Evaluating Asahi Kasei (TSE:3407): How New Healthcare Innovations Factor Into Its Valuation

Reviewed by Kshitija Bhandaru

Asahi Kasei (TSE:3407) has taken new steps in healthcare innovation by announcing two specialty additions to its Sonanos™ excipient portfolio for injectable drugs. The company has also secured FDA premarket approval for ZOLL's Zenix® monitor/defibrillator.

See our latest analysis for Asahi Kasei.

After a year marked by innovative product launches and a significant FDA approval, Asahi Kasei’s momentum is clearly reflected in the numbers. The company’s 90-day share price return of 16.6% stands out, and a one-year total shareholder return of 13.6% confirms that recent optimism is not just short-lived. Long-term investors have also seen their patience rewarded as Asahi Kasei continues to carve out a bigger role in healthcare solutions.

If these moves by Asahi Kasei spark your interest in healthcare and medical technology, it’s a smart time to see what other innovators are making waves. See the full list for free.

With strong recent returns and major new approvals, does Asahi Kasei still trade at an attractive value, or have investors already factored in its growth prospects and innovation pipeline?

Price-to-Earnings of 13.3x: Is it justified?

Asahi Kasei's shares recently closed at ¥1,185, trading at a price-to-earnings (P/E) ratio of 13.3x. This ratio suggests the stock is being valued well below its peer group and substantially beneath a fair value benchmark. This raises the likelihood of undervaluation in today's market.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. For a company like Asahi Kasei, which operates in the chemicals sector and is demonstrating renewed profit growth, P/E can be a useful shorthand for gauging market expectations about future performance.

With a P/E of 13.3x, Asahi Kasei is priced significantly below the peer average of 28.9x and also below its estimated fair P/E of 19.8x. This gap indicates the market may be underestimating the company's growth potential and earnings profile, despite its robust fundamentals and recent gains. The fair ratio serves as a level investors could look for should sentiment catch up.

Explore the SWS fair ratio for Asahi Kasei

Result: Price-to-Earnings of 13.3x (UNDERVALUED)

However, persistent market volatility or a slowdown in annual revenue growth could quickly challenge the current outlook and shift investor sentiment.

Find out about the key risks to this Asahi Kasei narrative.

Another View: Discounted Cash Flow Perspective

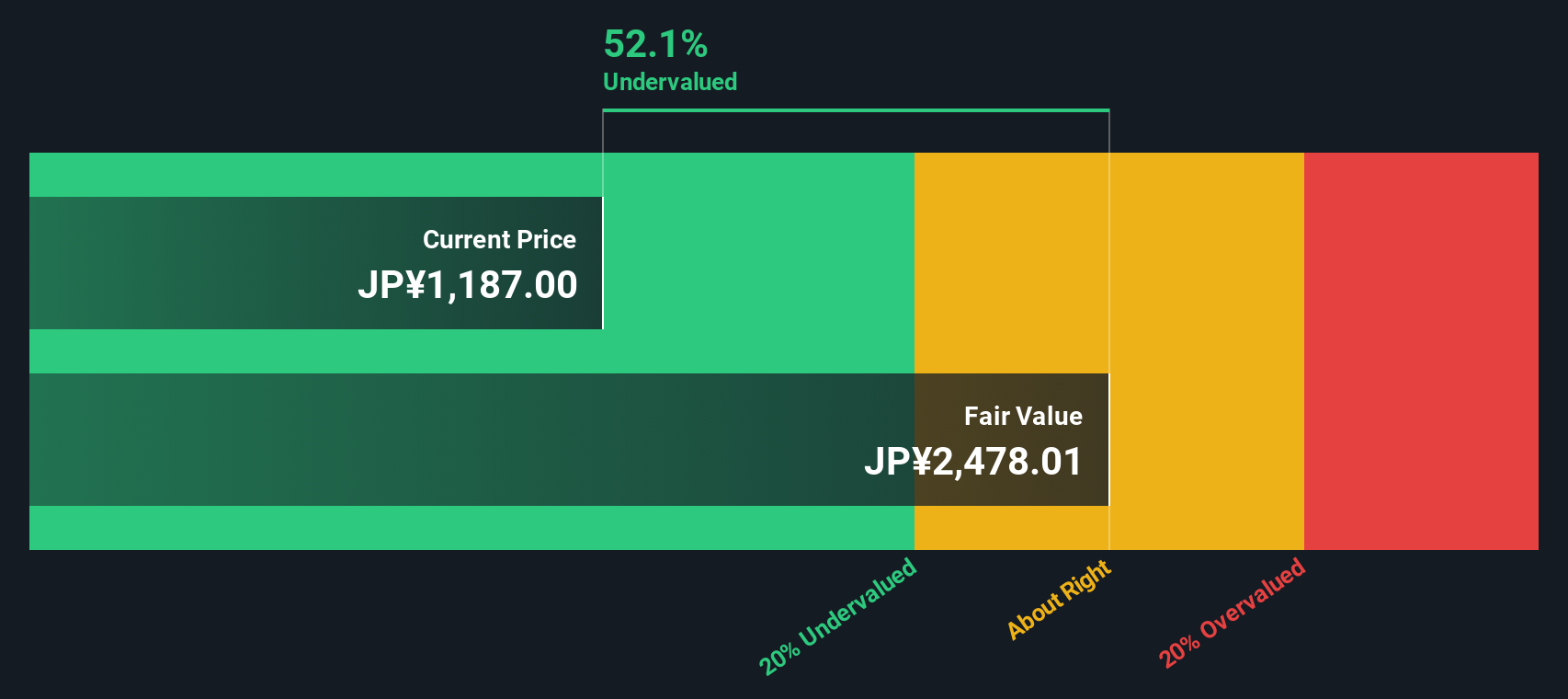

Taking a different approach, the SWS DCF model assesses Asahi Kasei’s shares as trading at a substantial 52.1% discount to its estimated fair value of ¥2,475.97. This deeper discount suggests even greater upside than the earnings-based ratio implies. Could the market be missing something fundamental here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Kasei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Kasei Narrative

Consider taking a hands-on approach and exploring the numbers for yourself. It's never been easier to develop your own take on Asahi Kasei in just a few minutes. Do it your way

A great starting point for your Asahi Kasei research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their horizons. Right now, the smartest opportunities could be just a click away. Don’t wait until the next big trend is yesterday’s news.

- Unlock potential future gains by scanning for reliable passive income among these 19 dividend stocks with yields > 3%, delivering solid yields above 3%.

- Tap into innovation with these 24 AI penny stocks, where advanced artificial intelligence is driving new growth stories across diverse industries.

- Catch the surge in digital assets and financial technology with these 79 cryptocurrency and blockchain stocks, connecting you to pioneers in cryptocurrency and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives