- Japan

- /

- Consumer Durables

- /

- TSE:8860

Discover January 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As 2024 drew to a close, global markets experienced moderate gains despite fluctuations in consumer confidence and economic indicators, with major U.S. stock indexes seeing mixed performance during the holiday-shortened week. Amid these shifting conditions, investors continue to seek stability and income through dividend stocks, which can offer potential benefits such as regular income streams and a cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1942 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

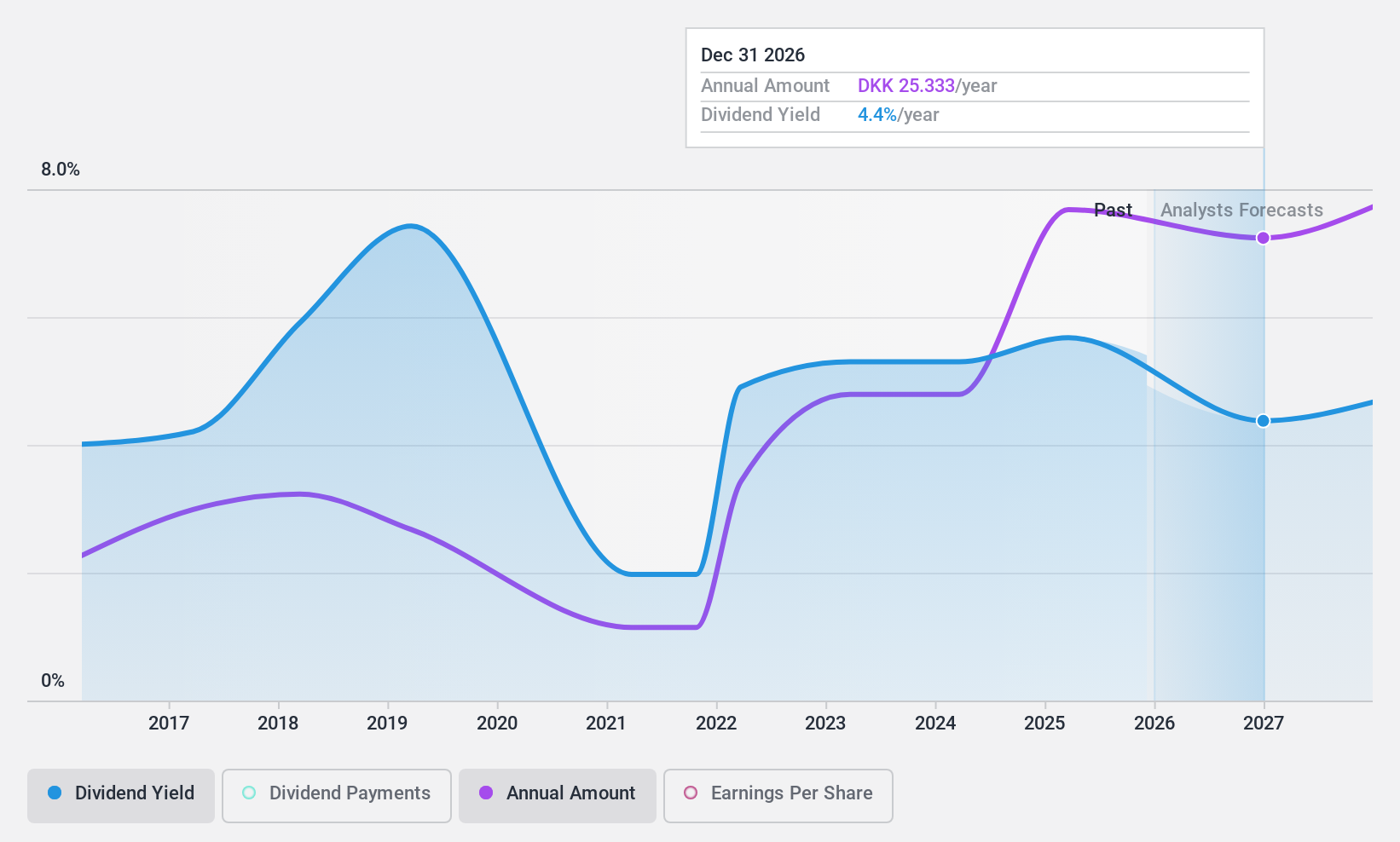

Sydbank (CPSE:SYDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sydbank A/S, along with its subsidiaries, offers a range of banking products and services to corporate, private, retail, and institutional clients both in Denmark and internationally, with a market cap of DKK19.58 billion.

Operations: Sydbank's revenue segments include Banking (DKK6.60 billion), Treasury (DKK118 million), Sydbank Markets (DKK373 million), and Asset Management (DKK418 million).

Dividend Yield: 8%

Sydbank's dividend yield is among the top 25% in Denmark, supported by a reasonable payout ratio of 50.3%, indicating coverage by earnings. However, its dividend history has been volatile and unreliable over the past decade. Recent earnings guidance was lowered due to potential impairment charges of DKK 450 million, affecting profit forecasts for 2024. Despite these challenges, Sydbank offers good relative value compared to peers but faces a forecasted average earnings decline of 12.4% annually over the next three years.

- Dive into the specifics of Sydbank here with our thorough dividend report.

- Our valuation report unveils the possibility Sydbank's shares may be trading at a discount.

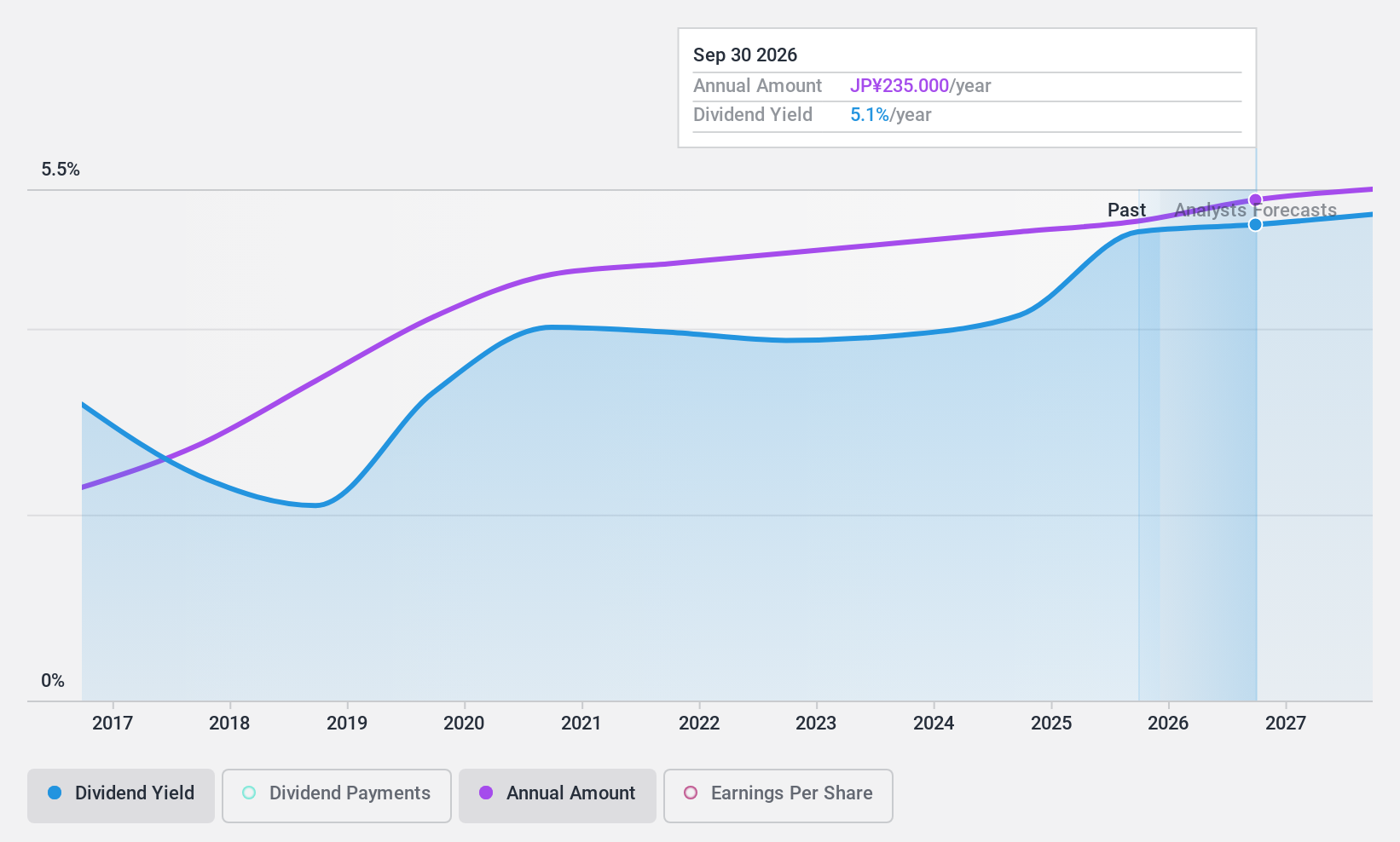

Noevir Holdings (TSE:4928)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Noevir Holdings Co., Ltd. is engaged in the development, production, and sale of cosmetics, pharmaceuticals, and health food products across several countries including Japan, China, and the United States with a market cap of ¥167.19 billion.

Operations: Noevir Holdings Co., Ltd. generates revenue from its Cosmetics segment, amounting to ¥49.76 billion, and its Pharmaceuticals and Food Business segment, contributing ¥11.44 billion.

Dividend Yield: 4.6%

Noevir Holdings offers a competitive dividend yield of 4.6%, ranking in the top 25% among Japanese dividend payers. However, its high payout ratio of 96.4% suggests dividends are not well covered by earnings or cash flows, raising sustainability concerns. Despite this, Noevir's dividends have been stable and growing over the past decade with minimal volatility. The company anticipates net sales of ¥64 billion and operating profit of ¥11.5 billion for fiscal year 2025, maintaining its current dividend level at ¥225 per share.

- Click here and access our complete dividend analysis report to understand the dynamics of Noevir Holdings.

- Our comprehensive valuation report raises the possibility that Noevir Holdings is priced lower than what may be justified by its financials.

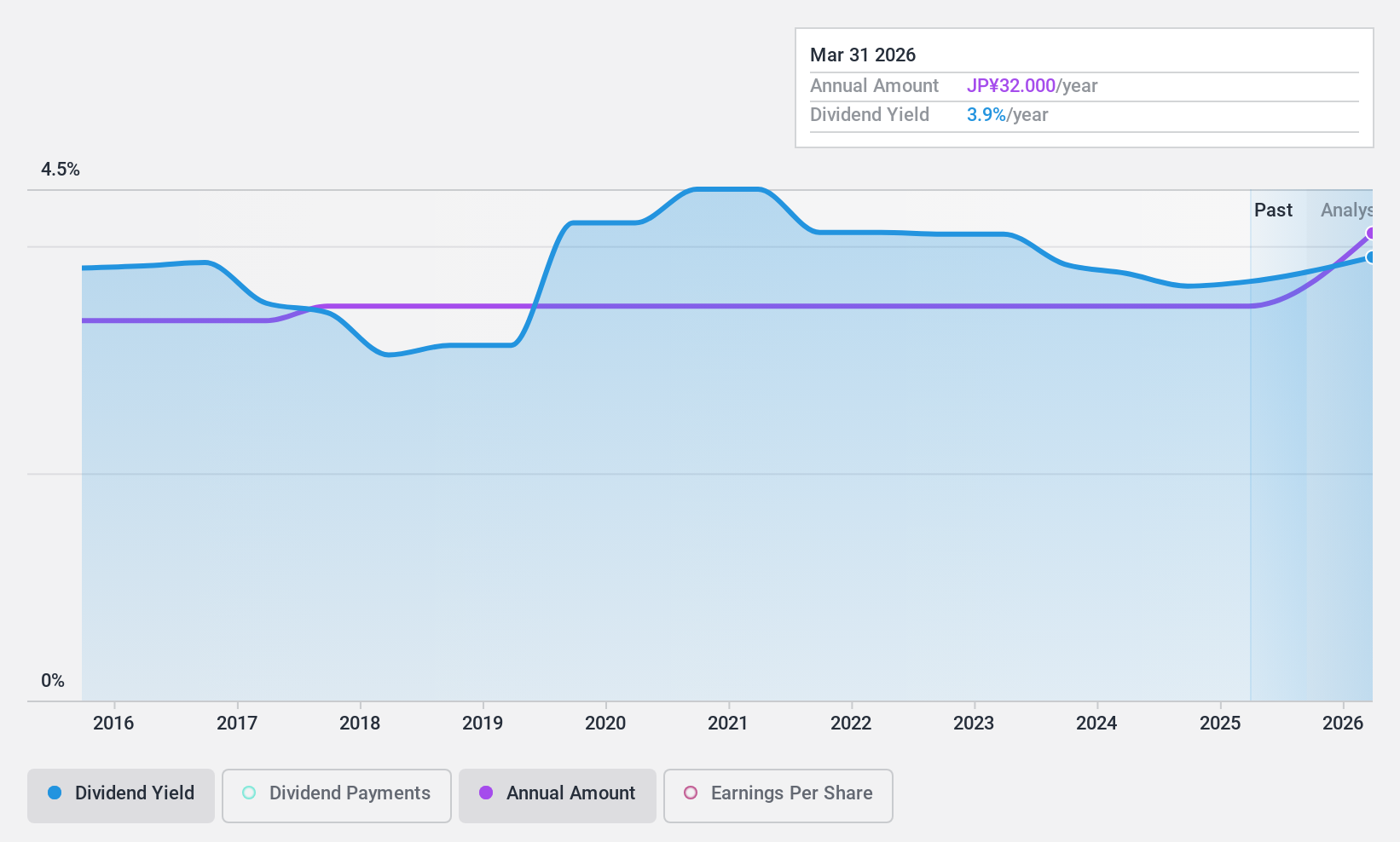

Fuji (TSE:8860)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fuji Corporation Limited designs, constructs, and sells detached houses and condominiums in Japan with a market cap of ¥29.09 billion.

Operations: Fuji Corporation Limited generates revenue from several segments, including Construction Related (¥2.71 billion), Housing Distribution (¥23.20 billion), Effective Use of Land (¥34.70 billion), Houses Built for Sale (¥40.25 billion), and Rental and Management (¥29.44 billion).

Dividend Yield: 3.4%

Fuji Corporation's dividend yield of 3.38% is below the top tier in Japan, and while dividends have been stable and growing over the past decade, they are not well covered by free cash flows despite a low payout ratio of 17.7%. The recent buyback of 350,000 shares for ¥269.14 million indicates active capital management but highlights concerns about dividend sustainability given limited free cash flow coverage.

- Navigate through the intricacies of Fuji with our comprehensive dividend report here.

- Our valuation report here indicates Fuji may be overvalued.

Where To Now?

- Discover the full array of 1942 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8860

Fuji

Designs, constructs, and sells detached houses and condominiums in Japan.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives