- Japan

- /

- Personal Products

- /

- TSE:4922

KOSÉ (TSE:4922): Evaluating Valuation As Investor Sentiment and Growth Diverge

Reviewed by Kshitija Bhandaru

KOSÉ (TSE:4922) has been navigating some ups and downs lately, with steady annual growth in both revenue and net income. Investors might be evaluating the latest numbers to gauge value and direction.

See our latest analysis for KOSÉ.

KOSÉ’s share price has seen a modest drift this year, with momentum fading as investors weigh steady business growth against softer sentiment, reflected in a one-year total shareholder return of -0.35%. While long-term holders have faced some lackluster returns, recent stability could eventually lay the groundwork for renewed optimism if fundamentals keep progressing.

If you’re open to exploring what other companies are catching investor interest lately, consider expanding your search with fast growing stocks with high insider ownership.

Given this backdrop of steady financial growth but lackluster returns, investors may be asking whether KOSÉ shares are undervalued at current levels or if the market has already priced in all future upside.

Price-to-Earnings of 111.9x: Is it justified?

KOSÉ’s shares most recently traded at ¥5,873, while the company’s price-to-earnings (P/E) multiple stands at 111.9x. This places it far above both peer and industry averages.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. For consumer and personal products companies like KOSÉ, a high P/E typically implies expectations of strong future growth or a premium market position.

However, this figure is particularly elevated. Compared to the peer average of 30.2x and the Japan Personal Products industry average of 23.4x, KOSÉ’s P/E is difficult to justify on current earnings alone. In fact, the fair P/E for the company is estimated at just 29.1x. The market could shift toward this level should sentiment or results change.

Explore the SWS fair ratio for KOSÉ

Result: Price-to-Earnings of 111.9x (OVERVALUED)

However, slower share price recovery and ongoing underperformance relative to peers could pressure sentiment if KOSÉ’s revenue growth weakens or if industry trends shift unexpectedly.

Find out about the key risks to this KOSÉ narrative.

Another View: DCF Suggests Shares May Be Undervalued

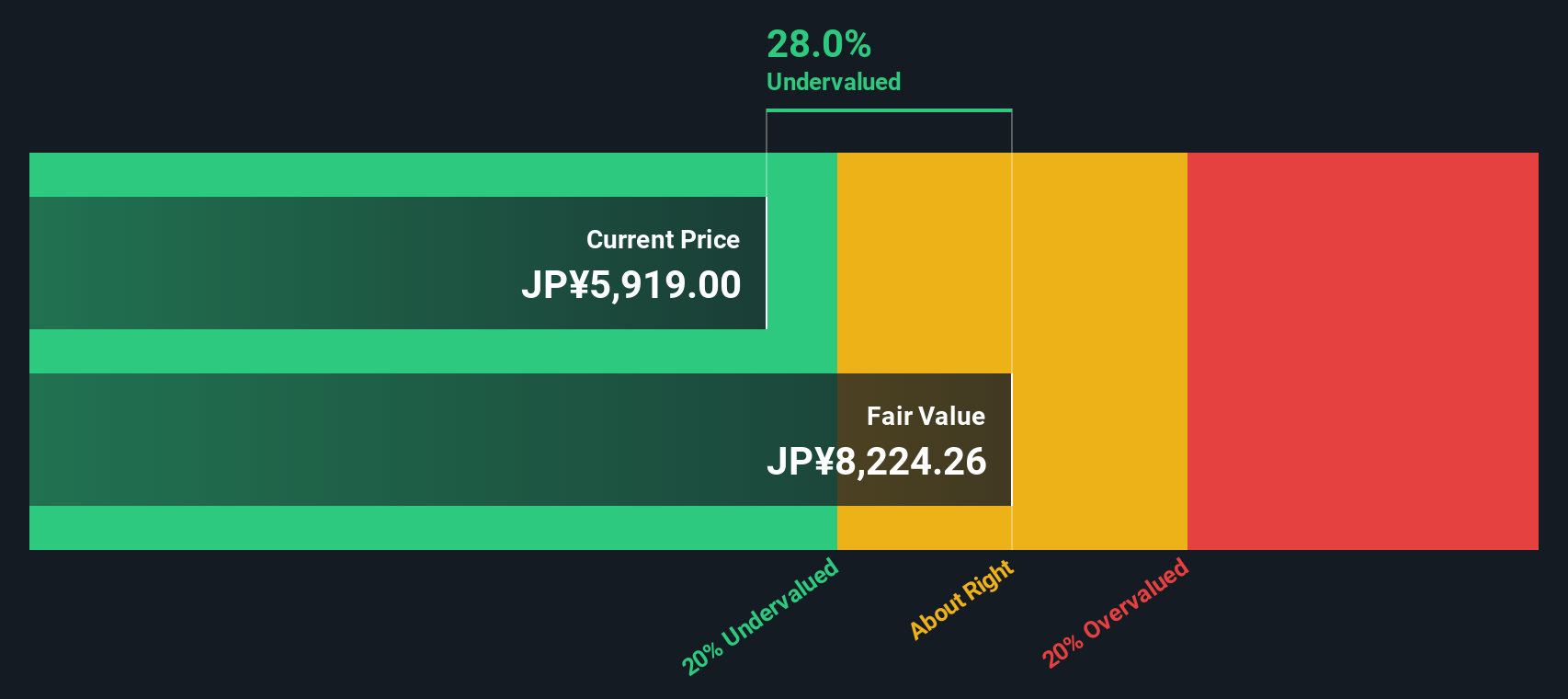

Switching gears from the current high price-to-earnings ratio, our SWS DCF model offers a different perspective. By forecasting KOSÉ’s future cash flows, this method suggests the shares are trading nearly 28% below their estimated fair value, which implies a potential disconnect between the current market price and underlying fundamentals. Could this gap present an opportunity or simply reflect market caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KOSÉ for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KOSÉ Narrative

If you see things differently or prefer diving into the numbers yourself, shaping your own view takes just a couple of minutes. Why not get started? Do it your way.

A great starting point for your KOSÉ research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead in today's market by uncovering unique stocks beyond the obvious. Act now so you never miss the next breakthrough opportunity. Your future portfolio will thank you.

- Spot real value by reviewing these 896 undervalued stocks based on cash flows, offering prime potential based on strong underlying cash flows and overlooked fundamentals.

- Boost your income by choosing these 19 dividend stocks with yields > 3% and tap into companies delivering generous yields above 3% to strengthen your returns.

- Capture tomorrow’s trends by following these 24 AI penny stocks, which are powering the massive growth wave of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOSÉ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4922

KOSÉ

Manufactures and sells cosmetics and cosmetology products primarily in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives