Stock Analysis

Amid a challenging week for Japanese markets, with the Nikkei 225 and TOPIX indices experiencing significant declines, investors may find potential opportunities in lesser-known stocks that could be poised for growth. In such a climate, identifying stocks with solid fundamentals and potential resilience against broader market volatility becomes particularly crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Otec | 7.45% | 2.06% | -0.77% | ★★★★★★ |

| DoshishaLtd | 7.83% | 1.91% | 4.41% | ★★★★★★ |

| Kondotec | 12.01% | 6.76% | 0.32% | ★★★★★☆ |

| NPR-Riken | 13.26% | 6.00% | 32.17% | ★★★★★☆ |

| Nikko | 32.39% | 4.11% | -8.57% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 130.22% | 1.61% | -0.98% | ★★★★★☆ |

| Nippon Care Supply | 8.20% | 10.03% | 0.30% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 39.31% | 2.95% | 19.16% | ★★★★★☆ |

| Yukiguni Maitake | 158.67% | -5.22% | -32.27% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Tokuyama (TSE:4043)

Simply Wall St Value Rating: ★★★★★★

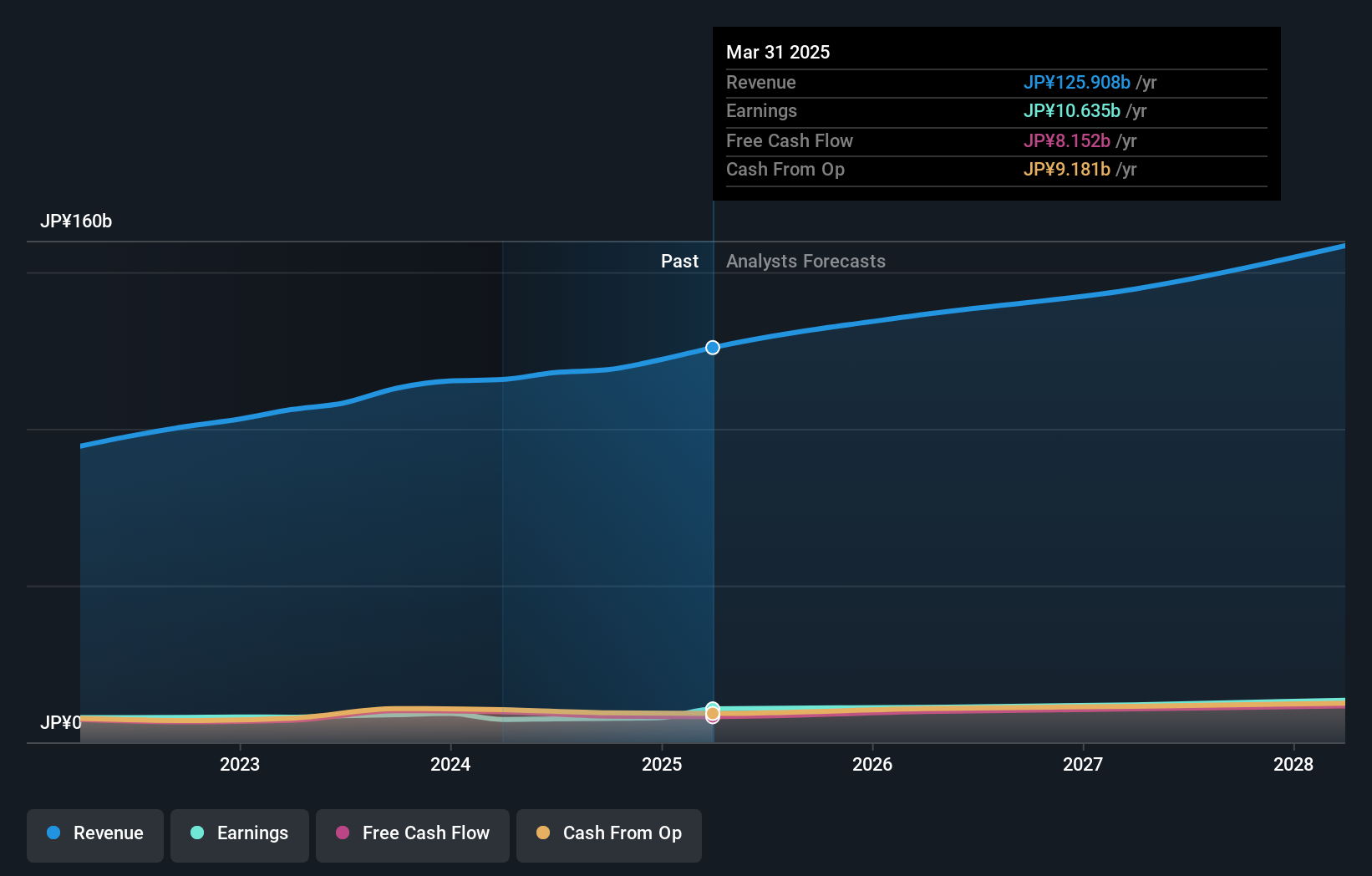

Overview: Tokuyama Corporation is a diversified chemical manufacturer based in Japan, operating across multiple sectors including electronics and advanced materials, life sciences, and cement, with a market cap of approximately ¥214.83 billion.

Operations: The company operates across diverse sectors including Cement, Life Science, Chemical Products, Environmental Business, and Electronic & Advanced Materials. It generates the highest revenue from Chemical Products (¥117.49 billion), followed by Electronic & Advanced Materials (¥77.49 billion) and Cement (¥67.07 billion).

Tokuyama Corporation, a lesser-known entity in Japan's chemical sector, has displayed robust performance with a 127% earnings growth over the past year, significantly outpacing the industry average of 8.8%. This growth is underpinned by a net debt to equity ratio that improved from 74.6% to 42.9%, reflecting strong financial health. Looking ahead, earnings are projected to grow by approximately 16.87% annually, offering potential for value appreciation especially as the stock trades at 60% below its estimated fair value. Recent strategic moves include a board meeting discussing subsidiary share exchanges and upcoming Q1 results announcement set for July 26, signaling ongoing corporate activity that could influence future performance.

- Navigate through the intricacies of Tokuyama with our comprehensive health report here.

Assess Tokuyama's past performance with our detailed historical performance reports.

Juroku Financial GroupInc (TSE:7380)

Simply Wall St Value Rating: ★★★★★☆

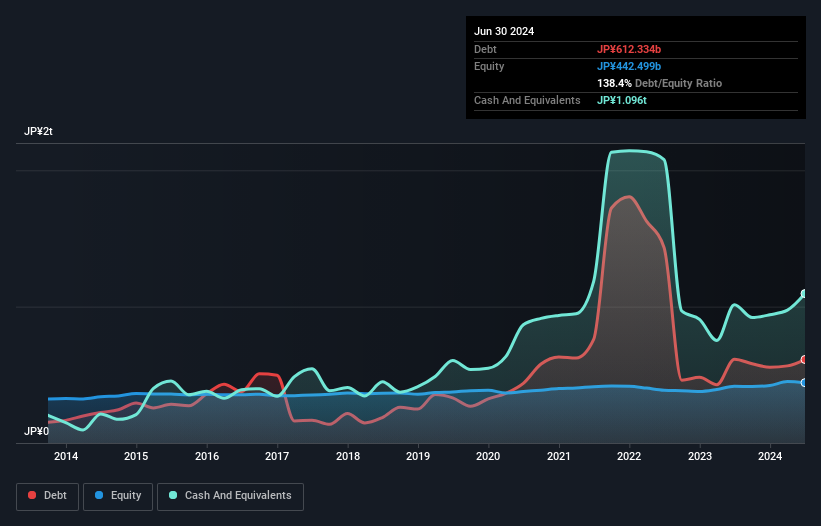

Overview: Juroku Financial Group, Inc. offers a range of banking and leasing products and services within Japan, with a market capitalization of approximately ¥176.99 billion.

Operations: The company generates revenue through its core operations, consistently achieving a gross profit margin of 100%. Its financial performance is highlighted by a net income margin that has seen fluctuations, with recent figures around 16.73% as of mid-2024, indicating profitability from its operational activities.

Juroku Financial Group's recent share repurchase announcement, involving ¥3.1 billion for 1.7% of its shares, underscores its proactive capital management. With total assets of ¥7,692 billion and a robust deposit base of ¥6,525 billion fueling low-risk funding, the company stands out in Japan's financial sector. Despite a modest bad loan allowance at 1.4%, Juroku has maintained earnings growth of 12% over the past year—outpacing the industry average by 1.8%. This performance highlights its potential as an undervalued gem with solid fundamentals and prudent financial strategies.

- Take a closer look at Juroku Financial GroupInc's potential here in our health report.

Gain insights into Juroku Financial GroupInc's past trends and performance with our Past report.

DTS (TSE:9682)

Simply Wall St Value Rating: ★★★★★★

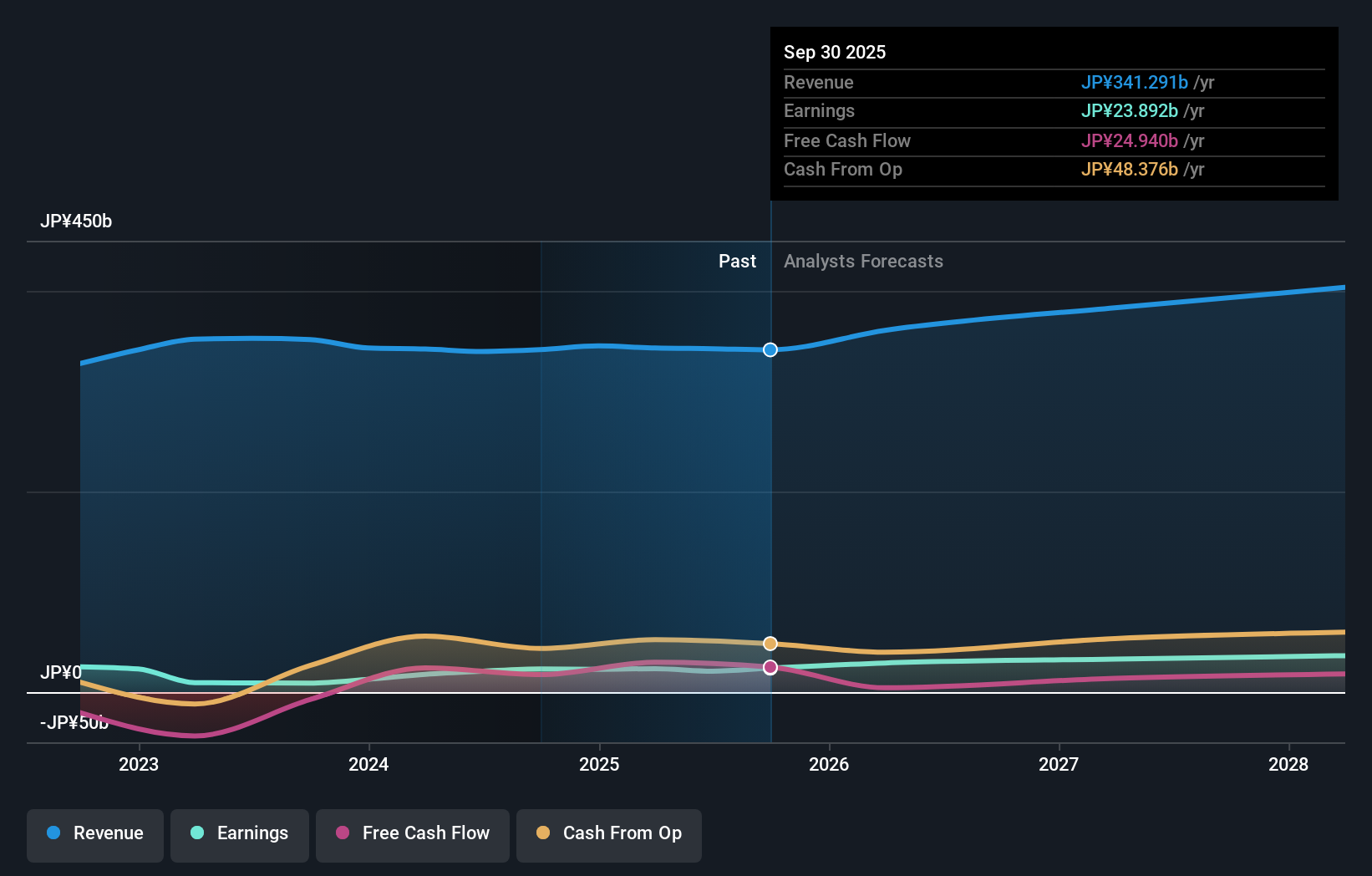

Overview: DTS Corporation specializes in systems integration services within Japan, boasting a market capitalization of ¥182.29 billion.

Operations: The company generates revenue through three primary segments: Platform & Service (¥31.21 billion), Technology & Solution (¥42.29 billion), and Operations & Solutions (¥45.14 billion). It has consistently demonstrated a gross profit margin improvement, reaching 21.60% in the latest period, reflecting its ability to manage production costs and enhance operational efficiency effectively.

DTS Corporation, a lesser-known entity in Japan's tech sector, is trading at 15.5% below its estimated fair value, making it an attractive prospect. With no debt and a history of high-quality earnings, the company has shown a consistent profit growth of 5% annually over the past five years. Recent strategic shifts include executive reshuffles and establishing a New Business Group to bolster innovation and global business promotion, aligning with its positive free cash flow and an earnings growth forecast of 6.79% per year.

Make It Happen

- Click here to access our complete index of 741 Japanese Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9682

Flawless balance sheet with proven track record and pays a dividend.