- Japan

- /

- Medical Equipment

- /

- TSE:7813

Improved Revenues Required Before Platz Co., Ltd. (TSE:7813) Stock's 34% Jump Looks Justified

The Platz Co., Ltd. (TSE:7813) share price has done very well over the last month, posting an excellent gain of 34%. The last 30 days bring the annual gain to a very sharp 35%.

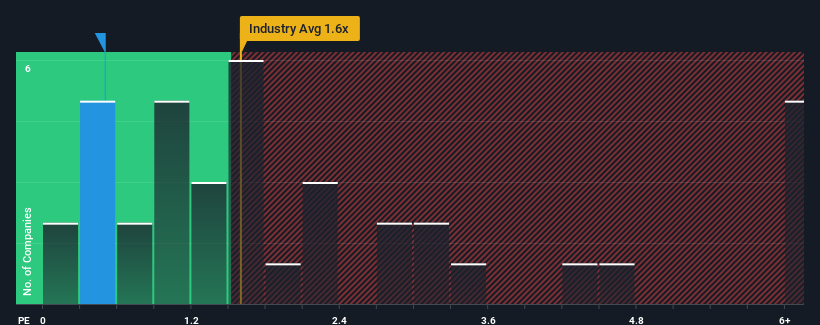

Although its price has surged higher, Platz's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Medical Equipment industry in Japan, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Platz

What Does Platz's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Platz, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Platz will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Platz, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Platz?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Platz's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.6% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

In contrast to the company, the rest of the industry is expected to grow by 7.2% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Platz is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Platz's P/S Mean For Investors?

Despite Platz's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Platz confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Platz (1 makes us a bit uncomfortable!) that you should be aware of.

If you're unsure about the strength of Platz's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7813

Platz

Produces and sells care beds, mattresses, and other add-on equipment in Japan.

Adequate balance sheet slight.

Market Insights

Community Narratives