Teijin (TSE:3401) Valuation Check After Recent Share Price Drift and Earnings Recovery

Reviewed by Simply Wall St

Teijin (TSE:3401) has been drifting lower in the past week even as its share price still sits modestly above where it started the year, creating an interesting setup for valuation minded investors.

See our latest analysis for Teijin.

With the latest pullback, Teijin’s share price return over the past month remains positive, but its year to date share price return is still slightly negative. Over the longer term, total shareholder returns have been modest rather than momentum driven.

If Teijin’s recent moves have you reassessing your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership as potential new ideas to research next.

With earnings recovering despite flat revenues and the shares still trading below one intrinsic value estimate, investors now face a familiar dilemma: is this a mispriced turnaround story, or is the market already factoring in Teijin’s future growth?

Most Popular Narrative: 3.3% Overvalued

Compared with Teijin’s last close of ¥1,287, the most widely followed narrative pegs fair value slightly lower at ¥1,246, framing today’s price as a modest premium to long term assumptions.

Ongoing introduction of cost reforms including workforce realignment, impairment related fixed cost reductions, and optimization of production should undergird gross margin expansion and enable Teijin to partially offset industry price pressures and demand volatility, leading to improved earnings resilience.

Curious how a shrinking top line can still support higher profits and a richer future earnings multiple than the wider chemicals sector? The full narrative breaks down the margin rebuild, the profit swing, and the valuation bridge that ties it all together.

Result: Fair Value of ¥1,246 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price pressure in aramid and carbon fibers, or weaker than expected healthcare growth, could quickly undermine the margin rebuild underpinning this valuation.

Find out about the key risks to this Teijin narrative.

Another View: Market Ratios Tell a Different Story

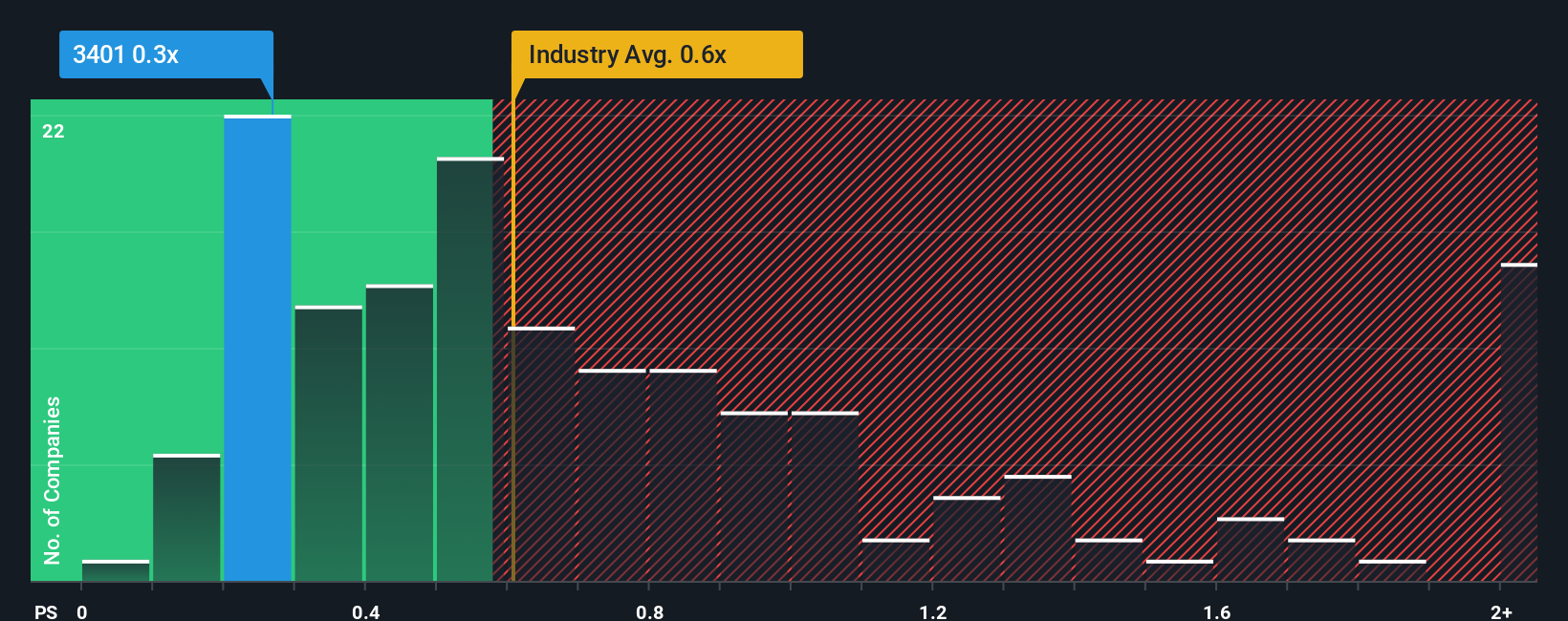

While the narrative based fair value suggests Teijin is 3.3% overvalued, the market is far more cautious. On a price to sales basis, the shares trade around 0.3 times revenue, roughly half both the industry and peer average of 0.6 times. This indicates investors are pricing in real execution risk but also leaving room for upside if margins recover.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teijin Narrative

If you see the outlook differently, or simply prefer digging into the numbers yourself, you can craft a tailored narrative in minutes: Do it your way.

A great starting point for your Teijin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with Teijin, use the Simply Wall Street Screener to uncover fresh opportunities tailored to your strategy before the market prices them in.

- Capture potential mispricings by reviewing these 908 undervalued stocks based on cash flows that currently trade below their estimated cash flow value.

- Tap into structural health trends by scanning these 30 healthcare AI stocks combining medical innovation with intelligent software.

- Position ahead of the next digital finance wave by assessing these 81 cryptocurrency and blockchain stocks benefiting from blockchain adoption and cryptocurrency growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teijin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3401

Teijin

Engages in the fibers, films and sheets, composites, healthcare, and IT businesses in Japan and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026