- Japan

- /

- Food and Staples Retail

- /

- TSE:2659

3 Undiscovered Japanese Gems with Strong Potential

Reviewed by Simply Wall St

Amid recent political shifts and economic policy adjustments in Japan, the Nikkei 225 and TOPIX indices have experienced notable fluctuations, reflecting investor reactions to new leadership and monetary policy directions. As market participants navigate these changes, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on opportunities within this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

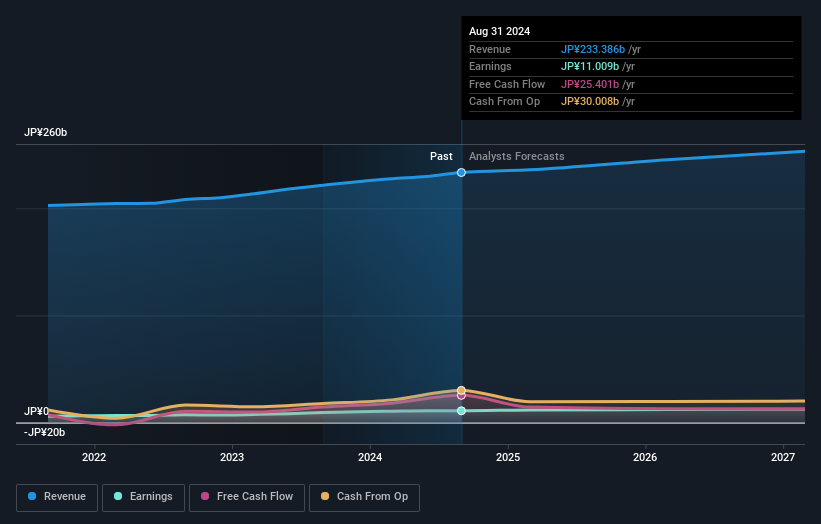

Overview: SAN-A CO., LTD. operates a chain of supermarkets in Okinawa and has a market capitalization of ¥179.23 billion.

Operations: SAN-A CO., LTD. generates revenue primarily through its supermarket operations in Okinawa. The company's financial performance is influenced by various cost components, with a particular focus on operational efficiencies to optimize profitability. Notably, the net profit margin has shown fluctuations over recent periods, reflecting changes in cost management and revenue strategies.

San-A Ltd., a small cap company in Japan, showcases promising attributes with earnings growing at 8.7% annually over the past five years. Despite not outpacing the Consumer Retailing industry's 22% growth last year, it remains a good value, trading at 40.9% below its estimated fair value. The company is debt-free and maintains high-quality earnings, suggesting a stable financial footing without concerns about interest coverage or cash runway limitations.

- Click here and access our complete health analysis report to understand the dynamics of SAN-ALTD.

Gain insights into SAN-ALTD's past trends and performance with our Past report.

