Tokio Marine Holdings (TSE:8766) Completes ¥60.88 Billion Buyback, Undervalued Stock Offers Growth Potential

Reviewed by Simply Wall St

Tokio Marine Holdings (TSE:8766) has recently completed a significant share buyback, repurchasing 11,105,600 shares for ¥60,882.75 million, as part of its strategic financial maneuvers announced earlier this year. This move underscores the company's financial health, characterized by impressive earnings growth and a strong net profit margin. As investors look forward to the upcoming company report, they can anticipate insights into how Tokio Marine navigates challenges like operational inefficiencies and regulatory changes while leveraging its market position and undervaluation for future growth.

Get an in-depth perspective on Tokio Marine Holdings's performance by reading our analysis here.

Unique Capabilities Enhancing Tokio Marine Holdings's Market Position

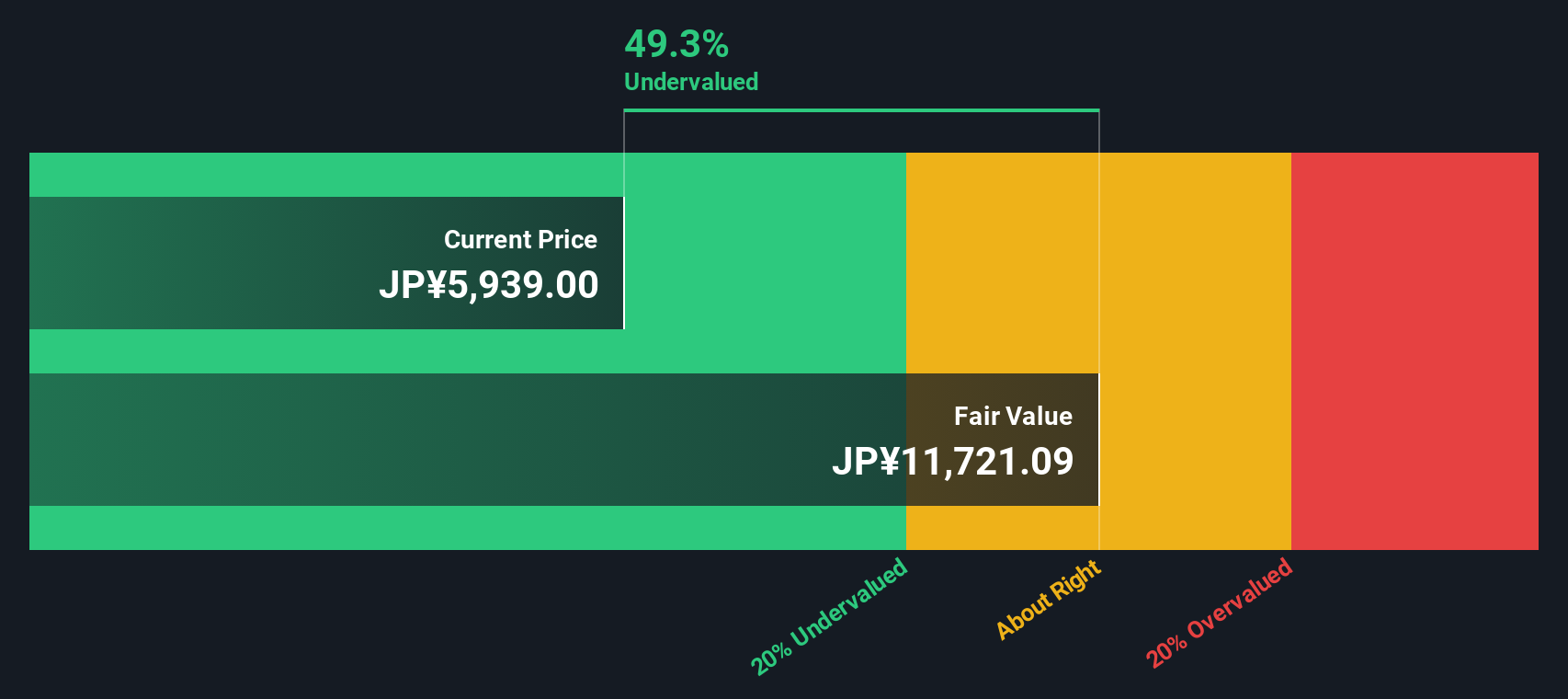

Tokio Marine Holdings has shown remarkable earnings growth, with a 101.4% increase surpassing the industry average of 45.2%. This is complemented by an improved net profit margin of 10.4%, up from 5.6% last year. The company's financial health is strong, with more cash than total debt and an interest coverage of 36.5 times. Its dividend policy is stable, with a low payout ratio of 31.7%, ensuring steady returns for investors. The leadership team, averaging 4.1 years of tenure, brings valuable experience that aligns with strategic goals. Furthermore, the company is trading at ¥5435, significantly below its estimated fair value of ¥12596.78, suggesting it may be undervalued and offering potential for price appreciation.

Learn about Tokio Marine Holdings's dividend strategy and how it impacts shareholder returns and financial stability.Challenges Constraining Tokio Marine Holdings's Potential

The company faces a forecasted Return on Equity of 14.2%, which is below the desired 20% benchmark. Its earnings growth forecast of 7.1% annually lags behind the JP market's 8.9%. Additionally, the company's Price-To-Earnings Ratio of 13.8x suggests it is expensive compared to industry peers. Operational inefficiencies, such as supply chain challenges, have led to delays, impacting overall efficiency. Rising costs have also pressured margins, indicating a need for better cost management strategies.

To dive deeper into how Tokio Marine Holdings's valuation metrics are shaping its market position, check out our detailed analysis of Tokio Marine Holdings's Valuation.Future Prospects for Tokio Marine Holdings in the Market

There is significant potential for earnings growth, with forecasts predicting a 7.06% annual increase. The company's undervaluation presents an opportunity for investors to capitalize on expected price appreciation. Recent product-related announcements, such as a successful product launch capturing a 20% market share, highlight its innovative capabilities. Strategic alliances and market expansion efforts could further enhance its competitive position.

To gain deeper insights into Tokio Marine Holdings's historical performance, explore our detailed analysis of past performance.Regulatory Challenges Facing Tokio Marine Holdings

The company must navigate economic headwinds, with inflation potentially affecting consumer spending. Intense competition requires continuous innovation to maintain market share. Regulatory changes pose additional challenges, necessitating adaptability to ensure compliance and operational continuity. Awareness of these threats allows for proactive strategies to mitigate their impact.

See what the latest analyst reports say about Tokio Marine Holdings's future prospects and potential market movements.Conclusion

Tokio Marine Holdings has demonstrated impressive financial performance, evidenced by its significant earnings growth and improved profit margins, which are bolstered by strong cash reserves and a stable dividend policy. Facing challenges such as a lower-than-desired Return on Equity and operational inefficiencies, the company's innovative capabilities and strategic alliances position it well for future growth. Trading at ¥5435, well below its estimated fair value of ¥12596.78, the company's current stock price presents a compelling opportunity for investors to benefit from potential price increases. As the company navigates economic and regulatory challenges, its ability to adapt and innovate will be crucial in maintaining its competitive edge and achieving long-term success.

Where To Now?

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Tokio Marine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8766

Tokio Marine Holdings

Engages in the non-life and life insurance, and financial and general businesses in Japan and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026