- Japan

- /

- Personal Products

- /

- TSE:4967

Kobayashi Pharmaceutical (TSE:4967): Assessing Valuation Following Shareholder Lawsuit Over Beni-Koji Health Incident

Reviewed by Kshitija Bhandaru

Oasis Management has launched a shareholder derivative lawsuit against the board of Kobayashi Pharmaceutical (TSE:4967), focusing on accountability for the Beni-Koji health incident. The court case could have a significant impact on perceptions of corporate governance and future risk.

See our latest analysis for Kobayashi Pharmaceutical.

The fallout from the Beni-Koji health incident and the ensuing legal dispute have weighed heavily on Kobayashi Pharmaceutical’s stock. The share price has declined 14.2% year-to-date and the total shareholder return is down 6.3% over the past year. Despite some modest recent gains, ongoing governance concerns have left sentiment cautious and momentum subdued for now as investors reassess long-term risks and opportunities.

If corporate shakeups and shifting sentiment in the health sector have you rethinking your strategies, consider broadening your search with our See the full list for free.

With share prices still languishing after months of turmoil, investors now face a critical question: is Kobayashi Pharmaceutical undervalued given its recent setbacks, or is the market already reflecting any hopes for a turnaround?

Price-to-Earnings of 32.9x: Is it justified?

Kobayashi Pharmaceutical is currently trading at a price-to-earnings ratio of 32.9x, well above the Japanese Personal Products industry average of 22.7x. Despite the recent share price slump, the stock still commands a higher-than-average earnings multiple compared to its peers.

The price-to-earnings (P/E) ratio shows how much investors are willing to pay for a yen of current earnings. For companies in the personal products sector, this figure often reflects confidence in stable profitability or above-market growth prospects.

In this case, Kobayashi Pharmaceutical’s P/E is significantly higher than the industry norm, indicating that the market is pricing in a rebound in profitability or future growth that is superior to its sector. However, compared to the estimated fair P/E of 24x, the current level appears stretched and could be vulnerable if earnings disappoint. If the market trend aligns with regression-based fair value, a downward adjustment is possible.

Explore the SWS fair ratio for Kobayashi Pharmaceutical

Result: Price-to-Earnings of 32.9x (OVERVALUED)

However, persistent regulatory uncertainty and further governance setbacks could quickly reverse optimism. This presents ongoing risks to any hopes for a near-term recovery.

Find out about the key risks to this Kobayashi Pharmaceutical narrative.

Another View: What Does Our DCF Model Say?

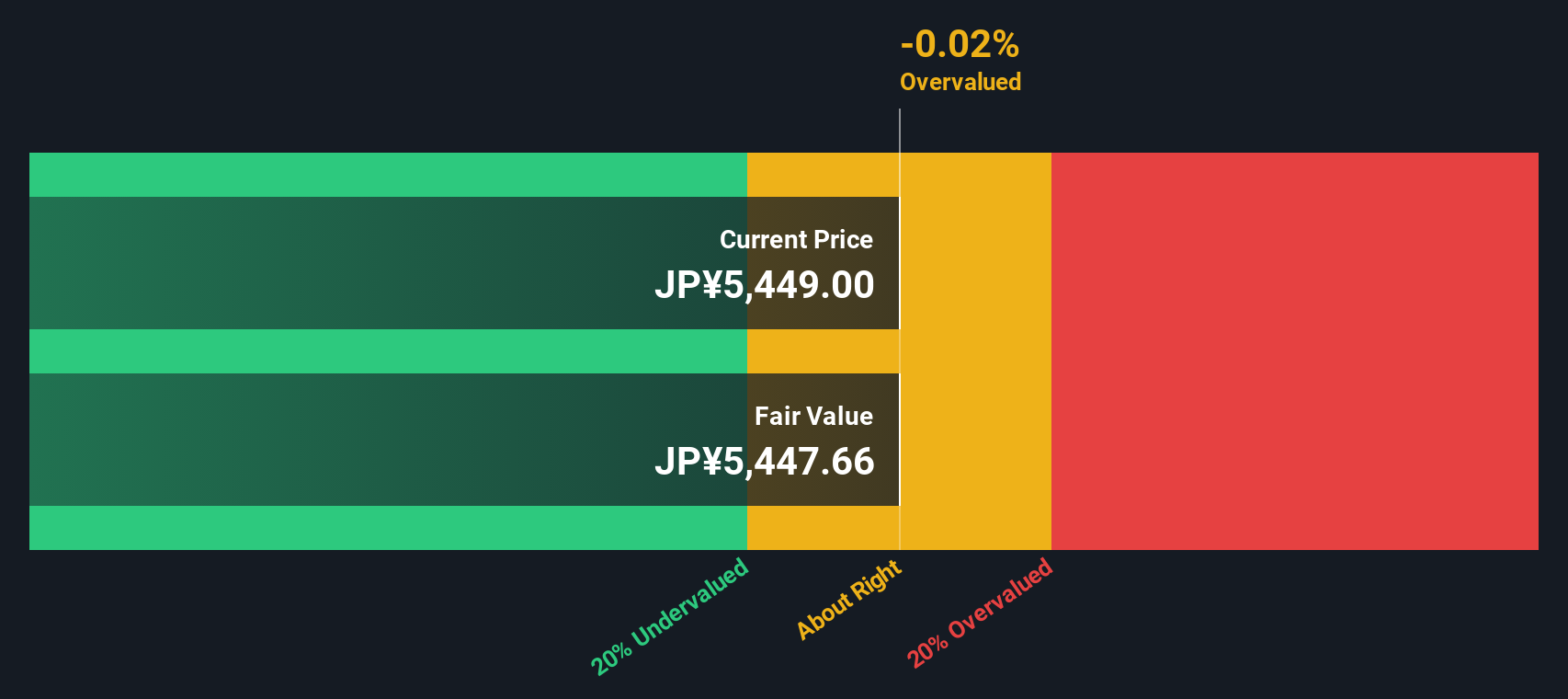

Switching perspective, the SWS DCF model offers a different take. It estimates Kobayashi Pharmaceutical’s fair value at ¥5,124.78, which is actually below the current price of ¥5,226. This means that, based on future cash flow projections, the stock looks slightly overvalued. Does this add a layer of caution for those hoping for a rebound?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kobayashi Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kobayashi Pharmaceutical Narrative

If you have a different perspective or want to take a hands-on approach, you can delve into the data and craft your own story in just a few minutes with our Do it your way

A great starting point for your Kobayashi Pharmaceutical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities slip away while you focus on just one stock. Tap into proven strategies to find market leaders and uncover potential hidden winners today.

- Generate consistent income by checking out these 18 dividend stocks with yields > 3% with yields above 3% and strong financial fundamentals.

- Capture the innovation boom by reviewing these 25 AI penny stocks, which are transforming industries with breakthroughs in artificial intelligence.

- Position your portfolio for tomorrow by investigating these 26 quantum computing stocks, companies pioneering the next wave of advanced computing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kobayashi Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4967

Kobayashi Pharmaceutical

Engages in the manufacture and sale of OTC pharmaceuticals, guasi-drugs, deodorizing air fresheners, and sanitary products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives