As global markets navigate a landscape marked by rising U.S. inflation and record-high stock indexes, investors are increasingly seeking stable income sources amid economic uncertainties. In this context, dividend stocks stand out as a reliable option for generating steady returns, offering the potential for both income and growth in an evolving market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

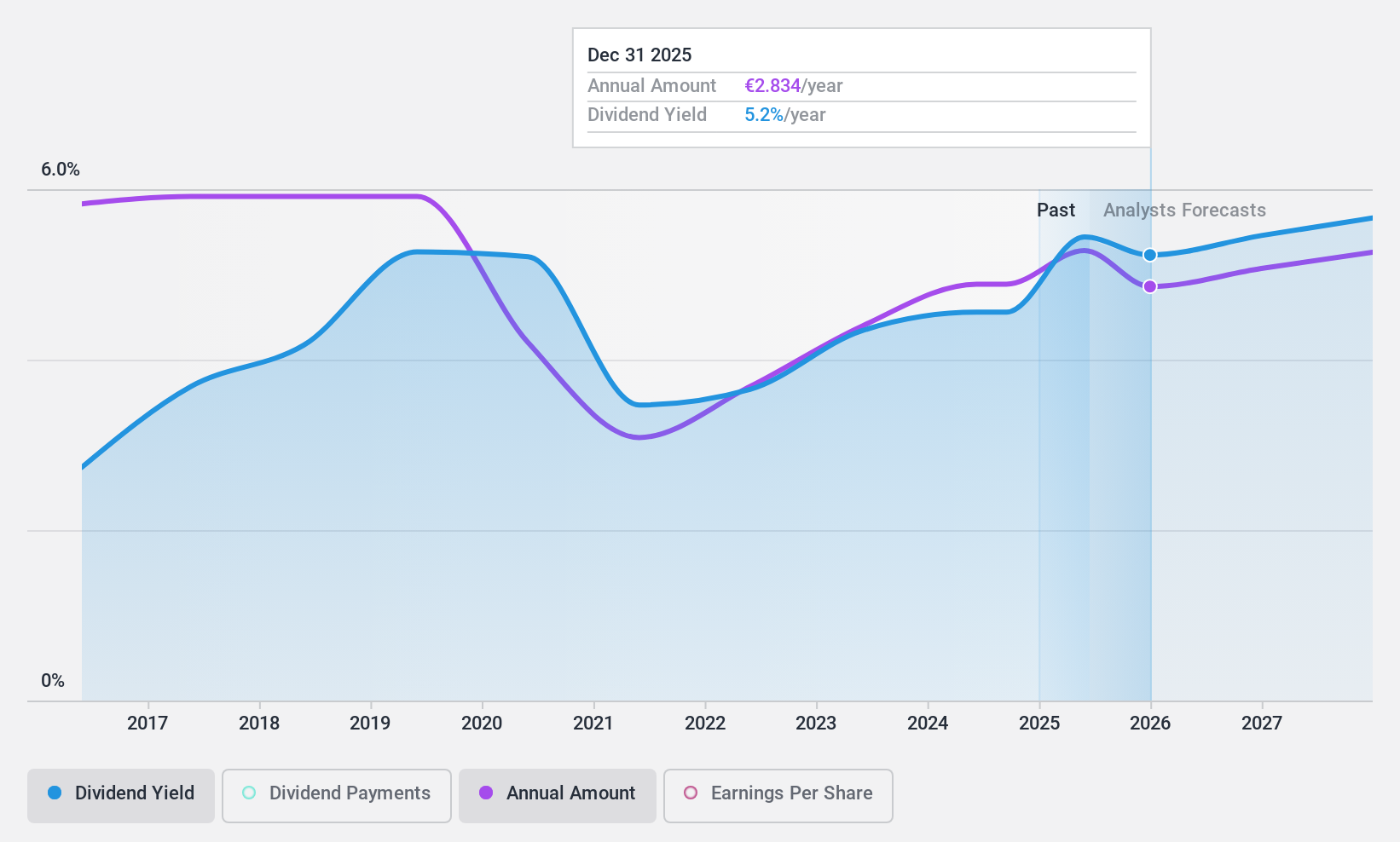

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA is a global manufacturer and seller of stationery, lighters, shavers, and other products with a market cap of €2.67 billion.

Operations: Société BIC generates revenue from three main segments: Lighters (€811.20 million), Shavers (€542.60 million), and Stationery (€823.20 million).

Dividend Yield: 4.3%

Société BIC's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 51.7% and a cash payout ratio of 40.9%. However, the dividends have been volatile over the past decade, experiencing drops over 20% annually at times. Despite this instability, dividends have increased over ten years. The stock trades at good value relative to peers and is priced significantly below its estimated fair value. Earnings grew by €12 million last year.

- Unlock comprehensive insights into our analysis of Société BIC stock in this dividend report.

- The valuation report we've compiled suggests that Société BIC's current price could be quite moderate.

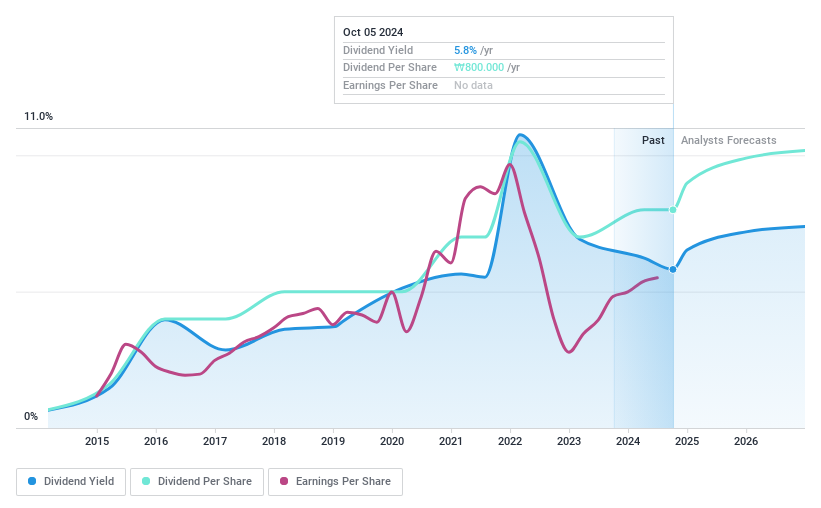

NH Investment & Securities (KOSE:A005940)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both in South Korea and internationally, with a market cap of ₩5.17 trillion.

Operations: NH Investment & Securities Co., Ltd. generates revenue from various segments including Sales (₩2.84 billion), Trading (₩1.83 billion), and Investment Banking (IB) (₩1.00 billion).

Dividend Yield: 5.3%

NH Investment & Securities offers a dividend yield of 5.31%, ranking in the top 25% in the KR market. Despite a low payout ratio of 42%, dividends are not covered by free cash flows and have been unreliable over the past decade, with volatility exceeding 20%. The stock trades at good value, priced 38.8% below its estimated fair value, yet high non-cash earnings raise concerns about quality. Recent conferences highlight ongoing investor engagement efforts across Asia.

- Take a closer look at NH Investment & Securities' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of NH Investment & Securities shares in the market.

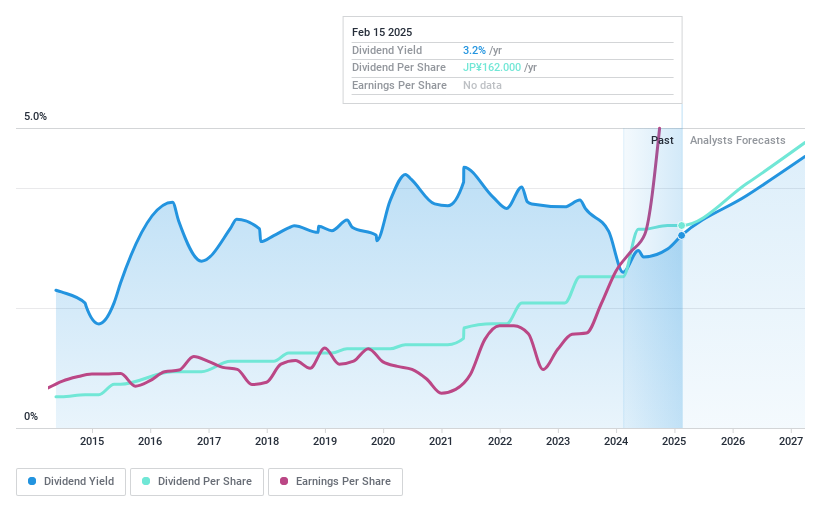

Tokio Marine Holdings (TSE:8766)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tokio Marine Holdings, Inc. operates in non-life and life insurance, as well as financial and general businesses both in Japan and internationally, with a market cap of approximately ¥10.02 billion.

Operations: Tokio Marine Holdings' revenue primarily comes from its Domestic Non-Life Insurance Business at ¥3.91 billion, International Insurance Business at ¥3.86 billion, Domestic Life Insurance at ¥0.54 billion, and Finance Other Businesses contributing ¥0.11 billion.

Dividend Yield: 3.1%

Tokio Marine Holdings' dividend yield of 3.13% is below the top 25% in Japan, yet dividends have grown steadily over the past decade with minimal volatility. The payout is well covered by earnings and cash flows, with a low payout ratio of 26.2%. Recent share buybacks totaling ¥47.57 billion reflect a flexible capital policy aimed at enhancing shareholder value. The stock trades significantly below its estimated fair value, suggesting potential upside for investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Tokio Marine Holdings.

- Our valuation report here indicates Tokio Marine Holdings may be undervalued.

Summing It All Up

- Discover the full array of 1983 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokio Marine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8766

Tokio Marine Holdings

Engages in the non-life and life insurance, and financial and general businesses in Japan and internationally.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives