As global markets show signs of optimism with cooling U.S. inflation and robust bank earnings propelling stocks higher, small-cap indices like the S&P MidCap 400 and Russell 2000 have also experienced notable gains. In this environment, identifying undiscovered gems requires a keen eye for companies that not only demonstrate resilience amidst economic shifts but also possess strong fundamentals that align with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Value Rating: ★★★★★★

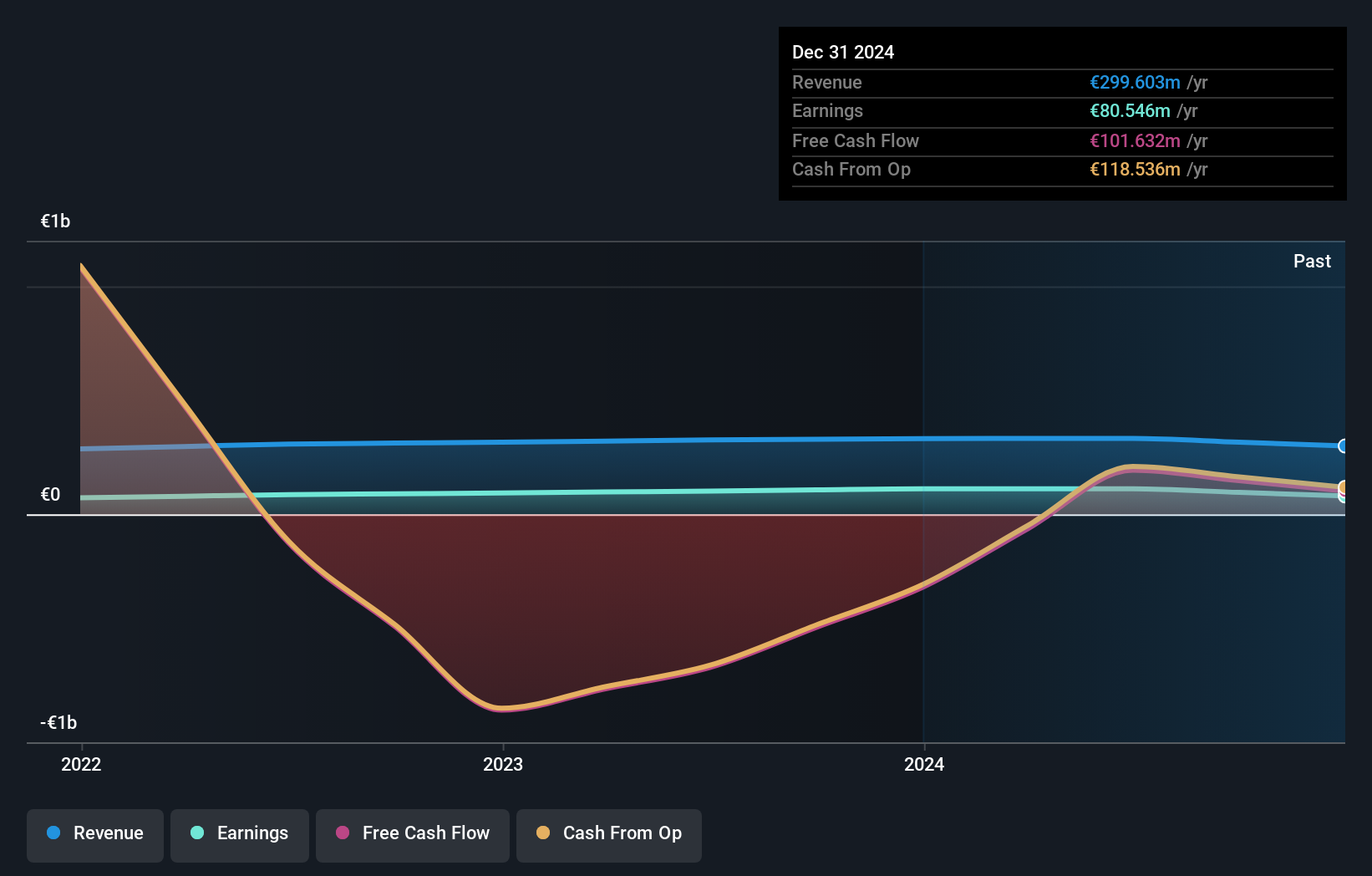

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market capitalization of €491.92 million.

Operations: CRTO generates revenue primarily from its Proximity Bank segment, contributing €254.46 million, and Management for Own Account and Miscellaneous activities, adding €94.09 million.

With total assets of €16.9 billion, Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou stands out for its robust financial health and prudent risk management. The cooperative's earnings grew by 9.3% over the past year, outpacing the industry average of 5.3%. It boasts a sufficient allowance for bad loans at 132%, ensuring resilience against potential defaults, while non-performing loans are kept at an appropriate level of 1.3%. Trading at a significant discount to its estimated fair value, this entity seems well-positioned with primarily low-risk funding sources comprising 95% customer deposits.

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★☆

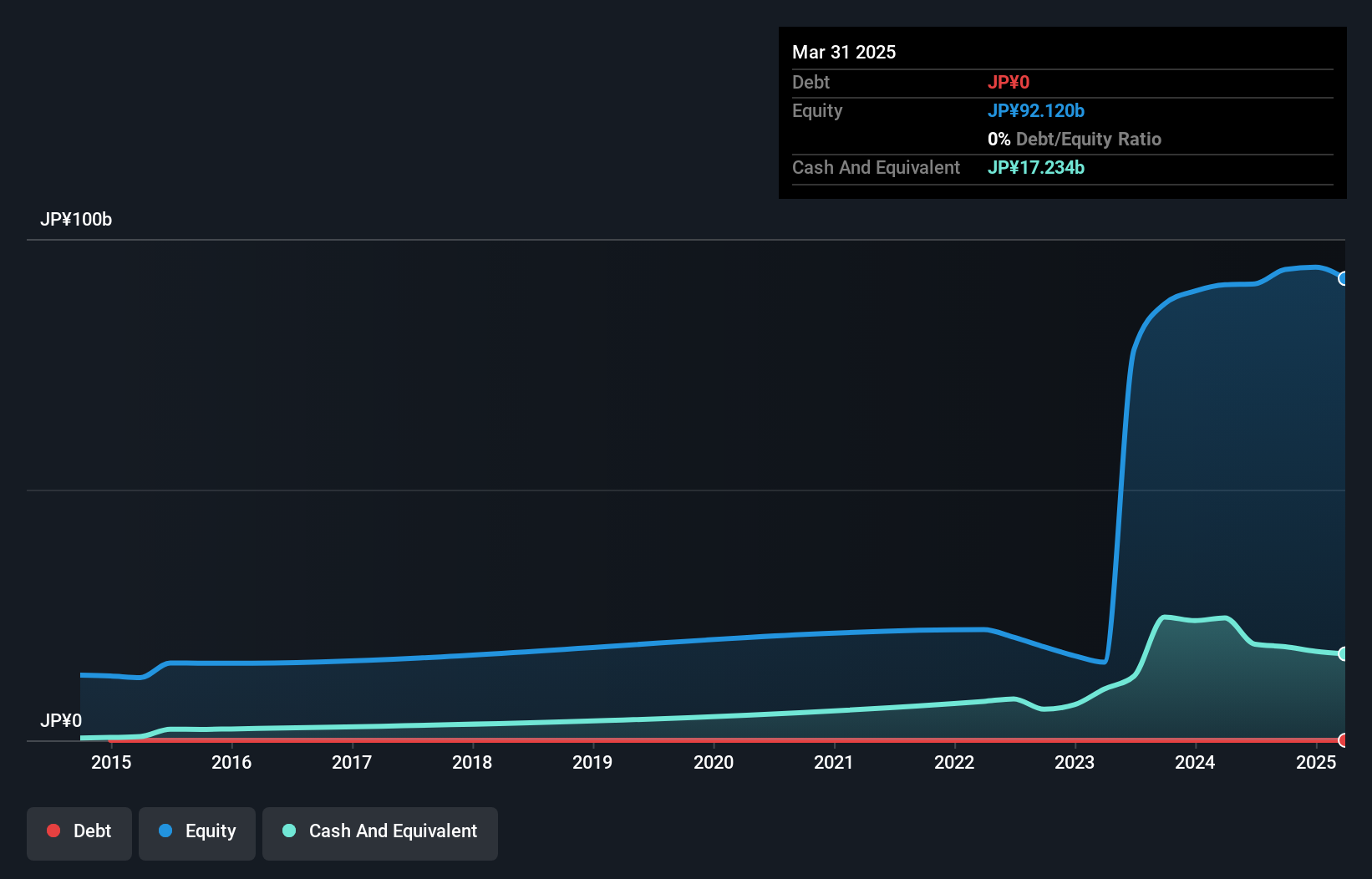

Overview: Lifenet Insurance Company offers life insurance products and services in Japan, North America, and internationally, with a market cap of ¥147.06 billion.

Operations: Lifenet Insurance generates revenue primarily through the sale of life insurance products across various regions. The company's net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and cost management.

Lifenet, a nimble player in the insurance sector, has demonstrated impressive financial resilience with earnings skyrocketing by 5791% over the past year, significantly outpacing the industry average of 64%. This debt-free company seems to have strategically managed its finances, resulting in high-quality earnings and positive free cash flow. With no interest payments to worry about due to its lack of debt for five years, Lifenet's future prospects appear promising as it forecasts an annual growth rate of 8.14%. Such robust performance suggests potential for continued value creation within this dynamic market space.

- Get an in-depth perspective on Lifenet Insurance's performance by reading our health report here.

Evaluate Lifenet Insurance's historical performance by accessing our past performance report.

