Evaluating MS&AD Insurance Group Holdings (TSE:8725) After New Buyback, Dividend Hikes and Upgraded Guidance

Reviewed by Simply Wall St

MS&AD Insurance Group Holdings (TSE:8725) just rolled out a sizeable capital return package, combining a new share repurchase plan, higher ordinary and special dividends, and upgraded earnings guidance for the current fiscal year.

See our latest analysis for MS&AD Insurance Group Holdings.

The market seems to be warming to that message, with a 1 month share price return of 10.51 percent helping lift the stock to ¥3,521. A huge 5 year total shareholder return of 323.49 percent underlines how long term holders have already been well rewarded and suggests that momentum in investor confidence is still very much intact.

If this kind of capital return story has your attention, it could be a good moment to see what insurers' peers are doing and explore fast growing stocks with high insider ownership.

Yet with the stock already up strongly and trading below, but not far from, analyst targets, the key question now is whether MS&AD is still mispriced or if the market is already factoring in its future growth.

Price-to-Earnings of 7.2x: Is it justified?

Based on a price-to-earnings ratio of 7.2 times, MS&AD Insurance Group Holdings appears undervalued at ¥3,521 compared with both peers and the wider Asian insurance industry.

The price-to-earnings multiple compares the current share price to per share earnings, making it a core yardstick for mature, profit-generating insurers where earnings quality matters.

In this case, the market is paying a materially lower multiple for MS&AD than for similar companies, which suggests investors may be underpricing its earnings power despite its high-quality track record.

Relative to the Asian insurance industry average of 10.8 times earnings and an estimated fair multiple of 11.7 times, the current 7.2 times ratio indicates a steep discount that could narrow if sentiment or profitability improve.

Explore the SWS fair ratio for MS&AD Insurance Group Holdings

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, softening earnings momentum and the possibility of weaker premium growth could challenge the undervaluation case if profitability does not reaccelerate.

Find out about the key risks to this MS&AD Insurance Group Holdings narrative.

Another View on Value

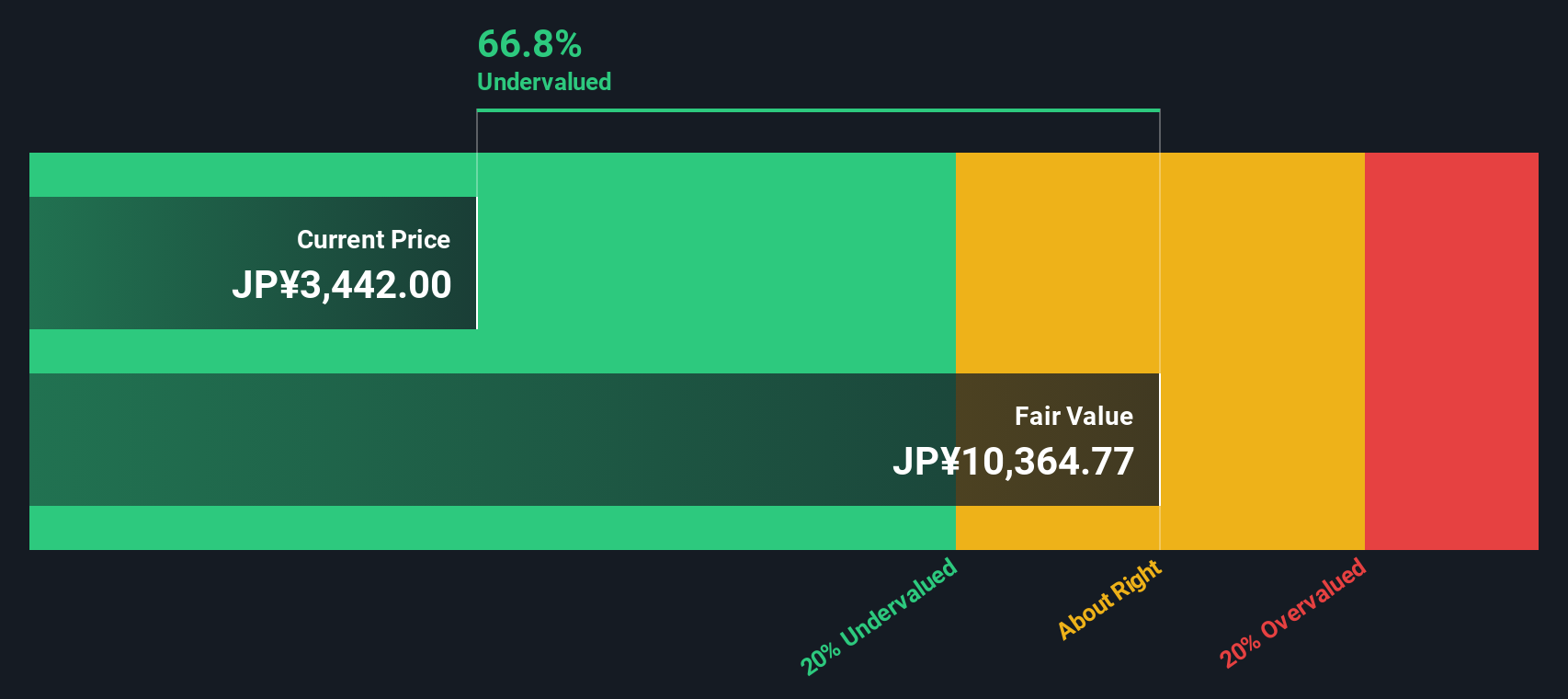

While the 7.2 times earnings multiple points to a clear discount versus peers, our DCF model goes even further. It suggests MS&AD's fair value sits far above the current ¥3,521 price, which implies the shares are deeply undervalued if those long term cash flow assumptions hold.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MS&AD Insurance Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MS&AD Insurance Group Holdings Narrative

If you want to stress test these assumptions or rely on your own analysis, you can quickly build a fully personalised view in minutes: Do it your way.

A great starting point for your MS&AD Insurance Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one opportunity; use the Simply Wall Street Screener to uncover focused ideas that match your strategy and could reshape your portfolio returns.

- Capture early stage growth potential with these 3569 penny stocks with strong financials that already show robust balance sheets and improving fundamentals.

- Target the next wave of digital innovation by reviewing these 81 cryptocurrency and blockchain stocks positioned at the crossroads of blockchain, payments, and financial infrastructure.

- Lock in reliable income streams by filtering for these 14 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8725

MS&AD Insurance Group Holdings

An insurance holding company, engages in the provision of insurance and financial services worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026