- Japan

- /

- Healthcare Services

- /

- TSE:9158

CUC Inc. Just Missed EPS By 71%: Here's What Analysts Think Will Happen Next

CUC Inc. (TSE:9158) just released its latest quarterly report and things are not looking great. Results showed a clear earnings miss, with JP¥13b revenue coming in 6.0% lower than what the analystsexpected. Statutory earnings per share (EPS) of JP¥7.10 missed the mark badly, arriving some 71% below what was expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

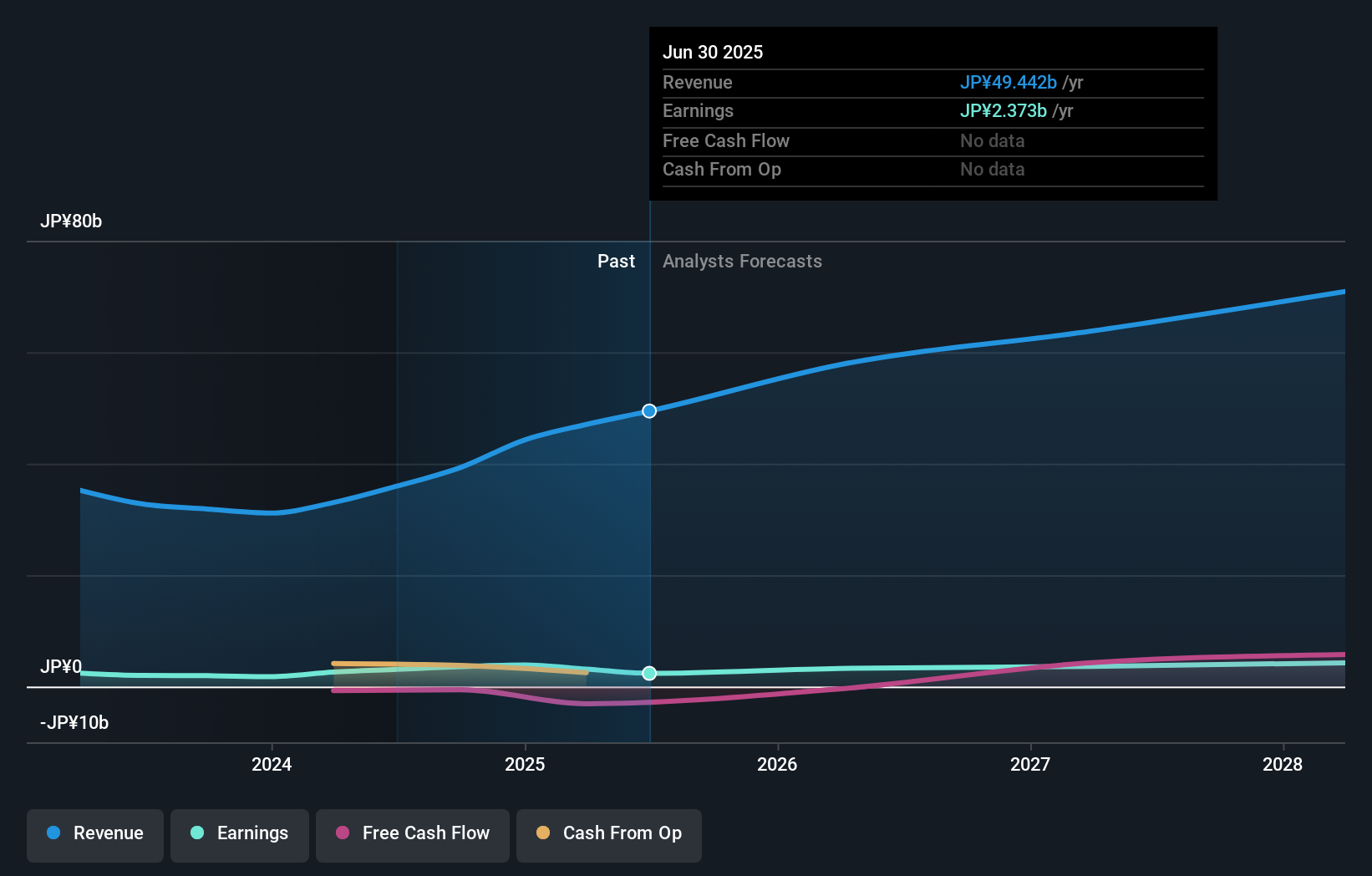

Taking into account the latest results, the consensus forecast from CUC's three analysts is for revenues of JP¥57.7b in 2026. This reflects a solid 17% improvement in revenue compared to the last 12 months. Per-share earnings are expected to bounce 36% to JP¥110. Yet prior to the latest earnings, the analysts had been anticipated revenues of JP¥59.0b and earnings per share (EPS) of JP¥114 in 2026. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

Check out our latest analysis for CUC

The consensus price target fell 11% to JP¥1,250, with the weaker earnings outlook clearly leading valuation estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that CUC's revenue growth will slow down substantially, with revenues to the end of 2026 expected to display 23% growth on an annualised basis. This is compared to a historical growth rate of 37% over the past year. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.5% per year. Even after the forecast slowdown in growth, it seems obvious that CUC is also expected to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for CUC. They also downgraded CUC's revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of CUC's future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for CUC going out to 2028, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 3 warning signs for CUC (1 is significant!) that you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9158

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026