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★☆

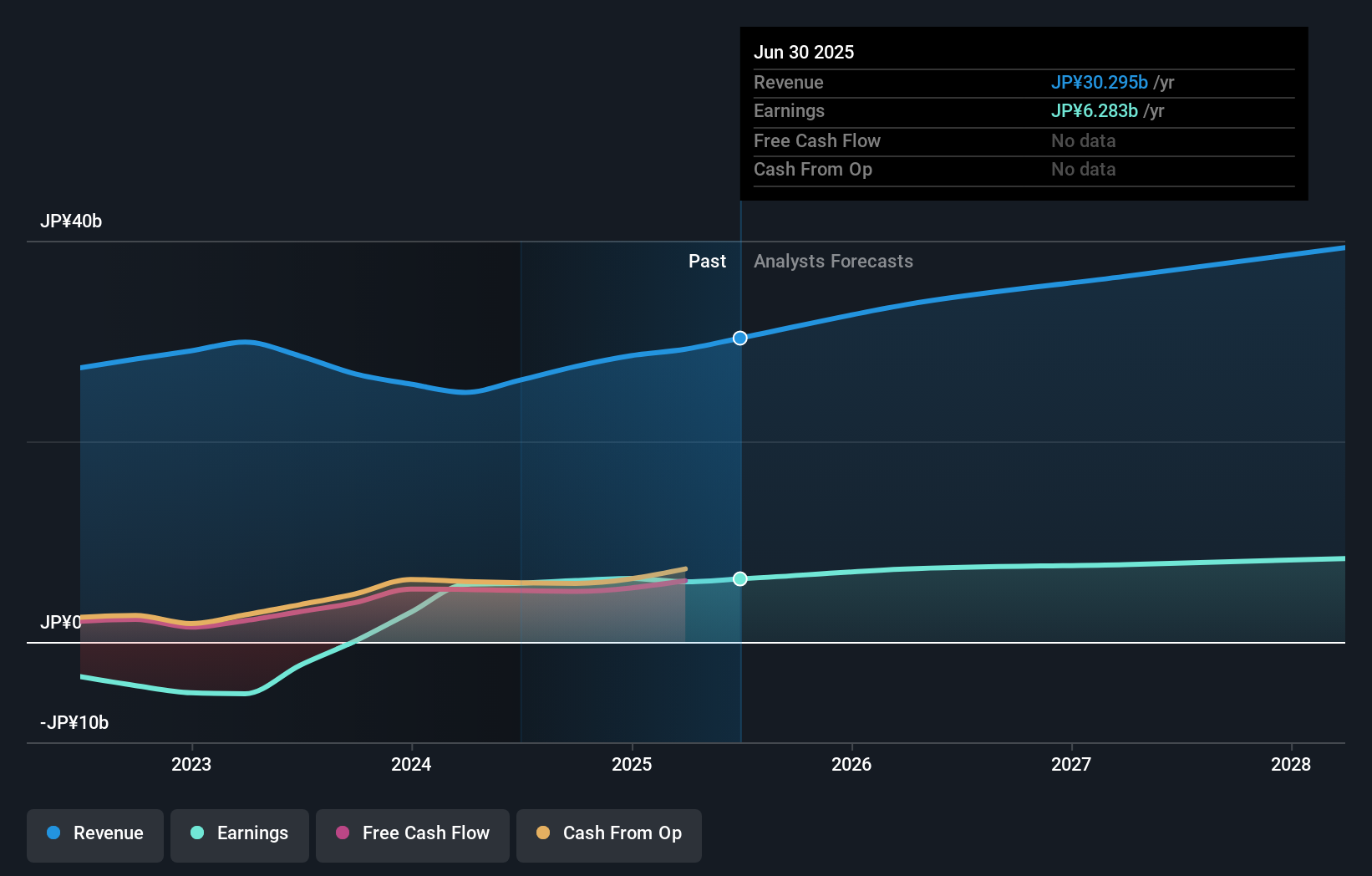

Overview: Lifenet Insurance Company offers life insurance products and services across Japan, North America, and internationally, with a market cap of ¥140.48 billion.

Operations: Lifenet Insurance generates revenue primarily from its life insurance products offered in various regions, including Japan and North America. The company focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on managing operational expenses. Its financial performance is reflected in the net profit margin trend, which provides insights into efficiency and profitability over time.

Lifenet Insurance, a nimble player in Japan's insurance sector, has recently turned profitable and boasts high-quality earnings. With no debt on its books for the past five years, the company seems financially robust. Its levered free cash flow reached ¥5.23 billion as of March 2024, showcasing strong cash generation capabilities. Lifenet's upcoming launch of term medical products on October 1 promises more affordable options for customers seeking flexible coverage periods and lower initial premiums compared to whole-life offerings.

77 Bank (TSE:8341)

Simply Wall St Value Rating: ★★★★☆☆

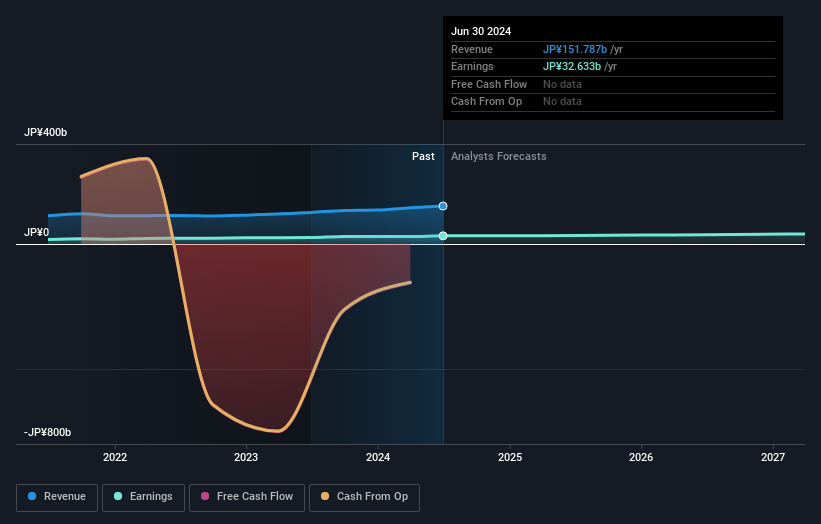

Overview: The 77 Bank, Ltd. offers a range of banking products and services to both corporate and individual clients in Japan, with a market capitalization of ¥291.37 billion.

Operations: The 77 Bank generates revenue primarily through interest income from loans and securities, as well as fees from various banking services. The bank's cost structure includes interest expenses, personnel costs, and general administrative expenses. Net profit margin trends can provide insights into the bank's profitability over time.

With assets totaling ¥10,577.6 billion and equity of ¥595.7 billion, 77 Bank stands out in Japan's banking sector. Deposits reach ¥8,999.8 billion while loans are at ¥5,866.4 billion with a modest net interest margin of 1%. Despite earnings growth of 27% surpassing the industry average of 19%, its allowance for bad loans is notably high at over 1010% of total loans. Trading significantly below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space.

- Navigate through the intricacies of 77 Bank with our comprehensive health report here.

Understand 77 Bank's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 730 hidden gems among our Japanese Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2659

Flawless balance sheet with solid track record and pays a dividend.