- Hong Kong

- /

- Oil and Gas

- /

- SEHK:386

Top Three Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, with U.S. stocks closing out a strong year despite recent fluctuations and European inflation showing unexpected strength, investors are increasingly focused on stability and income generation. In this context, dividend stocks offer an attractive option for those seeking to enhance their portfolios by providing regular income and potential growth amidst the current market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

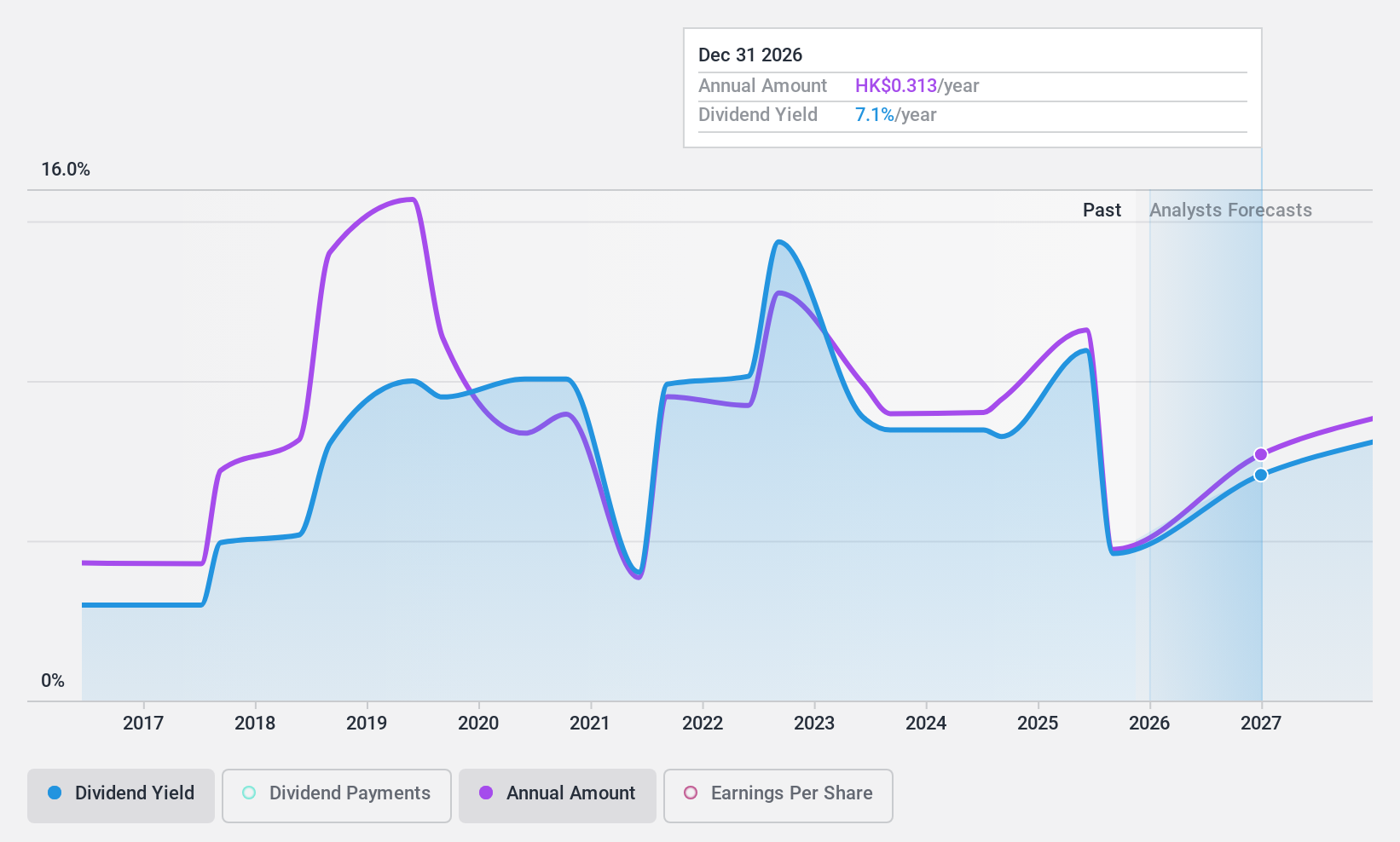

China Petroleum & Chemical (SEHK:386)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Petroleum & Chemical Corporation is an energy and chemical company involved in oil, gas, and chemical operations in Mainland China, Singapore, and internationally with a market cap of HK$784.89 billion.

Operations: China Petroleum & Chemical Corporation's revenue segments include Refining at CN¥1.52 billion, Chemicals at CN¥528.87 million, Exploration and Production at CN¥304.40 million, and Marketing and Distribution at CN¥1.77 billion.

Dividend Yield: 8.2%

China Petroleum & Chemical's dividend yield of 8.23% ranks in the top 25% of Hong Kong market payers, yet it faces challenges with sustainability as dividends are not well covered by free cash flows, indicated by a high cash payout ratio of 164.6%. Despite an increase in dividend payments over the past decade, they have been volatile, experiencing significant annual drops. Recent earnings showed a decline in net income and revenue compared to last year.

- Click to explore a detailed breakdown of our findings in China Petroleum & Chemical's dividend report.

- Our valuation report here indicates China Petroleum & Chemical may be undervalued.

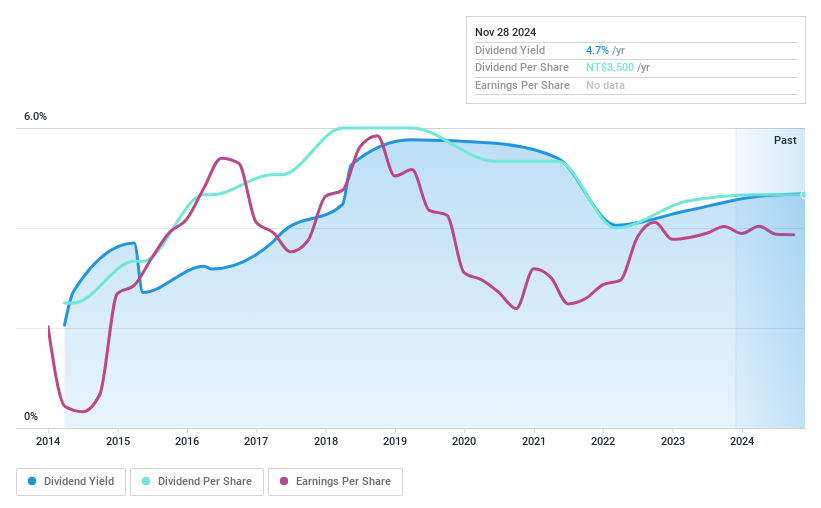

TTY Biopharm (TPEX:4105)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TTY Biopharm Company Limited, along with its subsidiaries, focuses on the development and sale of pharmaceutical and chemical drugs both in Taiwan and internationally, with a market cap of NT$18.28 billion.

Operations: TTY Biopharm's revenue is primarily derived from its Cancer Drug Business Group (NT$2.44 billion), Anti-infection Medicine Segment (NT$1.05 billion), Reinvestment Segment (NT$1.13 billion), Export and OEM Group (NT$981.22 million), and Healthcare Business Group (NT$562.90 million).

Dividend Yield: 4.8%

TTY Biopharm's dividend yield of 4.76% is among the top 25% in the Taiwan market, with dividends covered by earnings and cash flows, reflected in payout ratios of 77.7% and 85.6%, respectively. However, dividend reliability is a concern due to past volatility despite growth over the last decade. Recent earnings showed stable sales growth but slight declines in net income, highlighting potential challenges for future dividend stability amidst fluctuating profits.

- Take a closer look at TTY Biopharm's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of TTY Biopharm shares in the market.

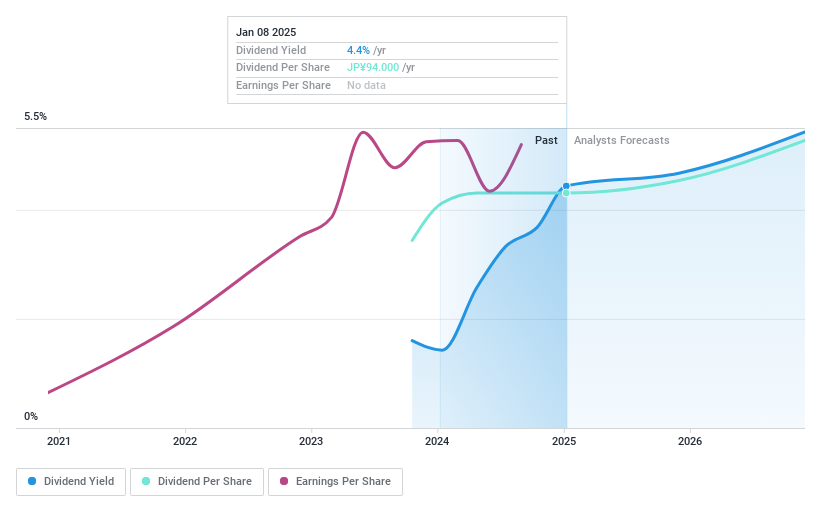

FP Partner (TSE:7388)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FP Partner Inc. offers insurance services to individuals and corporations in Japan, with a market cap of ¥47.32 billion.

Operations: FP Partner Inc.'s revenue primarily derives from its Insurance Agency Business, which generated ¥34.63 billion.

Dividend Yield: 4.5%

FP Partner's dividend yield of 4.52% ranks in the top 25% of the Japanese market, with dividends well-covered by earnings and cash flows, given a payout ratio of 26.5% and a cash payout ratio of 75.9%. However, dividend stability is uncertain as payments have only recently commenced. Despite high share price volatility and revised lower earnings guidance due to changing product sales dynamics, FP Partner remains undervalued compared to its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of FP Partner.

- Our expertly prepared valuation report FP Partner implies its share price may be lower than expected.

Next Steps

- Dive into all 1981 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:386

China Petroleum & Chemical

An energy and chemical company, engages in the oil and gas and chemical operations in Mainland China, Singapore, and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives