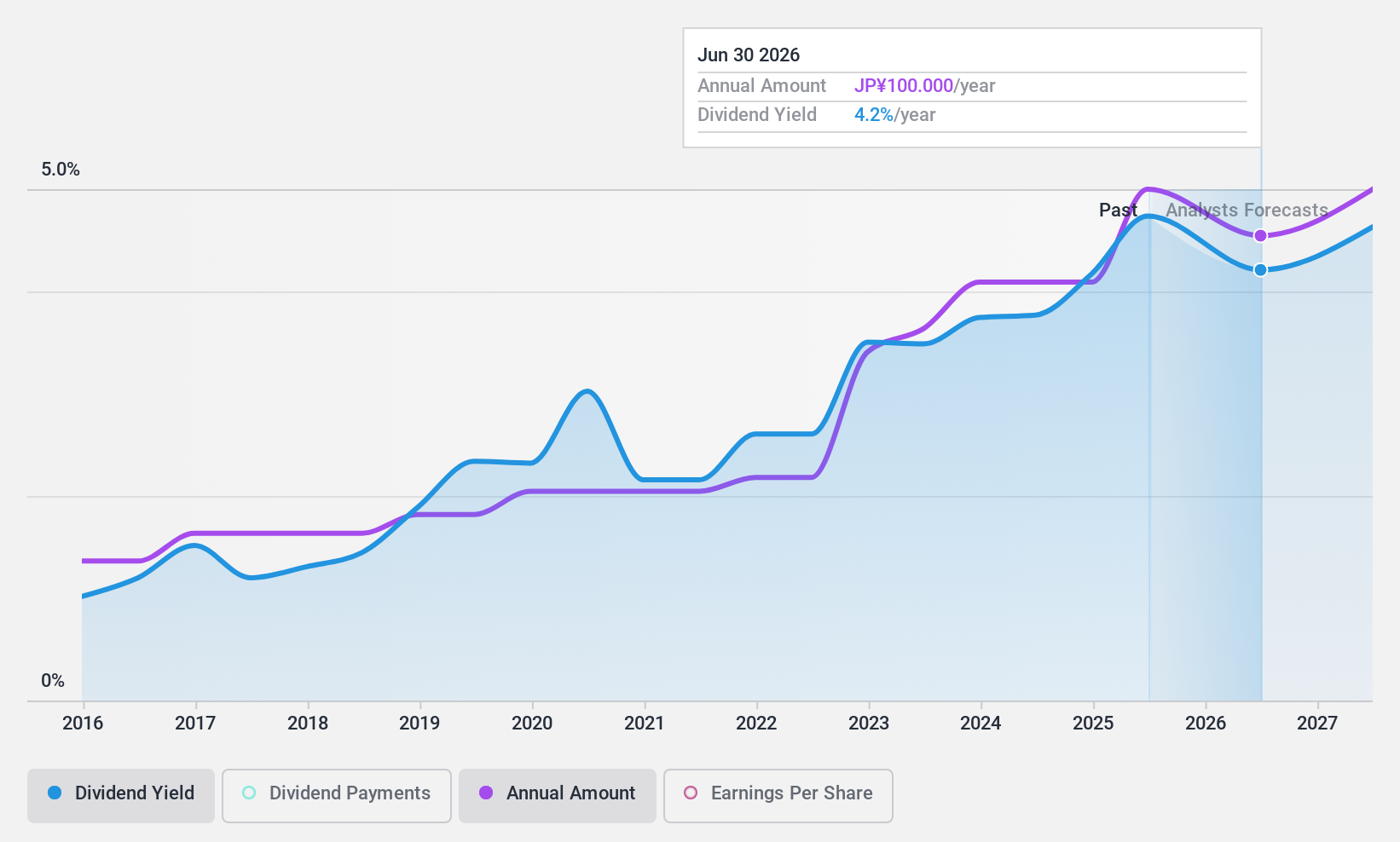

Ai Holdings (TSE:3076)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ai Holdings Corporation specializes in providing security and peripheral computer equipment, measuring devices, and card and other office equipment, with a market capitalization of approximately ¥118.40 billion.

Operations: Ai Holdings Corporation generates its revenue primarily from the sale of security systems, peripheral computer hardware, measurement instruments, and office machinery.

Dividend Yield: 3.6%

Ai Holdings maintains a steady dividend yield of 3.6%, positioned in the top 25% of Japanese dividend payers. The company's dividends are reliably backed by earnings with a low payout ratio of 15.6% and a cash payout ratio of 75.6%, indicating sound coverage from both profits and cash flows. Despite this robust dividend framework, earnings are projected to decline by an average of 21.1% annually over the next three years, suggesting potential challenges ahead in maintaining its dividend growth, which has been consistent over the past decade. Recent corporate guidance forecasts a significant increase in net sales and profits for FY ending June 2024, with expected net sales reaching JPY 53 billion and profit attributable to owners at JPY 15.60 billion.

- Unlock comprehensive insights into our analysis of Ai Holdings stock in this dividend report.

- Upon reviewing our latest valuation report, Ai Holdings' share price might be too pessimistic.

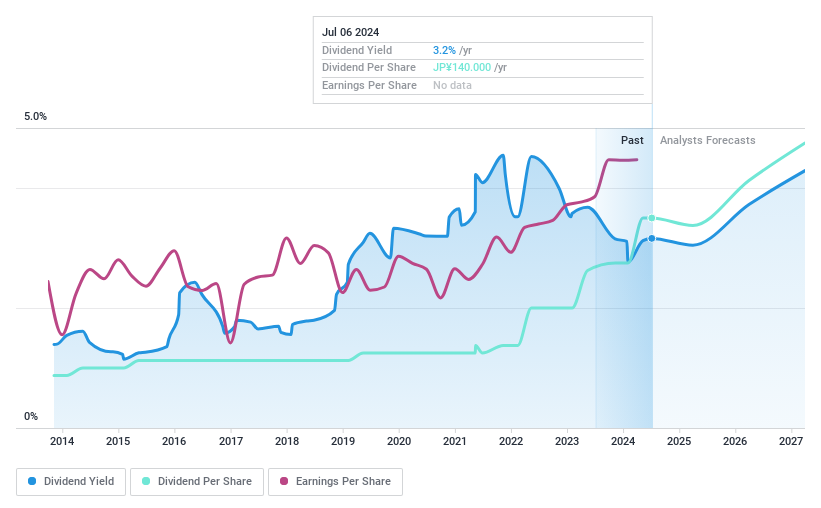

Chori (TSE:8014)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chori Co., Ltd. operates in textiles, chemicals, and machinery sectors across China and globally, with a market capitalization of approximately ¥94.25 billion.

Operations: Chori Co., Ltd. generates revenue primarily from its textiles and chemicals businesses, contributing ¥148.69 billion and ¥158.88 billion respectively, with a smaller contribution of ¥1.24 billion from its machinery business.

Dividend Yield: 3.2%

Chori Co., Ltd. shows a mixed dividend profile with a 25.1% earnings payout ratio and a 40.9% cash flow payout ratio, suggesting dividends are well covered. However, its dividend yield of 3.19% is below the top quartile of Japanese dividend stocks at 3.55%. Despite a decade of increasing dividends, payments have been unstable and unreliable over the same period, reflecting volatility in its financial commitments to shareholders. Recent executive changes could signal strategic shifts impacting future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Chori.

- Our valuation report unveils the possibility Chori's shares may be trading at a discount.

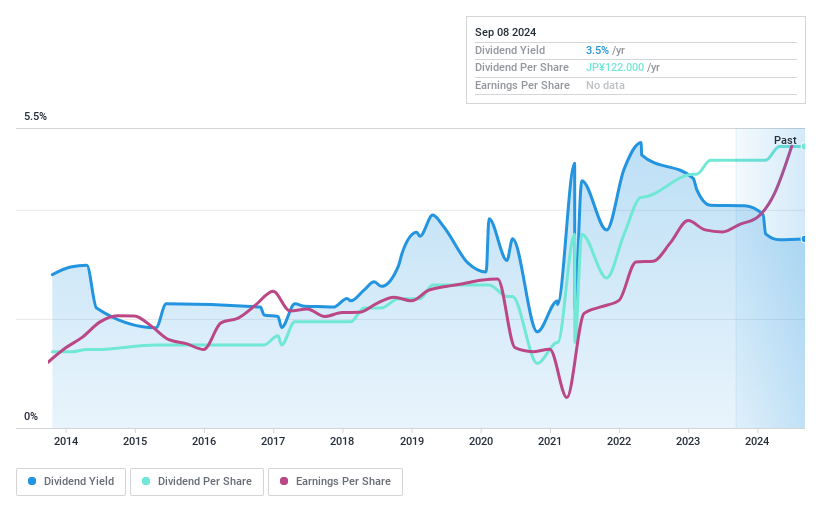

77 Bank (TSE:8341)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers a range of banking products and services to both corporate and individual clients in Japan, with a market capitalization of approximately ¥341.54 billion.

Operations: The 77 Bank, Ltd. primarily engages in delivering financial products and services tailored to both businesses and private individuals across Japan.

Dividend Yield: 3%

77 Bank offers a modest dividend yield of 3.04%, slightly below the top quartile in Japan. Over the past decade, its dividends have shown stability and growth, supported by a low payout ratio of 27.8%, indicating good coverage by earnings. However, concerns about its high bad loans ratio at 2% might pose risks to future sustainability. Recent financial performance shows a promising 27.2% earnings growth last year with an expected annual increase of 6.23%.

- Get an in-depth perspective on 77 Bank's performance by reading our dividend report here.

- According our valuation report, there's an indication that 77 Bank's share price might be on the cheaper side.

Next Steps

- Navigate through the entire inventory of 407 Top Japanese Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8014

Chori

Engages in textiles, chemicals, and machinery businesses in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.