Orient Semiconductor Electronics (TWSE:2329)

Simply Wall St Value Rating: ★★★★★★

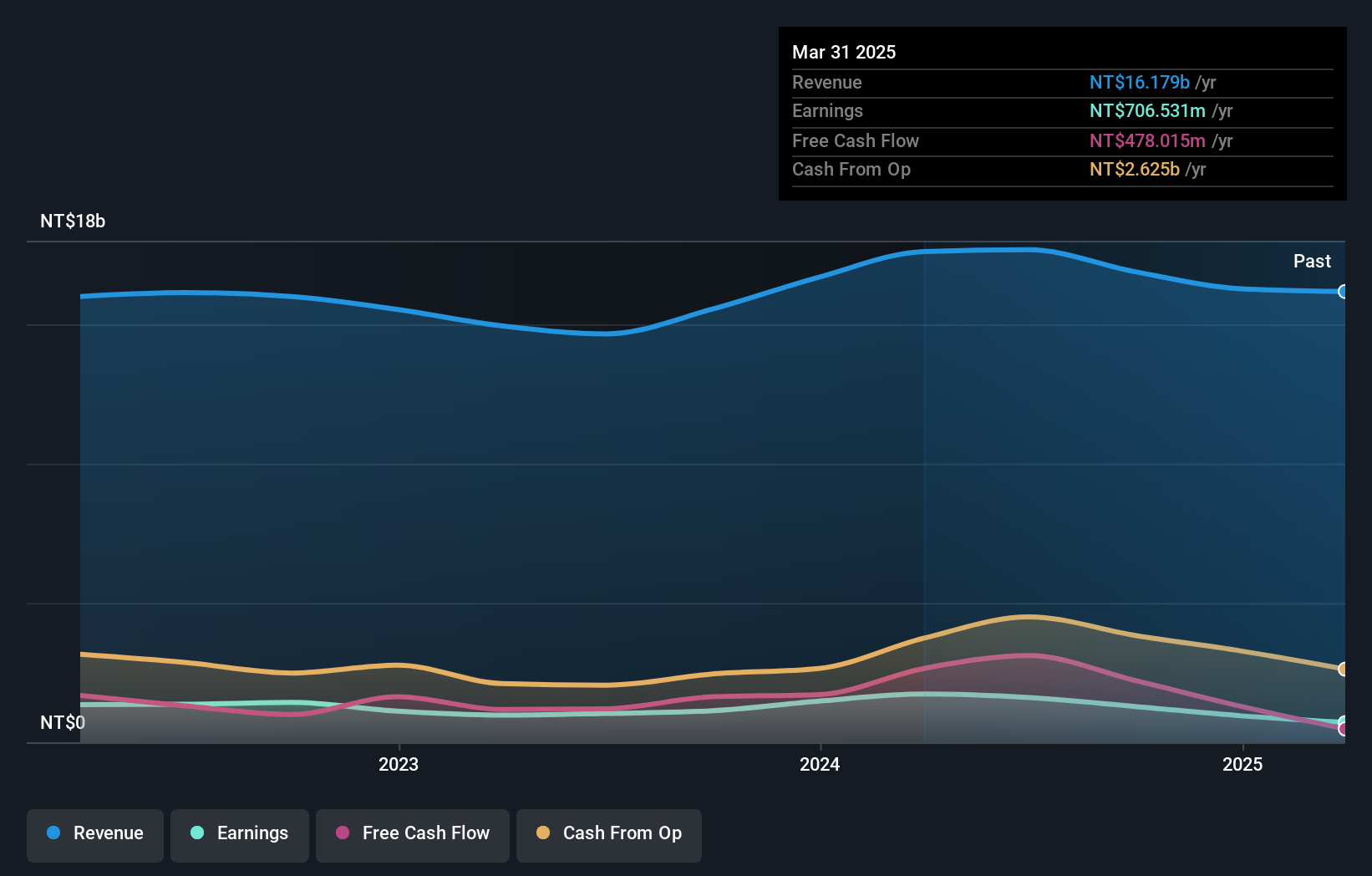

Overview: Orient Semiconductor Electronics, Limited is involved in the manufacturing, assembly, processing, and sale of integrated circuits and various electronic components across Taiwan, the United States, China, and other international markets with a market cap of NT$18.77 billion.

Operations: The company's revenue primarily stems from its Semiconductor Business Group, contributing NT$9.65 billion, and the Electronic Manufacturing and Service Segment, adding NT$7.27 billion.

In the semiconductor world, Orient Semiconductor Electronics stands out with its robust financial health and growth trajectory. Despite a dip in third-quarter sales to TWD 3,914 million from TWD 4,702 million last year, the company remains profitable with earnings growing by 13.5% over the past year. Trading at a significant discount of 76.2% below estimated fair value, it has reduced its debt-to-equity ratio from 81% to just over 11% in five years. With free cash flow positive and more cash than total debt, Orient seems well-positioned for future opportunities in this competitive industry.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4658 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRTO

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)