Dai-ichi Life Holdings (TSE:8750) Completes Buyback, Signals Strong Market Position and Growth Potential

Reviewed by Simply Wall St

Dai-ichi Life Holdings (TSE:8750) recently completed a significant buyback program, repurchasing 24,627,000 shares for ¥99,999.94 million, which marks a strategic move to enhance shareholder value. The company has demonstrated impressive earnings growth, significantly outpacing industry averages, but faces challenges such as a relatively inexperienced management team and slower projected revenue growth compared to the market. Readers should anticipate an analysis of how Dai-ichi Life Holdings plans to leverage its strengths and address these challenges to sustain its competitive edge.

Click here to discover the nuances of Dai-ichi Life Holdings with our detailed analytical report.

Core Advantages Driving Sustained Success for Dai-ichi Life Holdings

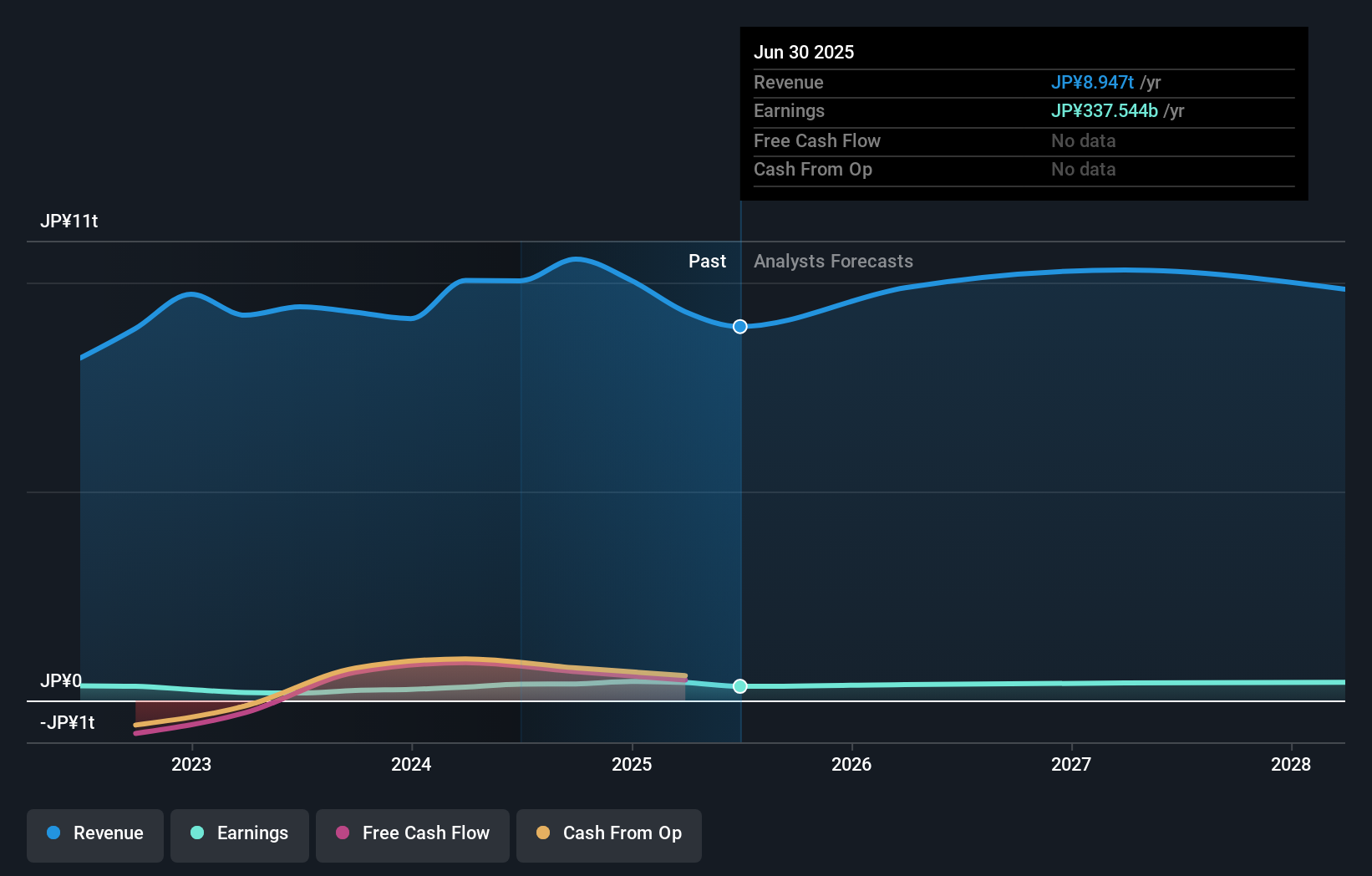

The company boasts a remarkable earnings growth rate of 117.7% over the past year, far surpassing the industry average of 45.2%. This performance is complemented by improved net profit margins, which have risen from 1.9% to 3.7%. Additionally, dividends are well-supported by earnings and cash flows, with payout ratios of 28% and 12.4%, respectively. The board's seasoned experience, averaging 3.9 years, provides strategic stability. The firm is trading at a SWS fair ratio of 9.1x, undercutting both the Asian Insurance industry average of 10.2x and the peer average of 15.4x, indicating a strong market position.

Learn about Dai-ichi Life Holdings's dividend strategy and how it impacts shareholder returns and financial stability.Challenges Constraining Dai-ichi Life Holdings's Potential

The company faces a few hurdles. The management team, with an average tenure of 1.7 years, may lack the experience needed for strategic execution. Forecasted revenue growth of 2.3% annually trails behind the JP market's 4.2%, and a projected Return on Equity of 9.3% is below the desired 20% threshold. Furthermore, the earnings growth forecast of 1% annually falls short of the JP market average of 8.9%, suggesting potential underperformance compared to industry peers.

See what the latest analyst reports say about Dai-ichi Life Holdings's future prospects and potential market movements.Areas for Expansion and Innovation for Dai-ichi Life Holdings

Opportunities for growth remain promising, with the potential to significantly enhance earnings growth, building on a historical performance of 13.5% annually over the past five years. The consistency of dividend payments over the last decade points to future growth prospects. Strategic product-related announcements and alliances could further bolster market presence and capitalize on emerging opportunities.

To gain deeper insights into Dai-ichi Life Holdings's historical performance, explore our detailed analysis of past performance.Competitive Pressures and Market Risks Facing Dai-ichi Life Holdings

However, the company must navigate a ¥395.7 billion one-off loss impacting recent financial results. With revenue growth expected to lag behind market trends, competitive positioning could be challenged. Additionally, economic headwinds and intensified competition necessitate strategic agility to maintain market share and mitigate external risks.

To dive deeper into how Dai-ichi Life Holdings's valuation metrics are shaping its market position, check out our detailed analysis of Dai-ichi Life Holdings's Valuation.Conclusion

Dai-ichi Life Holdings has demonstrated impressive earnings growth and improved profit margins, signaling strong operational performance and financial health. The company's management team may need to bolster its strategic execution capabilities to address the challenges of slower revenue growth and lower projected returns on equity compared to market averages. However, the company's consistent dividend payments and strategic opportunities for expansion suggest potential for future growth. Trading at a Price-To-Earnings Ratio of 9.1x, which is below industry and peer averages, Dai-ichi Life Holdings presents a compelling investment case, reflecting its strong market position and potential for value appreciation despite facing competitive pressures and market risks.

Turning Ideas Into Actions

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, engages in the provision of insurance products in Japan, the United States, and internationally.

Undervalued established dividend payer.