- Japan

- /

- Medical Equipment

- /

- TSE:7747

Did Asahi Intecc's Share Buyback Completion Just Shift Its (TSE:7747) Investment Narrative?

Reviewed by Sasha Jovanovic

- Asahi Intecc announced the completion of its share repurchase program, having bought back 5,094,500 shares, 1.88% of shares outstanding, for ¥12,150.05 million as of September 30, 2025.

- This move underscores the company’s commitment to capital allocation and returning value to shareholders through buybacks over multiple tranches.

- We’ll explore how the completed share buyback could factor into Asahi Intecc’s investment narrative around shareholder returns.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is Asahi Intecc's Investment Narrative?

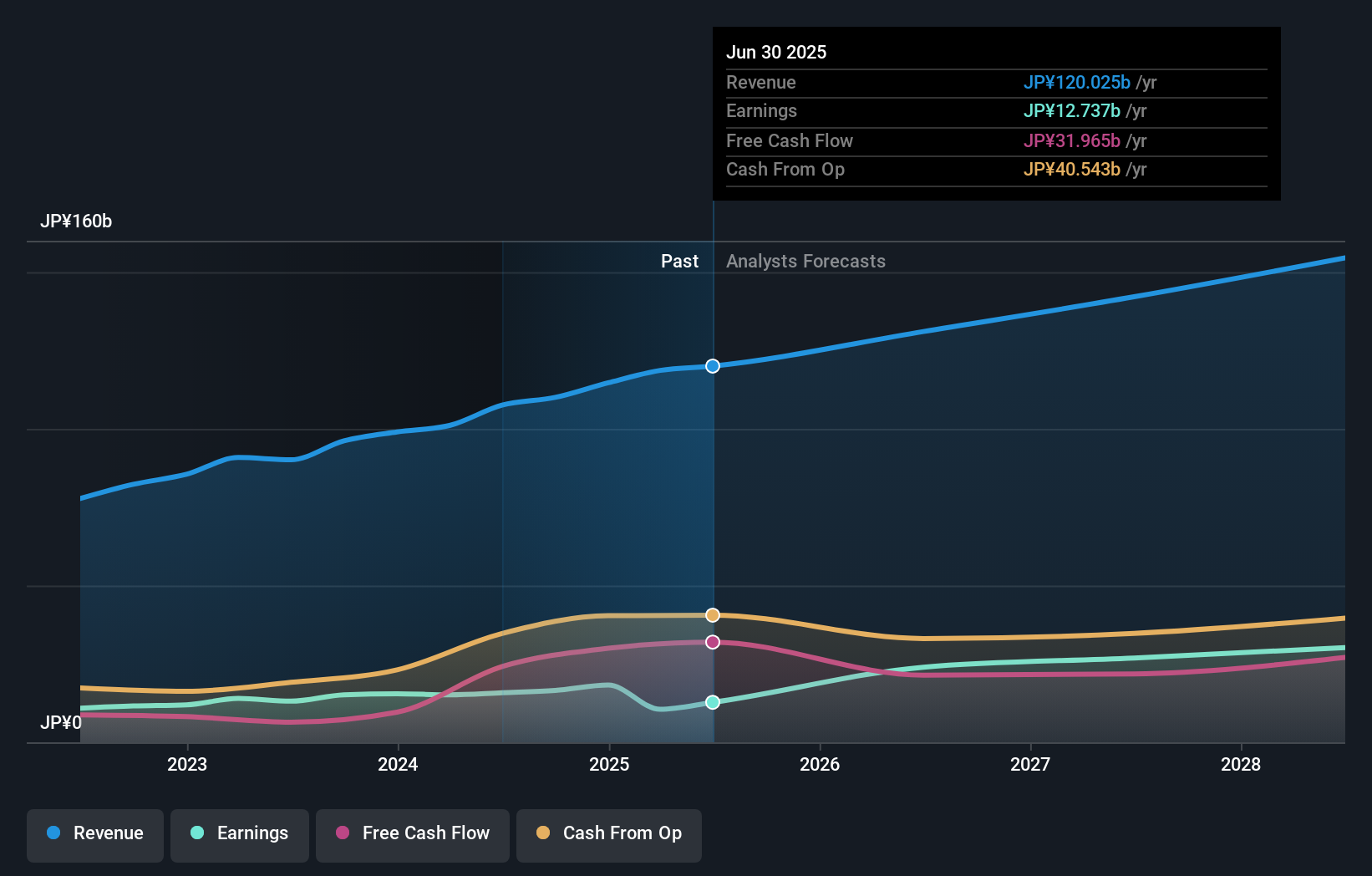

To be an Asahi Intecc shareholder right now, you’d want to believe in the company’s ability to turn high R&D investments and expanding cardiovascular partnerships into long-term growth, despite recent bumps in performance. The completion of the sizeable share buyback adds another tool for supporting returns, alongside consistent dividend increases and positive guidance for next year’s sales and profit. That said, the buyback has not shifted the biggest near-term catalyst: the upcoming quarterly earnings report and, more broadly, the company’s ability to recover margins following the previous year's large one-off loss. While the buyback could support confidence in capital allocation, it doesn’t materially change the financial risks, investors are still watching for margin improvement, better returns on equity and whether the business can deliver on its revenue and profit forecasts amid a historically expensive price-to-earnings ratio. Recent price moves suggest the market reaction has been muted for now.

But board independence and ongoing margin volatility remain issues investors should have on their radar. Asahi Intecc's shares have been on the rise but are still potentially undervalued by 11%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Asahi Intecc - why the stock might be worth as much as 12% more than the current price!

Build Your Own Asahi Intecc Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asahi Intecc research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Asahi Intecc research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asahi Intecc's overall financial health at a glance.

No Opportunity In Asahi Intecc?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7747

Asahi Intecc

Engages in the development, manufacture, and sale of medical devices in Japan, the United States, Europe, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives